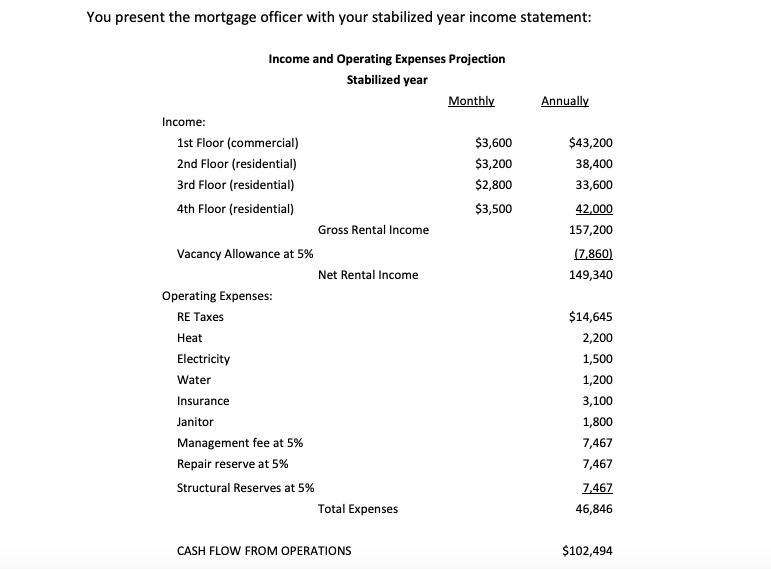

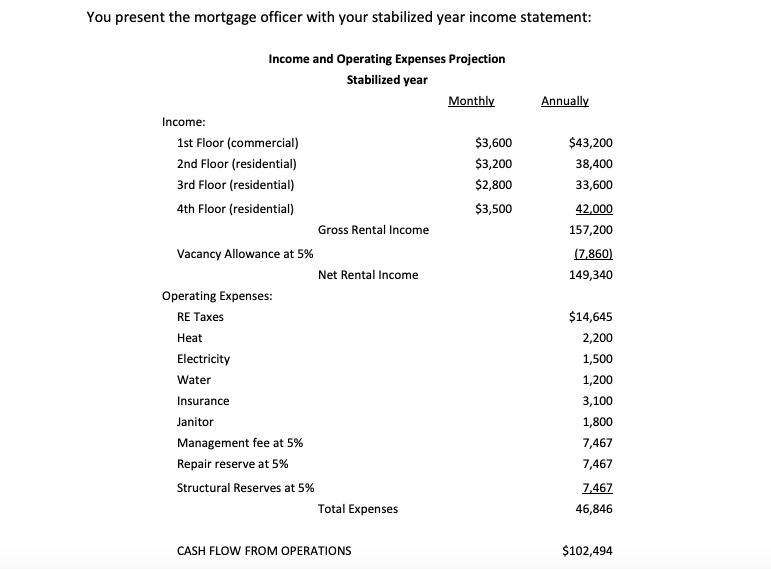

Your Goal to Become a Real Estate Investor You are searching for a small income-producing apartment building in which to invest. Not having been in the real estate industry previously, and having your only exposure to the industry through your university degree program and working in some small summer construction jobs. To enhance your knowledge, you are planning to attend graduate school Working in various jobs and through a modest inheritance, you have savings of about $240,000. Now, while working at a start-up company, you earn about $145,000 a year between salary and equity warrants from your employer. However, you have student loan payments of $1,200 a month, a car loan with $350 monthly payments and credit cards with total monthly payments of $150 You found a neighborhood in area which you consider to be one of the best residential areas in the city, so you spend all of your free evenings and weekends becoming familiar with the area. You're thinking about acquiring a multi-family rental property. You spend a considerable about of time focused on Internet research using the typical suspect sites such as Zillow, Realtor.com, etc. You also check various bank loan rates at web sites like BankRate. You chart recent sales, locations, sales prices, etc. and try to compute applicable cap rates. You also study real estate sections of local newspapers to get a sense of the local brokers, who they are and what types of properties they typically represent. You even visit some of the brokers who placed ads online and in the newspapers to inquire further. As expected, the brokers ask invasive, nuisance questions about your interests and resources such as What type of property? How much cash do you have for a down payment? Will you live in the building? After several broker visits, you become very disappointed and discouraged. The properties you saw were either in deplorable condition or too expensive. In fact, even though brokers claimed 20% cash-on-cash returns based on fully-rented properties, you realize those returns do not include the cost of rehabilitation, let alone renovation costs. When those costs were considered, the returns dropped to 3% or less. Most of the properties you like require a down payment of about $400,000. You expect to obtain a bank loan for part of the purchase price, but institutional lenders are reluctant to lend more than 70% or so of the value of the property. Additional money could be raised using a second mortgage or mezzanine loan, but the interest costs on those loans are much higher than you expected. Amazingly, some of the sellers were open to offering seller financing. Nevertheless, you're quickly learning that $240,000 in savings is not much money. You realize that you will have to seek friends and family money to perhaps make up some of the difference. Even more discouraging, was that many of the properties brokers show you are in fact owned by the brokers personally. Few properties-not many-were sold by the current owners (for sale by owner) in this market giving you the clear impression that this is a highly desirable area. The area you targeted has attracted many professionals such as attorneys and doctors. The area is also located near some very high-end retailers and several transportation links. Property values have been steadily increasing for the last year, even through the 2008 financial crisis. These research points bolster your confidence in your chosen targeted investment neighborhood. The downside of this neighborhood is that it is designated as a historical district. Any changes to the exterior of the building has to have the approval of the local historic commission. Approval was not difficult as long as the change is "sensitive" to the historic nature of the building and area, but...approval takes a long time to obtain. Finally, a broker located a property that was just listed and calls you. It's a small five-unit building (four residential units and one commercial unit). You know the competition for good property is fierce, and if you want this building, you have to act very quickly. The building was built in 1820 and sits on a corner with natural light on two sides. It has a water view. The building suffered a major fire about ten years ago. An architect purchased the building about a year after the fire and began a $450,000 renovation. The architect's work done so far looked good, but the architect decided that the renovations were taking too much time- and too much money. Thus, he decided to place the building for sale. You think the property has profit potential and has an asking price within your price range of $1 million. Fantastically, the architect is willing to offer 20% seller financing at 5% with a five-year balloon over a 30-year amortization You learn the sales price is firm. You also speak to a contractor who tells you that to complete the renovations it would cost approximately $450,000 above what work the current owner has already completed. Given the cost estimate, you think you will act as your own general contractor to save the contractor's fee (you have worked in construction and understand how things work) After doing some detailed analysis, you learn that the property's tax assessed value is about $335,500 below what your expected investment will be ($1 million purchase price plus renovations cost) You speak to some friends about your "find" telling them you plan to live "rent free" to save money in one of the units while managing and maintaining the property yourself to save money. You think that having a place to live rent-free will be a fantastic idea. Your friends think you are crazy. They question your competence at managing a construction job. They question if you'll have the time to maintain a property while working and planning to attend graduate school. They also question the practicality of having tenants being able to knock on your door 24/7 when a light bulb burns out, or there's an insect running around in their bathroom. You shrug off these comments because even though you're inexperienced, you are confident and have the motivation and moxie to get started with real estate investments. You now visit with a mortgage officer at a local bank. You selected this bank because you recently read the bank had given a 30-year $1 million loan at 4% on this building. A portion of the loan funding is being withheld pending completion of construction. You present the mortgage officer with your stabilized year income statement Income and Operating Expenses Projection Stabilized year Monthly Income 1st Floor (commercial) 2nd Floor (residential) 3rd Floor (residential) 4th Floor (residential) $3,600 $3,200 $2,800 3,500 $43,200 38,400 33,600 42,000 157,200 (7.860) 149,340 Gross Rental Income Vacancy Allowance at 5% Net Rental Income Operating Expenses: RE Taxes Heat Electricity Water Insurance Janitor Management fee at 5% Repair reserve at 5% Structural Reserves at 5% $14,645 2,200 1,500 1,200 3,100 1,800 7,467 7,467 7467 46,846 Total Expenses CASH FLOW FROM OPERATIONS 102,494 You explain your plans for the building along with your financial projections. Your underwriting analysis noted that your revenue projections are $12,000 higher than the current owner's projections-even though you plan to rent out only 75% of the residential units. At the time of the original loan, the bank had the property valued at $1.425 million, but recognizes that values in the neighborhood have steadily been increasing. You ask the bank to consider increasing the loan to $1.05 million. You argue that you project a property NOI of $102,494, which at a current market cap rate of 7% should give the bank comfort. The mortgage officer declines any loan amount increase because (1) he doesn't believe the increased revenues are achievable (partially because you will be living in one of he residential units) and (2) the limited amount of capital you plan to invest in the project. However, the mortgage officer said he would consider a loan amount increase when the building is rented and has a year or two of seasoning That said, the mortgage officer mentioned that they have a strict 75% LTV policy, which means that the property must appraise at $1.4 million to justify a $1.05 million loan. The mortgage officer also says that interest rates are dropping, so it's very possible after lease- up about a year from now, the bank could offer a 3.75% interest rate on a 30-year loan with interest-only payments for the first six months. All said, however, the mortgage officer tells you that you will personally have to sign the promissory note. When you ask why, the mortgage officer says it's the bank's policy You then speak with an attorney who questions your desire to place a written purchase offer before securing financing. He details the risks you would face should you renege on your purchase agreement. Your attorney also asks why you're are renting the units and not selling them as condominiums. You respond by saying you are hopeful of increased rents that will in turn increase the building value more, and that will give you increased profit when you decide to sell the building 1. What difficulties and disappointments can you imagine encountering when searching for a property list at least five points? What conclusions can you draw about the ease or difficulty of a property search in general, as well as for someone at your stage of an investing career - list at least three points? Have you done everything