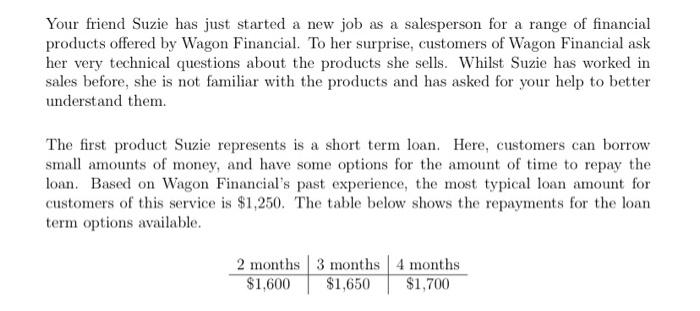

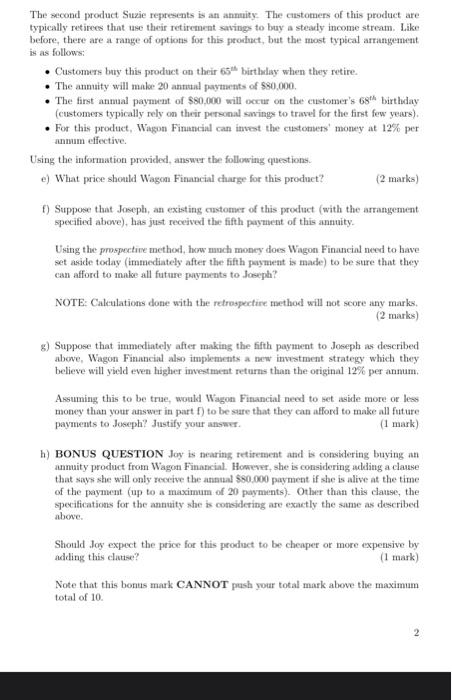

Your friend Suzie has just started a new job as a salesperson for a range of financial products offered by Wagon Financial. To her surprise, customers of Wagon Financial ask her very technical questions about the products she sells. Whilst Suzie has worked in sales before, she is not familiar with the products and has asked for your help to better understand them. The first product Suzie represents is a short term loan. Here, customers can borrow small amounts of money, and have some options for the amount of time to repay the loan. Based on Wagon Financial's past experience, the most typical loan amount for customers of this service is $1,250. The table below shows the repayments for the loan term options available. The second product Suzie represents is an annnity. The customers of this product are typically retirees that use their retirenent savings to buy a steady income stream. Like before, there are a range of options for this jroduct, but the most typical arrangement is as follows: - Customezs buy this product on their 65th birthilay when they retire. - The annuity will maloe 20 annual payments of $80,000. - The first anmal paymueat of $80,000 will occur on the customer's 68th birthday (customers typically rely on their personal savings to travel for the first few years). - For this product, Waggon Finamcial can invest the custotavers' money at 12% per annum effective. Using the information provided, answer the following questions. e) What price should Wagon Financial charge for this product? (2 marks) f) Suppose that Joseph, an existing castomer of this product (with the arrangemuent specified above), has just received the fifth payment of this annuity. Using the prospectine method, how mnch money does Wagon Finaucial need to have set aside today (imznediately after the fifth payment is made) to be sure that they can afford to make all future payments to Joseph? NOTE: Caleulations done with the retrospectire method will not score any marks. (2 marks) g) Suppose that immediately after making the fifth payment to Joseph as described above, Wagon Finuncial also implements a new invextment strategy which they believe will yield even higher imvestment returns than the original 12% per annum. Assuming this to be true, would Wagon Financial need to set aside more or less money than your answer in part f ) to be sare that they ean afford to make all future payments to Joseph? Justify your answer. (1 mark) h) BONUS QUESTION Joy is nearing, retirement atd is considering buying an annuity product from Wagon Financial. However, she is considering adding a classe that says she will only receive the ananal $50,000 payment if she is alive at the time of the payment (up to a maximum of 20 payments). Other than this classe, the specitications for the annuity she is considering are exactly the sume as described above. Should Joy expect the price for this prodact to be cheaper or more expensive by adding this clatse? (1 mark) Note that this bonus mark CANNOT push your total mark above the maximum total of 10. 2 Your friend Suzie has just started a new job as a salesperson for a range of financial products offered by Wagon Financial. To her surprise, customers of Wagon Financial ask her very technical questions about the products she sells. Whilst Suzie has worked in sales before, she is not familiar with the products and has asked for your help to better understand them. The first product Suzie represents is a short term loan. Here, customers can borrow small amounts of money, and have some options for the amount of time to repay the loan. Based on Wagon Financial's past experience, the most typical loan amount for customers of this service is $1,250. The table below shows the repayments for the loan term options available. The second product Suzie represents is an annnity. The customers of this product are typically retirees that use their retirenent savings to buy a steady income stream. Like before, there are a range of options for this jroduct, but the most typical arrangement is as follows: - Customezs buy this product on their 65th birthilay when they retire. - The annuity will maloe 20 annual payments of $80,000. - The first anmal paymueat of $80,000 will occur on the customer's 68th birthday (customers typically rely on their personal savings to travel for the first few years). - For this product, Waggon Finamcial can invest the custotavers' money at 12% per annum effective. Using the information provided, answer the following questions. e) What price should Wagon Financial charge for this product? (2 marks) f) Suppose that Joseph, an existing castomer of this product (with the arrangemuent specified above), has just received the fifth payment of this annuity. Using the prospectine method, how mnch money does Wagon Finaucial need to have set aside today (imznediately after the fifth payment is made) to be sure that they can afford to make all future payments to Joseph? NOTE: Caleulations done with the retrospectire method will not score any marks. (2 marks) g) Suppose that immediately after making the fifth payment to Joseph as described above, Wagon Finuncial also implements a new invextment strategy which they believe will yield even higher imvestment returns than the original 12% per annum. Assuming this to be true, would Wagon Financial need to set aside more or less money than your answer in part f ) to be sare that they ean afford to make all future payments to Joseph? Justify your answer. (1 mark) h) BONUS QUESTION Joy is nearing, retirement atd is considering buying an annuity product from Wagon Financial. However, she is considering adding a classe that says she will only receive the ananal $50,000 payment if she is alive at the time of the payment (up to a maximum of 20 payments). Other than this classe, the specitications for the annuity she is considering are exactly the sume as described above. Should Joy expect the price for this prodact to be cheaper or more expensive by adding this clatse? (1 mark) Note that this bonus mark CANNOT push your total mark above the maximum total of 10. 2