Question

Your friend Manuel is 20 years old and wants to begin taking steps to prepare for retirement right now. Manuel has a limited budget that

- Your friend Manuel is 20 years old and wants to begin taking steps to prepare for retirement right now. Manuel has a limited budget that does not allow a maximum contribution to a defined contribution plan, but he thinks he can save $5,500 per year into a plan. Which retirement plan type would you recommend that he utilize based on his limited income and contributions? How much could the account be worth if he continues contributing until he reaches age 65?

-

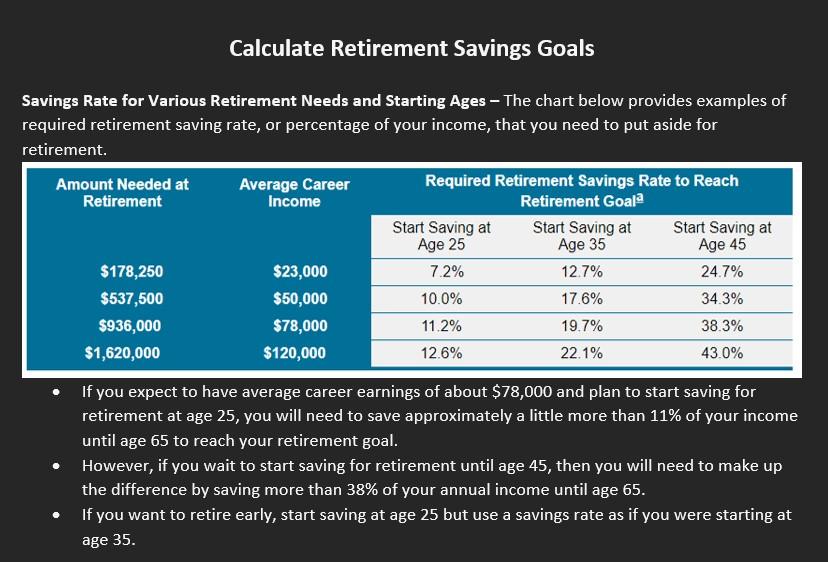

For the final calculation, lets go beyond this chart instead, utilize one of the retirement calculator websites provided in this module (or find an alternative one that you prefer instead), and determine how much you need to be saving annually to reach your savings goals and your ideal retirement age.

-

Please explain which calculator website you selected, and the information you provided to create your calculation.

-

What did you find interesting about this retirement savings calculator simulation? Anything stand out to you that you may or may not have considered previously?

- What are you hoping to start implementing or adjust in your current retirement savings plan?

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started