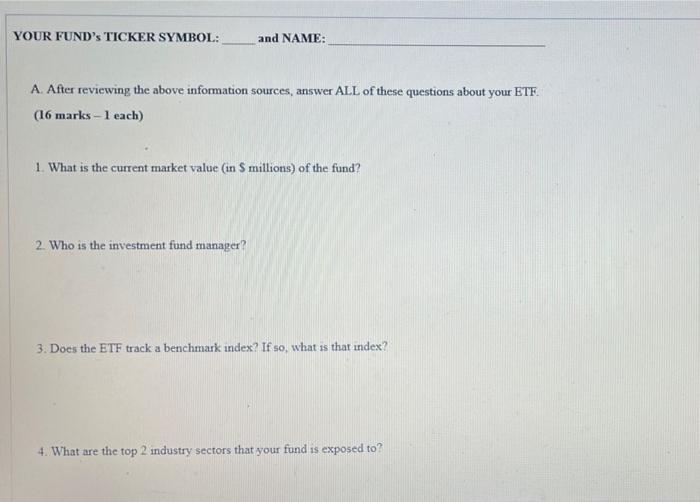

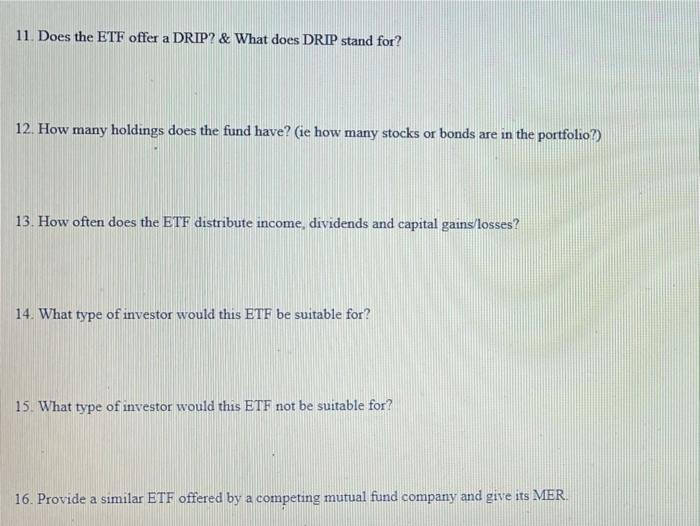

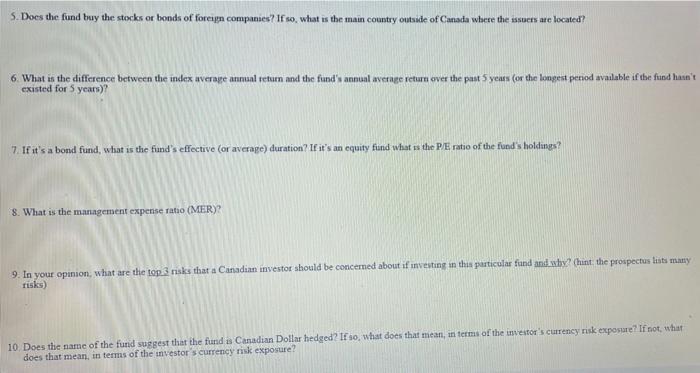

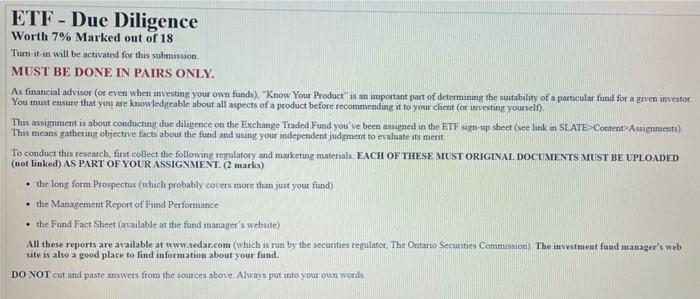

YOUR FUND's TICKER SYMBOL: and NAME: A. After reviewing the above information sources, answer ALL of these questions about your ETF. (16 marks-1 each) 1. What is the current market value in S millions) of the fund? 2. Who is the investment fund manager? 3. Does the ETF track a benchmark index? If so, what is that index? 4. What are the top 2 industry sectors that your fund is exposed to? 11 Does the ETF offer a DRIP? & What does DRIP stand for? 12. How many holdings does the fund have? (ie how many stocks or bonds are in the portfolio?) 13. How often does the ETF distribute income, dividends and capital gains/losses? 14. What type of investor would this ETF be suitable for? 15. What type of investor would this ETF not be suitable for? 16. Provide a similar ETF offered by a competing mutual fund company and give its MER. Ticker VEE XEG VXC VUS FSF XGB Assigned ETF ETF NAME ETF Issuer Vanguard FTSE Emerging Markets All Cap Index ETF Vanguard Investments Canada iShares S&P/TSX Capped Energy Index ETF BlackRock Asset Management Canada Vanguard FTSE Global All Cap ex Canada Index ETF Vanguard Investments Canada Vanguard US Total Market Index ETF CAD-Hedged Vanguard Investments Canada Ci First Asset Global Financial Sector ETF CI Financial Corp iShares Canadian Government Bond Index ETF BlackRock Asset Management Canada Vanguard FTSE Developed All Cap ex U.S. Index ETF (CAD. Vanguard Investments Canada iShares S&P/TSX Capped Consumer Staples Index Fund BlackRock Asset Management Canada iShares S&P/TSX Capped Materials Index ETF BlackRock Asset Management Canada Vanguard FTSE Developed All Cap ex North America Index ET Vanguard Investments Canada iShares US High Dividend Equity Index Fund (CAD-Hedged) BlackRock Asset Management Canada VEF XST XMA VIU XHD 5. Does the fund buy the stocks or bonds of foreign companies? If so, what is the main country outside of Canada where the issues are located? 6. What is the difference between the index average animal teturn and the fund's annual average return over the past 5 years (or the longest period available if the fund hasn't existed for 5 years)? 7. If it's a bond fund, what is the fund's effective (or average) duration? If it's an equity fund what is the P/E ratio of the fund's holdings? 8. What is the management expense ratio (MER)? 9. In your opinion, what are the top 3 risks that a Canadian investor should be concerned about if Investing in this particular fund and why? (hint the prospectus lists many risks) 10 Does the name of the fund suggest that the fund is Canadian Dollar hedged? If so, what does that mean, in terms of the investor's currency risk exposure? If not, what does that mean, in terms of the investors currency risk exposure? ETF - Due Diligence Worth 7% Marked out of 18 Turn-it-in will be activated for this submission MUST BE DONE IN PAIRS ONLY. As financial advisor (or even when investing your own funds). Know Your Product is an important part of determining the suitability of a particular fund for a piven investor You must ensure that you are knowledgeable about all aspects of a product before recommending it to your client (or investing yourself). This assignment is about conducting due diligence on the Exchange Traded Fund you've been assigned in the ETF sign-up sheet (see link in SLATE ContentAssignments) This means gathering objective facts about the fund and using your independent judgment to evaluate itsment To conduct this research, first collect the following regulatory and marketing materials. EACH OF THESE MUST ORIGINAL DOCUMENTS MUST BE UPLOADED (not linked) AS PART OF YOUR ASSIGNMENT. (2 marks) the long form Prospectus (which probably covers more than just your fund) . the Management Report of Fund Performance . the Fund Fact Sheet (available at the fund manager's website) All these reports are available at www.sedar.com (which is run by the securities regulator The Ontario Securities Commission The investment fund manager's web site is also a good place to find information about your fund. DO NOT cut and paste answers from the sources above Always put into your own words