Answered step by step

Verified Expert Solution

Question

1 Approved Answer

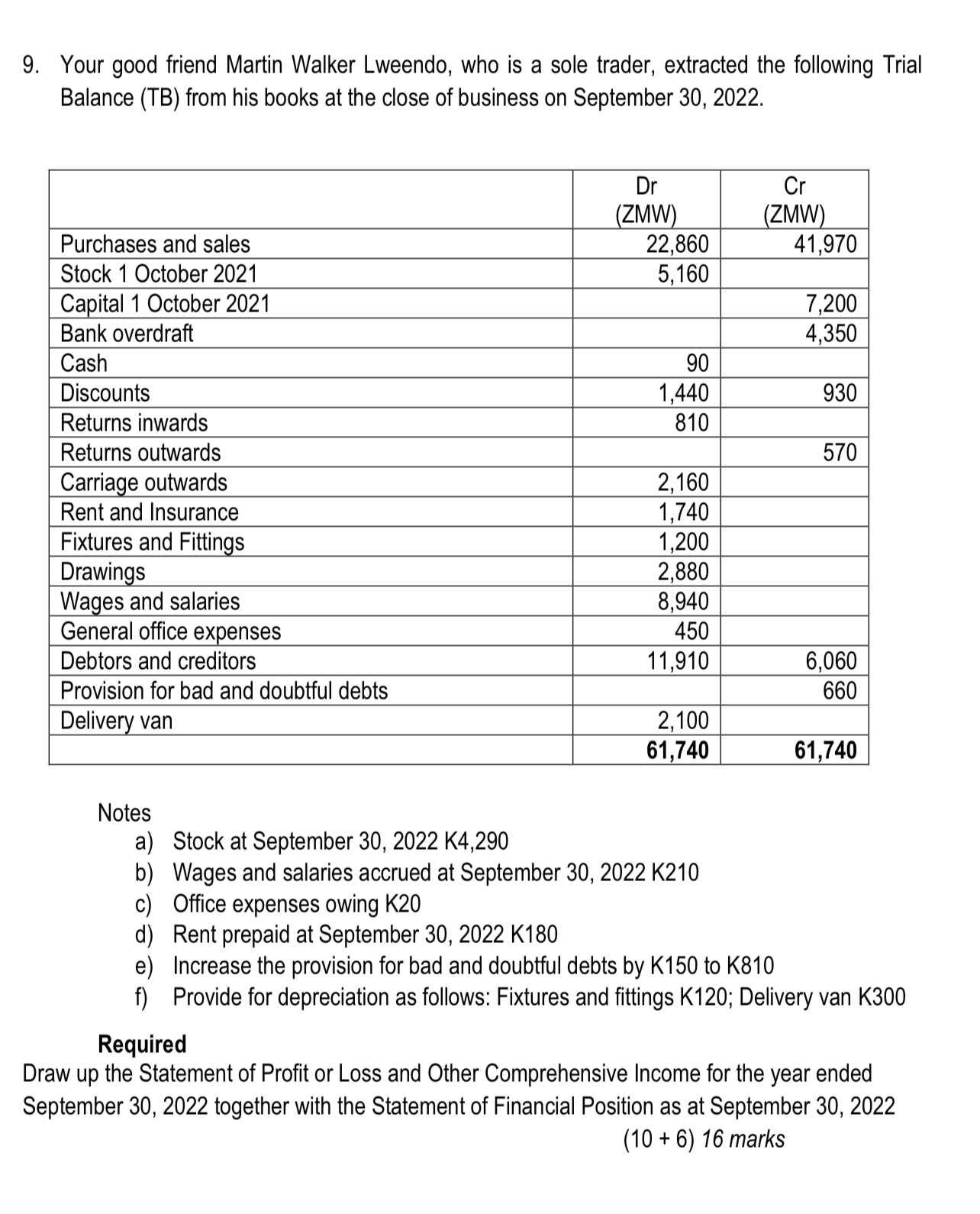

Your good friend Martin Walker Lweendo, who is a sole trader, extracted the following Trial Balance ( TB ) from his books at the close

Your good friend Martin Walker Lweendo, who is a sole trader, extracted the following Trial Balance TB from his books at the close of business on September

tabletableDrZMWtableCrZMWPurchases and sales,Stock October Capital October Bank overdraft,CashDiscountsReturns inwards,,Returns outwards,Carriage outwards,Rent and Insurance,Fixtures and Fittings,DrawingsWages and salaries,General office expenses,Debtors and creditors,,Provision for bad and doubtful debts,Delivery van,

Notes

a Stock at September K

b Wages and salaries accrued at September K

c Office expenses owing KO

d Rent prepaid at September K

e Increase the provision for bad and doubtful debts by K to K

f Provide for depreciation as follows: Fixtures and fittings K; Delivery van K

Required

Draw up the Statement of Profit or Loss and Other Comprehensive Income for the year ended September together with the Statement of Financial Position as at September

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started