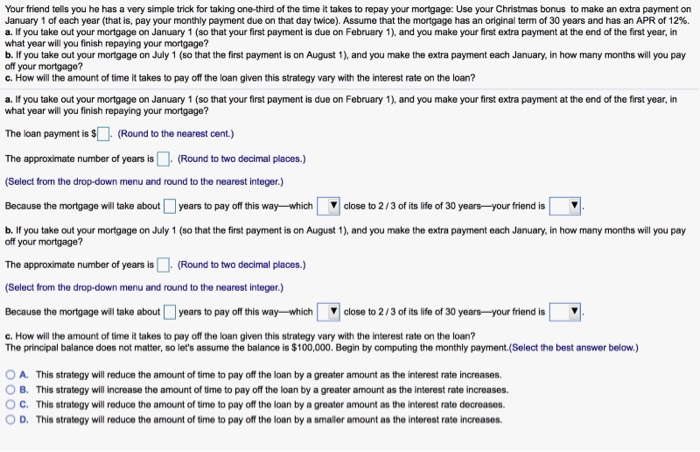

Your friend tells you he has a very simple trick for taking one-third of the time it takes to repay your mortgage: Use your Christmas bonus to make an extra payment on January 1 of each year that is pay your monthly payment due on that day twice Assume that the mortgage has an original term of 30 years and has an APR of 12%, a. If you take out your mortgage on January 1 (so that your first payment is due on February 1), and you make your first extra payment at the end of the first year, in what year will you finish repaying your mortgage? b. If you take out your mortgage on July 1 (so that the first payment is on August 1), and you make the extra payment each January, in how many months will you pay off your mortgage? c. How will the amount of time it takes to pay off the loan given this strategy vary with the interest rate on the loan? a. If you take out your mortgage on January 1 (so that your first payment is due on February 1), and you make your first extra payment at the end of the first year, in what year will you finish repaying your mortgage? The loan payment is S(Round to the nearest cent) The approximate number of years is. (Round to two decimal places.) Select from the drop-down menu and round to the nearest integer.) Because the mortgage will take about years to pay off this way- whichclose to 2/3 of its life of 30 years-your friend is b. If you take out your mortgage on July 1 (so that the first payment is on August 1), and you make the extra payment each January, in how many months will you pay off your mortgage? The approximate number of years is(Round to two decimal placos.) Select from the drop-down menu and round to the nearest integer.) Because the mortgage will take about | | years to pay off this way-hich | | close to 2 , 3 of its life of 30 years-your friend is ! c. How will the amount of time it takes to pay off the loan given this strategy vary with the interest rate on the loan? The principal balance does not matter, so let's assume the balance is $100,000. Begin by computing the monthly payment (Select the best answer below.) 0 A. This strategy will reduce the amount of time to pay off the loan by a greater amount as the interest rate increases. O B. This strategy will increase the amount of time to pay off the loan by a greater amount as the interest rate increases. O C. This strategy will reduce the amount of time to pay off the loan by a greater amount as the interest rate decreases. O D. This strategy will reduce the amount of time to pay off the loan by a smaller amount as the interest rate increases. Your friend tells you he has a very simple trick for taking one-third of the time it takes to repay your mortgage: Use your Christmas bonus to make an extra payment on January 1 of each year that is pay your monthly payment due on that day twice Assume that the mortgage has an original term of 30 years and has an APR of 12%, a. If you take out your mortgage on January 1 (so that your first payment is due on February 1), and you make your first extra payment at the end of the first year, in what year will you finish repaying your mortgage? b. If you take out your mortgage on July 1 (so that the first payment is on August 1), and you make the extra payment each January, in how many months will you pay off your mortgage? c. How will the amount of time it takes to pay off the loan given this strategy vary with the interest rate on the loan? a. If you take out your mortgage on January 1 (so that your first payment is due on February 1), and you make your first extra payment at the end of the first year, in what year will you finish repaying your mortgage? The loan payment is S(Round to the nearest cent) The approximate number of years is. (Round to two decimal places.) Select from the drop-down menu and round to the nearest integer.) Because the mortgage will take about years to pay off this way- whichclose to 2/3 of its life of 30 years-your friend is b. If you take out your mortgage on July 1 (so that the first payment is on August 1), and you make the extra payment each January, in how many months will you pay off your mortgage? The approximate number of years is(Round to two decimal placos.) Select from the drop-down menu and round to the nearest integer.) Because the mortgage will take about | | years to pay off this way-hich | | close to 2 , 3 of its life of 30 years-your friend is ! c. How will the amount of time it takes to pay off the loan given this strategy vary with the interest rate on the loan? The principal balance does not matter, so let's assume the balance is $100,000. Begin by computing the monthly payment (Select the best answer below.) 0 A. This strategy will reduce the amount of time to pay off the loan by a greater amount as the interest rate increases. O B. This strategy will increase the amount of time to pay off the loan by a greater amount as the interest rate increases. O C. This strategy will reduce the amount of time to pay off the loan by a greater amount as the interest rate decreases. O D. This strategy will reduce the amount of time to pay off the loan by a smaller amount as the interest rate increases