you could do as part of your research? Your Goal to Become a Real Estate Investor You are searching for a small income-producing apartment building in which to invest. Not having been in the real estate industry previously, and having your only exposure to the industry through your university degree program and working in some small summer construction jobs. To enhance your knowledge, you are planning to attend graduate school Working in various jobs and through a modest inheritance, you have savings of about $240,000. Now, while working at a start-up company, you earn about $145,000 a year between salary and equity warrants from your employer. However, you have student loan payments of $1,200 a month, a car loan with $350 monthly payments and credit cards with total monthly payments of $150 You found a neighborhood in area which you consider to be one of the best residential areas in the city, so you spend all of your free evenings and weekends becoming familiar with the area. You're thinking about acquiring a multi-family rental property. You spend a considerable about of time focused on Internet research using the typical suspect sites such as Zillow, Realtor.com, etc. You also check various bank loan rates at web sites like BankRate. You chart recent sales, locations, sales prices, etc. and try to compute applicable cap rates. You also study real estate sections of local newspapers to get a sense of the local brokers, who they are and what types of properties they typically represent. You even visit some of the brokers who placed ads online and in the newspapers to inquire further. As expected, the brokers ask invasive, nuisance questions about your interests and resources such as What type of property? How much cash do you have for a down payment? Will you live in the building? After several broker visits, you become very disappointed and discouraged. The properties you saw were either in deplorable condition or too expensive. In fact, even though brokers claimed 20% cash-on-cash returns based on fully-rented properties, you realize those returns do not include the cost of rehabilitation, let alone renovation costs. When those costs were considered, the returns dropped to 3% or less. Most of the properties you like require a down payment of about $400,000. You expect to obtain a bank loan for part of the purchase price, but institutional lenders are reluctant to lend more than 70% or so of the value of the property. Additional money could be raised using a second mortgage or mezzanine loan, but the interest costs on those loans are much higher than you expected. Amazingly, some of the sellers were open to offering seller financing. Nevertheless, you're quickly learning that $240,000 in savings is not much money. You realize that you will have to seek friends and family money to perhaps make up some of the difference. Even more discouraging, was that many of the properties brokers show you are in fact owned by the brokers personally. Few properties-not many-were sold by the current owners (for sale by owner) in this market giving you the clear impression that this is a highly desirable area. The area you targeted has attracted many professionals such as attorneys and doctors. The area is also located near some very high-end retailers and several transportation links. Property values have been steadily increasing for the last year, even through the 2008 financial crisis. These research points bolster your confidence in your chosen targeted investment neighborhood. The downside of this neighborhood is that it is designated as a historical district. Any changes to the exterior of the building has to have the approval of the local historic commission. Approval was not difficult as long as the change is "sensitive" to the historic nature of the building and area, but...approval takes a long time to obtain. Finally, a broker located a property that was just listed and calls you. It's a small five-unit building (four residential units and one commercial unit). You know the competition for good property is fierce, and if you want this building, you have to act very quickly. The building was built in 1820 and sits on a corner with natural light on two sides. It has a water view. The building suffered a major fire about ten years ago. An architect purchased the building about a year after the fire and began a $450,000 renovation. The architect's work done so far looked good, but the architect decided that the renovations were taking too much time- and too much money. Thus, he decided to place the building for sale. You think the property has profit potential and has an asking price within your price range of $1 million. Fantastically, the architect is willing to offer 20% seller financing at 5% with a five-year balloon over a 30-year amortization You learn the sales price is firm. You also speak to a contractor who tells you that to complete the renovations it would cost approximately $450,000 above what work the current owner has already completed. Given the cost estimate, you think you will act as your own general contractor to save the contractor's fee (you have worked in construction and understand how things work) After doing some detailed analysis, you learn that the property's tax assessed value is about $335,500 below what your expected investment will be ($1 million purchase price plus renovations cost) You speak to some friends about your "find" telling them you plan to live "rent free" to save money in one of the units while managing and maintaining the property yourself to save money. You think that having a place to live rent-free will be a fantastic idea. Your friends think you are crazy. They question your competence at managing a construction job. They question if you'll have the time to maintain a property while working and planning to attend graduate school. They also question the practicality of having tenants being able to knock on your door 24/7 when a light bulb burns out, or there's an insect running around in their bathroom. You shrug off these comments because even though you're inexperienced, you are confident and have the motivation and moxie to get started with real estate investments. You now visit with a mortgage officer at a local bank. You selected this bank because you recently read the bank had given a 30-year $1 million loan at 4% on this building. A portion of the loan funding is being withheld pending completion of construction. You present the mortgage officer with your stabilized year income statement Income and Operating Expenses Projection Stabilized year Monthly Income 1st Floor (commercial) 2nd Floor (residential) 3rd Floor (residential) 4th Floor (residential) $3,600 $3,200 $2,800 3,500 $43,200 38,400 33,600 42,000 157,200 (7.860) 149,340 Gross Rental Income Vacancy Allowance at 5% Net Rental Income Operating Expenses: RE Taxes Heat Electricity Water Insurance Janitor Management fee at 5% Repair reserve at 5% Structural Reserves at 5% $14,645 2,200 1,500 1,200 3,100 1,800 7,467 7,467 7467 46,846 Total Expenses CASH FLOW FROM OPERATIONS 102,494 You explain your plans for the building along with your financial projections. Your underwriting analysis noted that your revenue projections are $12,000 higher than the current owner's projections-even though you plan to rent out only 75% of the residential units. At the time of the original loan, the bank had the property valued at $1.425 million, but recognizes that values in the neighborhood have steadily been increasing. You ask the bank to consider increasing the loan to $1.05 million. You argue that you project a property NOI of $102,494, which at a current market cap rate of 7% should give the bank comfort. The mortgage officer declines any loan amount increase because (1) he doesn't believe the increased revenues are achievable (partially because you will be living in one of he residential units) and (2) the limited amount of capital you plan to invest in the project. However, the mortgage officer said he would consider a loan amount increase when the building is rented and has a year or two of seasoning That said, the mortgage officer mentioned that they have a strict 75% LTV policy, which means that the property must appraise at $1.4 million to justify a $1.05 million loan. The mortgage officer also says that interest rates are dropping, so it's very possible after lease- up about a year from now, the bank could offer a 3.75% interest rate on a 30-year loan with interest-only payments for the first six months. All said, however, the mortgage officer tells you that you will personally have to sign the promissory note. When you ask why, the mortgage officer says it's the bank's policy You then speak with an attorney who questions your desire to place a written purchase offer before securing financing. He details the risks you would face should you renege on your purchase agreement. Your attorney also asks why you're are renting the units and not selling them as condominiums. You respond by saying you are hopeful of increased rents that will in turn increase the building value more, and that will give you increased profit when you decide to sell the building 1. What difficulties and disappointments can you imagine encountering when searching for a property list at least five points? What conclusions can you draw about the ease or difficulty of a property search in general, as well as for someone at your stage of an investing career - list at least three points? Have you done everything you could do as part of your research