Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend Tim runs his own retail business. At year-end, his accounting technician resigned and after you told him about the course you are doing

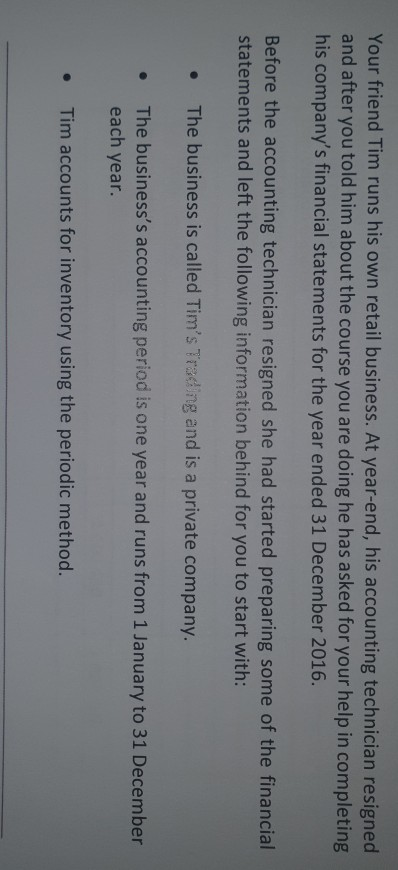

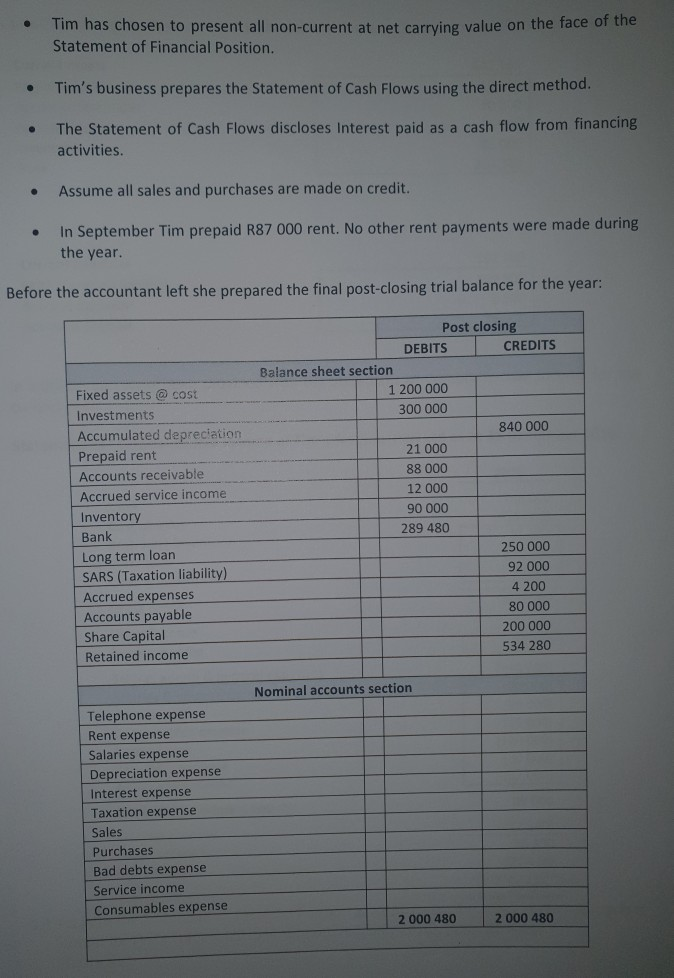

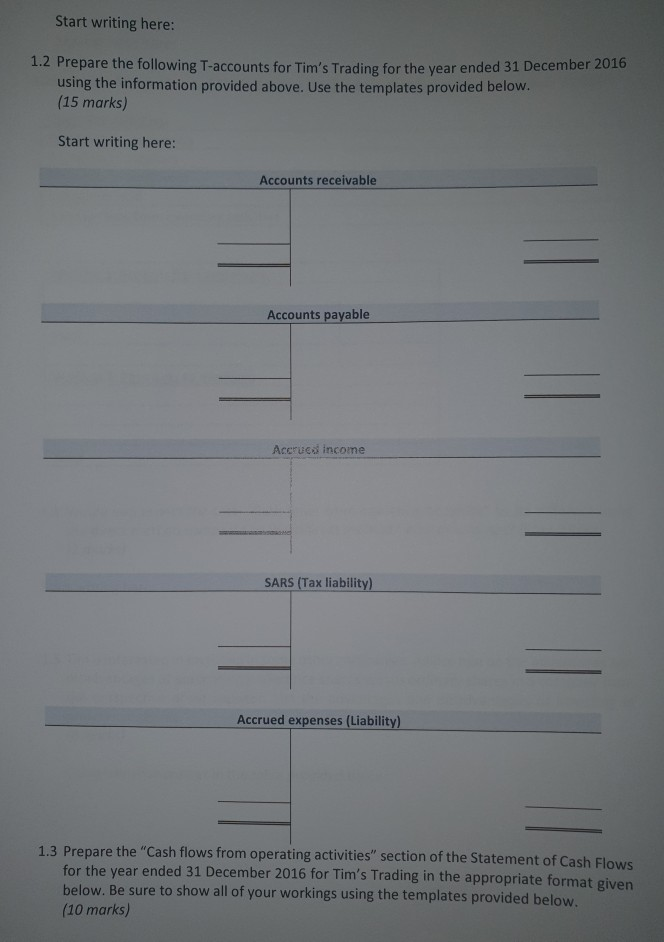

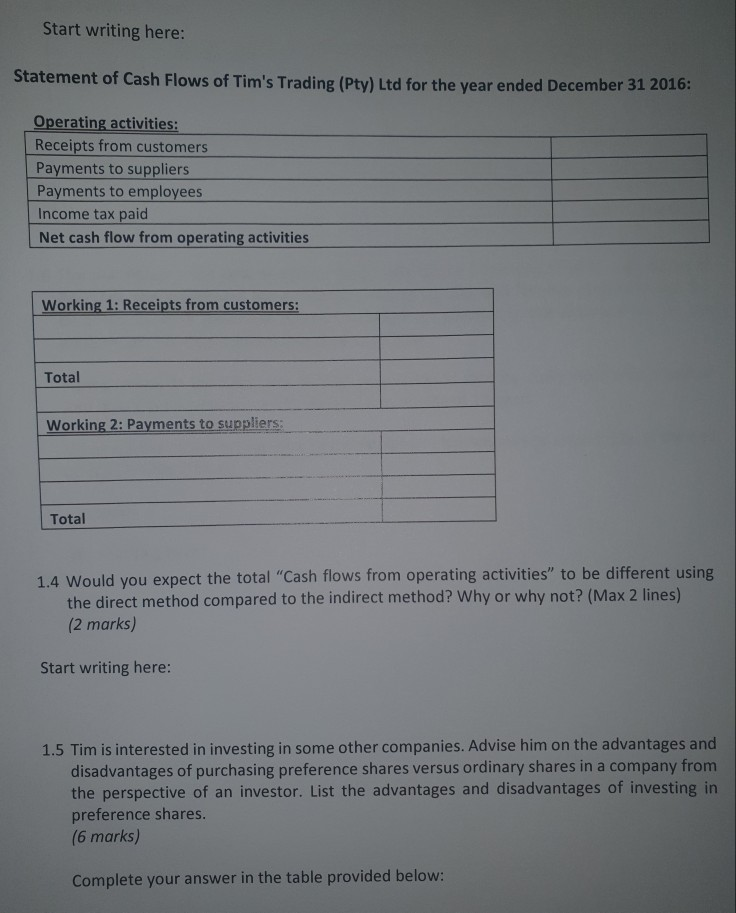

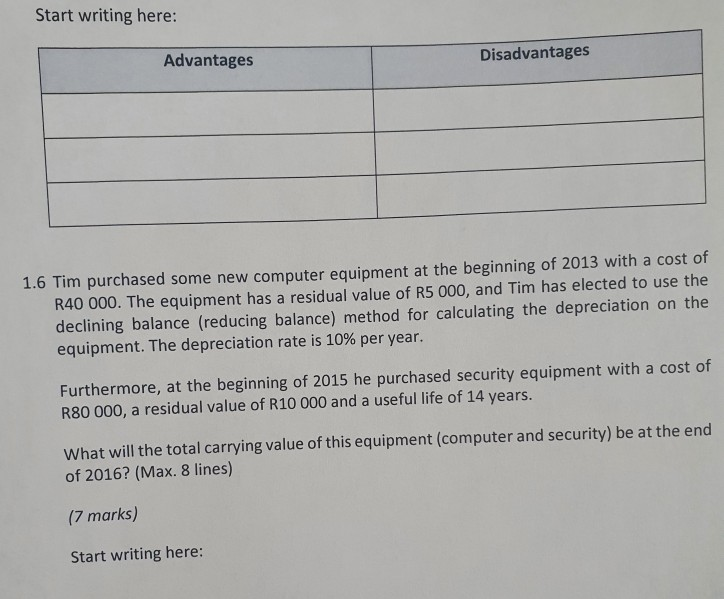

Your friend Tim runs his own retail business. At year-end, his accounting technician resigned and after you told him about the course you are doing he has asked for your help in completing his company's financial statements for the year ended 31 December 2016. Before the accounting technician resigned she had started preparing some of the financial statements and left the following information behind for you to start with: The business is called Tim's Trading and is a private company. The business's accounting period is one year and runs from 1 January to 31 December each year. Tim accounts for inventory using the periodic method. . Tim has chosen to present all non-current at net carrying value on the face of the Statement of Financial Position. . Tim's business prepares the Statement of Cash Flows using the direct method. The Statement of Cash Flows discloses Interest paid as a cash flow from financing activities. . Assume all sales and purchases are made on credit. In September Tim prepaid R87 000 rent. No other rent payments were made during the year. Before the accountant left she prepared the final post-closing trial balance for the year: Fixed assets @ cost Investments Accumulated depreciation Prepaid rent Accounts receivable Accrued service income Inventory Bank Long term loan SARS (Taxation liability) Accrued expenses Accounts payable Share Capital Retained income Post closing DEBITS CREDITS Balance sheet section 1 200 000 300 000 840 000 21 000 88 000 12 000 90 000 289 480 250 000 92 000 4 200 80 000 200 000 534 280 Nominal accounts section Telephone expense Rent expense Salaries expense Depreciation expense Interest expense Taxation expense Sales Purchases Bad debts expense Service income Consumables expense 2 000 480 2 000 480 A small extract of the Statement of Financial Position as at 31 December 2015 is given below: Current assets Prepaid rent Accounts receivable Accrued income Inventory Bank 442 380 18 000 70 000 15 000 75 000 264 380 Current liabilities SARS (Taxation liability) Accrued expenses Accounts payable 192 100 107 600 8 500 76 000 In addition you have been provided with the Statement of Comprehensive Income for the current year: Statement of Comprehensive income of Tim's Trading (Pty) Ltd