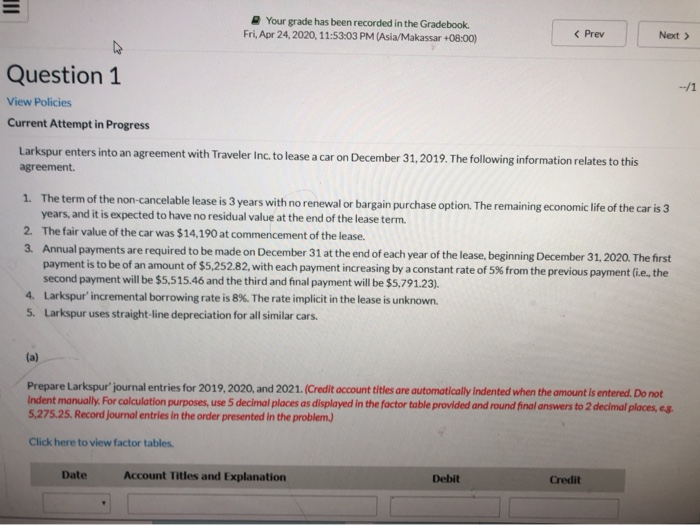

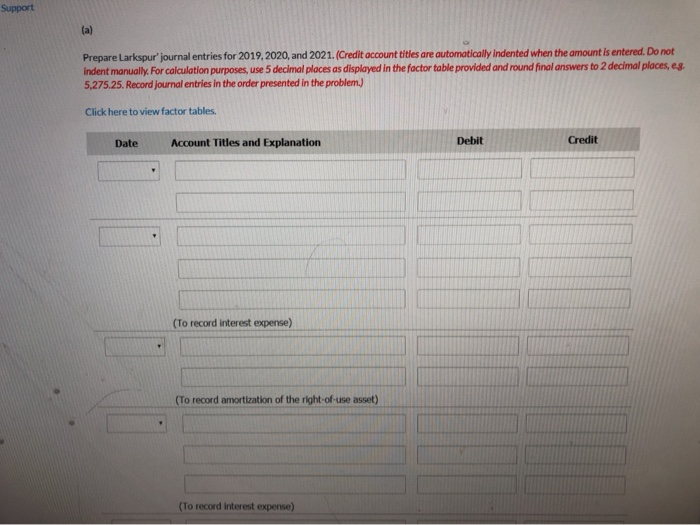

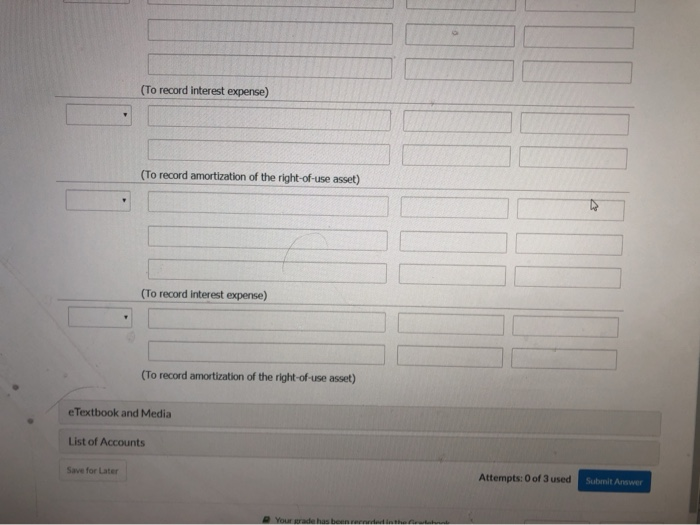

Your grade has been recorded in the Gradebook Fri, Apr 24, 2020, 11:53:03 PM (Asia/Makassar +08:00) Question 1 View Policies Current Attempt in Progress Larkspur enters into an agreement with Traveler Inc. to lease a car on December 31, 2019. The following information relates to this agreement 1. The term of the non-cancelable lease is 3 years with no renewal or bargain purchase option. The remaining economic life of the car is 3 years, and it is expected to have no residual value at the end of the lease term. 2. The fair value of the car was $14,190 at commencement of the lease. 3. Annual payments are required to be made on December 31 at the end of each year of the lease, beginning December 31, 2020. The first payment is to be of an amount of $5,252.82, with each payment increasing by a constant rate of 5% from the previous payment (ie, the second payment will be $5,515.46 and the third and final payment will be $5.791.23). 4. Larkspur'incremental borrowing rate is 8%. The rate implicit in the lease is unknown. 5. Larkspur uses straight-line depreciation for all similar cars. Prepare Larkspur' journal entries for 2019, 2020, and 2021. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 2 decimal places 5.275.25. Record journal entries in the order presented in the problem.) Click here to view factor tables. Date Account Titles and Explanation Debit Credit Support (a) Prepare Larkspur' journal entries for 2019,2020, and 2021. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 2 decimal places, es 5,275.25. Record journal entries in the order presented in the problem.) Click here to view factor tables. Date Account Titles and Explanation Debit Credit (To record interest expense) (To record amortization of the right-of-use asset) (To record interest expense) (To record interest expense) (To record amortization of the right-of-use asset) (To record interest expense) (To record amortization of the right-of-use asset) e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit