Question

Your friends are going to Puerto Vallarta, Mexico, over Reading Week and you want to go too. Unfortunately, you haven't been good at saving, so

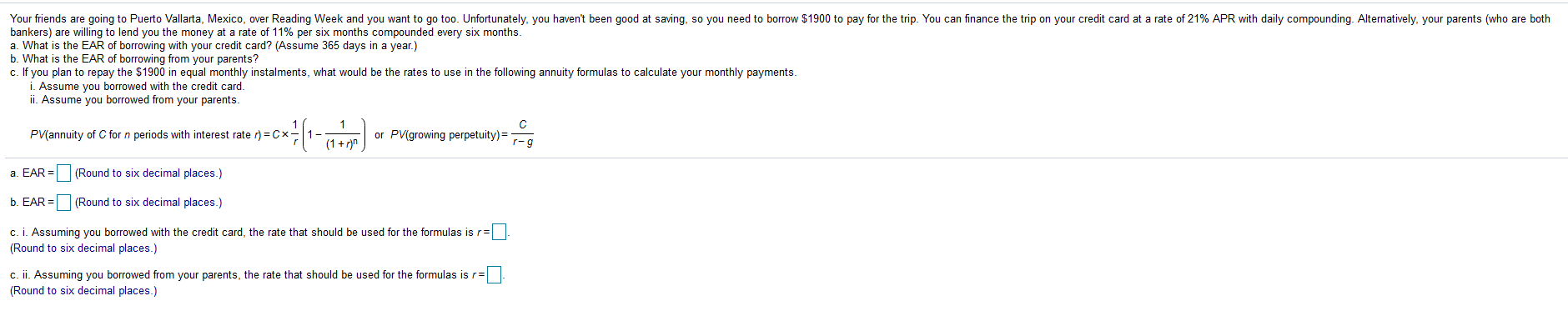

Your friends are going to Puerto Vallarta, Mexico, over Reading Week and you want to go too. Unfortunately, you haven't been good at saving, so you need to borrow $1900 to pay for the trip. You can finance the trip on your credit card at a rate of 21% APR with daily compounding. Alternatively, your parents (who are both bankers) are willing to lend you the money at a rate of 11% per six months compounded every six months. a. What is the EAR of borrowing with your credit card? (Assume 365 days in a year.) b. What is the EAR of borrowing from your parents? c. If you plan to repay the $1900 in equal monthly instalments, what would be the rates to use in the following annuity formulas to calculate your monthly payments. i. Assume you borrowed with the credit card. ii. Assume you borrowed from your parents. PV(annuity of C for n periods with interest rate :) = Cx- 1 - or PV(growing perpetuity)= ( r-9 a. EAR = (Round to six decimal places.) b. EAR=(Round to six decimal places.) c. i. Assuming you borrowed with the credit card, the rate that should be used for the formulas is r=0 (Round to six decimal places.) c. ii. Assuming you borrowed from your parents, the rate that should be used for the formulas is rul (Round to six decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started