as at 31 December 2016: 2016 Sales 760 000 Cost of sales (355 000) Beginning inventory 75 000 Purchases 370 000 Closing inventory 90 000 Gross profit 405 000 Other income 30 000 Service income 30 000 Selling, admin & general expenses (336 000) Salaries & wages expense (70 000) Rent expense (84 000) Consumables expense (15 000) Depreciation (120 000) Bad debts expense (30 000) Telephone expense (17000) Profit before interest and tax 99 000 Interest expense (22 500) Profit before tax 76 500 Tax expense (21 420) Net profit 55 080 1.1 Prepare the Statement of Financial Position as at 31 December 2016 in the appropriate format for Tim's Trading (2015 is not required, only 2016). (Max. 25 lines) (10 marks) Start writing here: 1.2 Prepare the following T-accounts for Tim's Trading for the year ended 31 December 2016 using the information provided above. Use the templates provided below. (15 marks) Start writing here: Accounts receivable Accounts payable Accrued income SARS (Tax liability) Accrued expenses (Liability) 1.3 Prepare the "Cash flows from operating activities" section of the Statement of Cash Flows for the year ended 31 December 2016 for Tim's Trading in the appropriate format given below. Be sure to show all of your workings using the templates provided below. (10 marks) Start writing here: Statement of Cash Flows of Tim's Trading (Pty) Ltd for the year ended December 31 2016: Operating activities: Receipts from customers Payments to suppliers Payments to employees Income tax paid Net cash flow from operating activities Working 1: Receipts from customers: Total Working 2: Payments to suppliers: Total 1.4 Would you expect the total "Cash flows from operating activities to be different using the direct method compared to the indirect method? Why or why not? (Max 2 lines) (2 marks) Start writing here: 1.5 Tim is interested in investing in some other companies. Advise him on the advantages and disadvantages of purchasing preference shares versus ordinary shares in a company from the perspective of an investor. List the advantages and disadvantages of investing in preference shares. (6 marks) Complete your answer in the table provided below: Start writing here: Advantages Disadvantages 1.6 Tim purchased some new computer equipment at the beginning of 2013 with a cost of R40 000. The equipment has a residual value of R5 000, and Tim has elected to use the declining balance (reducing balance) method for calculating the depreciation on the equipment. The depreciation rate is 10% per year. Furthermore, at the beginning of 2015 he purchased security equipment with a cost of R80 000, a residual value of R10 000 and