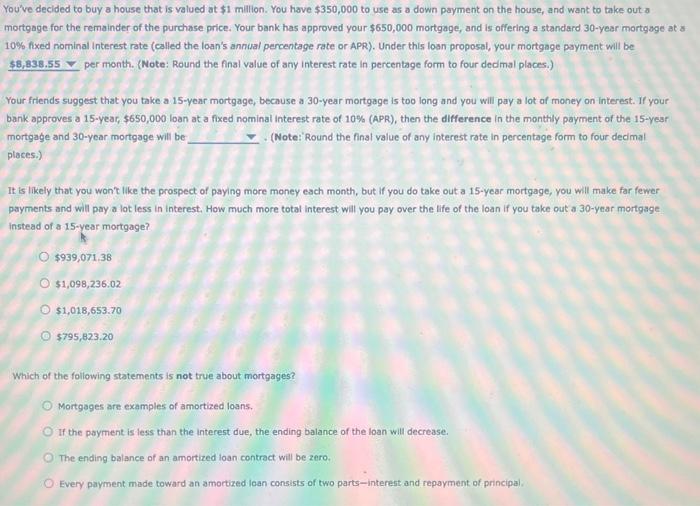

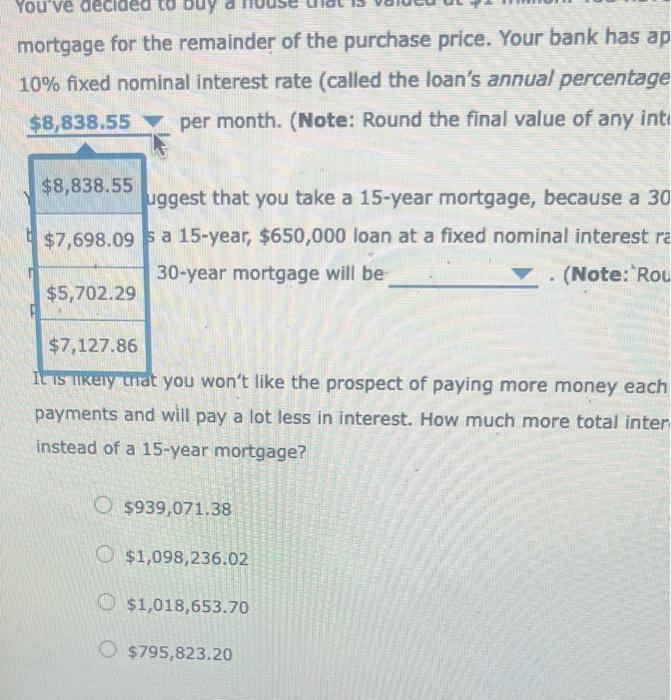

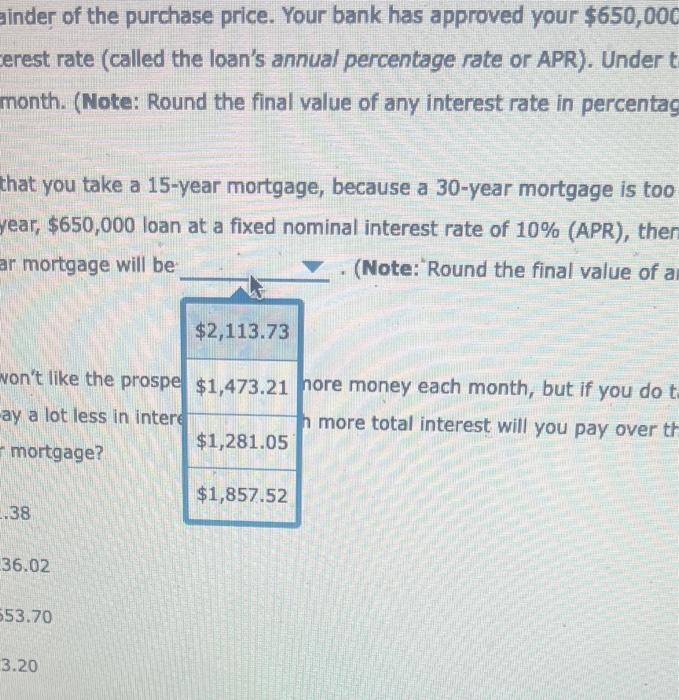

Your friends suggest that you take a 15 -year mortgage, because a 30 -year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15 -year, $650,000-oan at a fixed nominal interest rate of 10% (APR), then the difference in the monthly payment of the 15 -year mortgage and 30 -year mortgage will be (Note:'Round the final value of any interest rate in percentage form to four dedmal places.) It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15 -year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15 -year mortgage? $939,071.36$1,098,236.02$1,018,653.70$795,823.20 Which of the following statements is not true about mortgages? Mortgages are examples of amortized loans. If the payment is less than the interest due, the ending balance of the loan will decrease. The ending balance of an amortized loan contract will be zero. Every payment made toward an amortized loan consists of two parts-interest and repayment of principal. mortgage for the remainder of the purchase price. Your bank has ap 10% fixed nominal interest rate (called the loan's annual percentage $8,838.55 per month. (Note: Round the final value of any int $8,838.55 uggest that you take a 15 -year mortgage, because a \begin{tabular}{|l|l} $7,698.09 & s a 15 -year, $650,000 loan \\ 30 -year mortgage will be \end{tabular} - (Note: Rou $7,127.86 Itis iikely crat you won't like the prospect of paying more money each payments and will pay a lot less in interest. How much more total inter instead of a 15-year mortgage? $939,071.38$1,098,236.02$1,018,653.70$795,823.20 ainder of the purchase price. Your bank has approved your $650,000 erest rate (called the loan's annual percentage rate or APR). Under t month. (Note: Round the final value of any interest rate in percentag that you take a 15 -year mortgage, because a 30 -year mortgage is too year, $650,000 loan at a fixed nominal interest rate of 10% (APR), then ar mortgage will be (Note:' Round the final value of a \begin{tabular}{l|l|} \hline & $2,113.73 \\ \hline von't like the prospe & $1,473.21 \\ ay a lot less in intere & $1,281.05 \\ \hline mortgage? & $1,28 more total interest will you pay over th \\ \hline .38 & $1,857.52 \\ \hline \end{tabular} 36.02