Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your fund is a VC fund in software services sector, where you are a general partner (GP). Your optimal portfolio size' is 10 ventures for

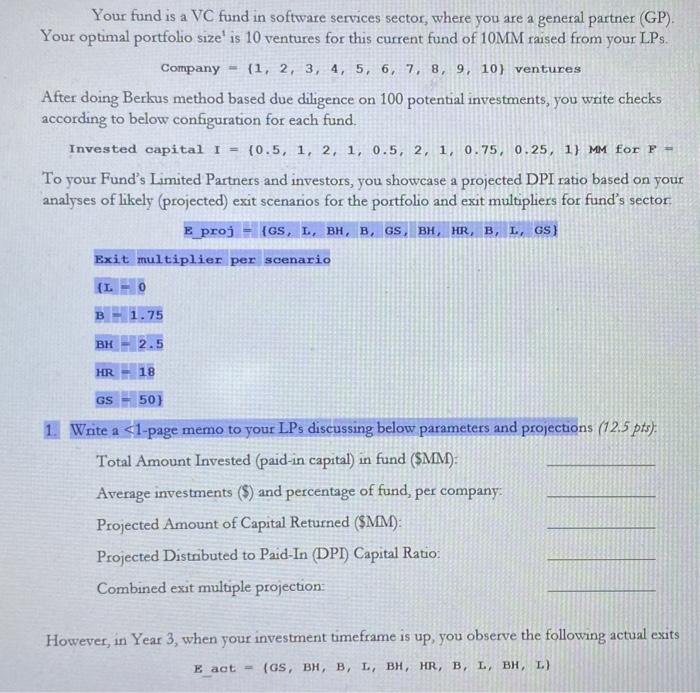

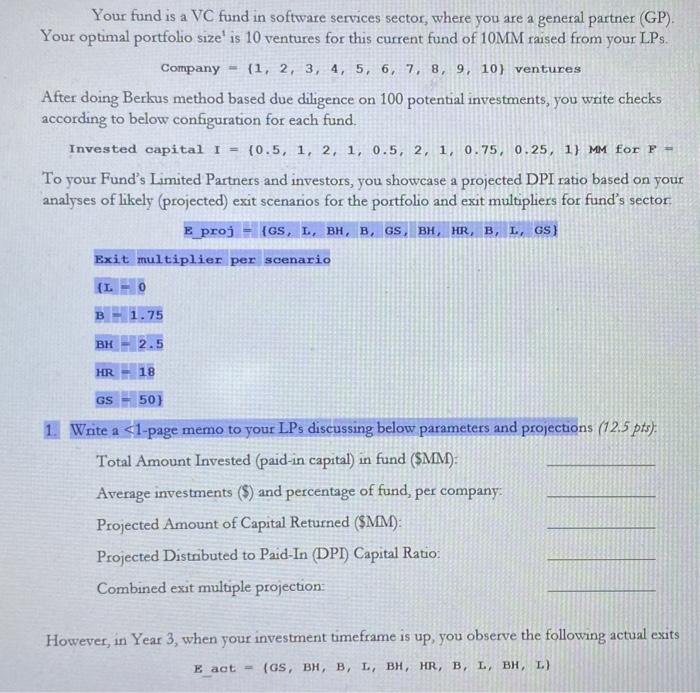

Your fund is a VC fund in software services sector, where you are a general partner (GP). Your optimal portfolio size' is 10 ventures for this current fund of 10MM raised from your LPs. Company = {1, 2, 3, 4, 5, 6, 7, 8, 9, 10) ventures After doing Berkus method based due diligence on 100 potential investments, you write checks according to below configuration for each fund. (0.5, 1, 2, 1, 0.5, 2, 1, 0.75, 0.25, 1} MM for F = Invested capital I To your Fund's Limited Partners and investors, you showcase a projected DPI ratio based on your analyses of likely (projected) exit scenarios for the portfolio and exit multipliers for fund's sector. E proj {GS, L, BH, B, GS, BH, HR, B, L, GS} Exit multiplier per scenario {L = 0 B = 1.75 BH = 2.5 HR = 18 = GS 50} 1. Write a

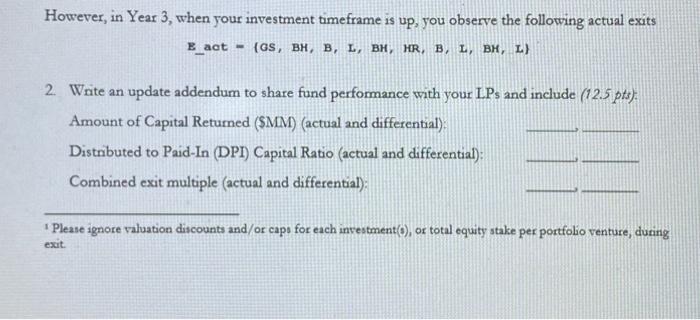

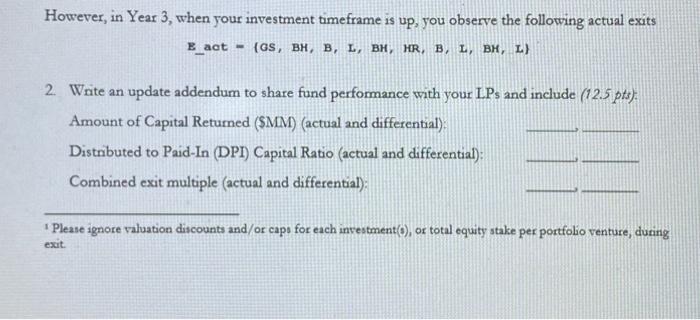

Your fund is a VC fund in software services sector, where you are a general partner (GP). Your optimal portfolio size 1 is 10 ventures for this current fund of 10MM raised from your LPs. Company={1,2,3,4,5,6,7,8,9,10}ventures After doing Berkus method based due diligence on 100 potential investments, you write checks according to below configuration for each fund. InvestedcapitalI={0.5,1,2,1,0.5,2,1,0.75,0.25,1}MMforF= To your Fund's Limited Partners and investors, you showcase a projected DPI ratio based on your analyses of likely (projected) exit scenarios for the portfolio and exit multipliers for fund's sector \[ \text { E_proj }=\{\text { GS, L, BH, B, GS, BH, HR, B, L, GS }\} \] Exit multiplier per scenario fL=0B=1.75BH=2.5HR=18GS=50} However, in Year 3 , when your investment timeframe is up, you observe the following actual exits \[ E_{\text {_act }}=\{\mathrm{GS}, \mathrm{BH}, \mathrm{B}, \mathrm{L}, \mathrm{BH}, \mathrm{HR}, \mathrm{B}, \mathrm{L}, \mathrm{BH}, \mathrm{L}\} \] \[ E_{\text {_act }}=(G S, B H, B, L, B H, H R, B, I, B H, L) \] 2. Write an update addendum to share fund performance with your LPs and include (12.5pts) : Amount of Capital Returned (\$MM) (actual and differential): Distributed to Paid-In (DPI) Capital Ratio (actual and differential): Combined exit multiple (actual and differential): 1 Please ignore valuation discounts and/or caps for each investment( (0), or total equity stake per portfolio venture, during exit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started