a useful life of 14 years. What will the total carrying value of this equipment (computer and security) be at the end of 2016? (Max. 8 lines) (7 marks) Start writing here: Your friend Tim runs his own retail business. At year-end, his accounting technician resigned and after you told him about the course you are doing he has asked for your help in completing his company's financial statements for the year ended 31 December 2016. Before the accounting technician resigned she had started preparing some of the financial statements and left the following information behind for you to start with: The business is called Tim's Trading and is a private company. The business's accounting period is one year and runs from 1 January to 31 December each year. Tim accounts for inventory using the periodic method. . Tim has chosen to present all non-current at net carrying value on the face of the Statement of Financial Position. . Tim's business prepares the Statement of Cash Flows using the direct method. The Statement of Cash Flows discloses Interest paid as a cash flow from financing activities. . Assume all sales and purchases are made on credit. In September Tim prepaid R87 000 rent. No other rent payments were made during the year. Before the accountant left she prepared the final post-closing trial balance for the year: Fixed assets @ cost Investments Accumulated depreciation Prepaid rent Accounts receivable Accrued service income Inventory Bank Long term loan SARS (Taxation liability) Accrued expenses Accounts payable Share Capital Retained income Post closing DEBITS CREDITS Balance sheet section 1 200 000 300 000 840 000 21 000 88 000 12 000 90 000 289 480 250 000 92 000 4 200 80 000 200 000 534 280 Nominal accounts section Telephone expense Rent expense Salaries expense Depreciation expense Interest expense Taxation expense Sales Purchases Bad debts expense Service income Consumables expense 2 000 480 2 000 480 A small extract of the Statement of Financial Position as at 31 December 2015 is given below: Current assets Prepaid rent Accounts receivable Accrued income Inventory Bank 442 380 18 000 70 000 15 000 75 000 264 380 Current liabilities SARS (Taxation liability) Accrued expenses Accounts payable 192 100 107 600 8 500 76 000 In addition you have been provided with the Statement of Comprehensive Income for the current year: Statement of Comprehensive income of Tim's Trading (Pty) Ltd as at 31 December 2016: 2016 Sales 760 000 Cost of sales (355 000) Beginning inventory 75 000 Purchases 370 000 Closing inventory 90 000 Gross profit 405 000 Other income 30 000 Service income 30 000 Selling, admin & general expenses (336 000) Salaries & wages expense (70 000) Rent expense (84 000) Consumables expense (15 000) Depreciation (120 000) Bad debts expense (30 000) Telephone expense (17000) Profit before interest and tax 99 000 Interest expense (22 500) Profit before tax 76 500 Tax expense (21 420) Net profit 55 080 1.1 Prepare the Statement of Financial Position as at 31 December 2016 in the appropriate format for Tim's Trading (2015 is not required, only 2016). (Max. 25 lines) (10 marks) Start writing here: 1.2 Prepare the following T-accounts for Tim's Trading for the year ended 31 December 2016 using the information provided above. Use the templates provided below. (15 marks) Start writing here: Accounts receivable Accounts payable Accrued income SARS (Tax liability) Accrued expenses (Liability) 1.3 Prepare the "Cash flows from operating activities" section of the Statement of Cash Flows for the year ended 31 December 2016 for Tim's Trading in the appropriate format given below. Be sure to show all of your workings using the templates provided below. (10 marks) Start writing here: Statement of Cash Flows of Tim's Trading (Pty) Ltd for the year ended December 31 2016: Operating activities: Receipts from customers Payments to suppliers Payments to employees Income tax paid Net cash flow from operating activities Working 1: Receipts from customers: Total Working 2: Payments to suppliers: Total 1.4 Would you expect the total "Cash flows from operating activities to be different using the direct method compared to the indirect method? Why or why not? (Max 2 lines) (2 marks) Start writing here: 1.5 Tim is interested in investing in some other companies. Advise him on the advantages and disadvantages of purchasing preference shares versus ordinary shares in a company from the perspective of an investor. List the advantages and disadvantages of investing in preference shares. (6 marks) Complete your answer in the table provided below: Start writing here: Advantages Disadvantages 1.6 Tim purchased some new computer equipment at the beginning of 2013 with a cost of R40 000. The equipment has a residual value of R5 000, and Tim has elected to use the declining balance (reducing balance) method for calculating the depreciation on the equipment. The depreciation rate is 10% per year. Furthermore, at the beginning of 2015 he purchased security equipment with a cost of R80 000, a residual value of R10 000 and a useful life of 14 years. What will the total carrying value of this equipment (computer and security) be at the end of 2016? (Max. 8 lines) (7 marks) Start writing here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started