Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios

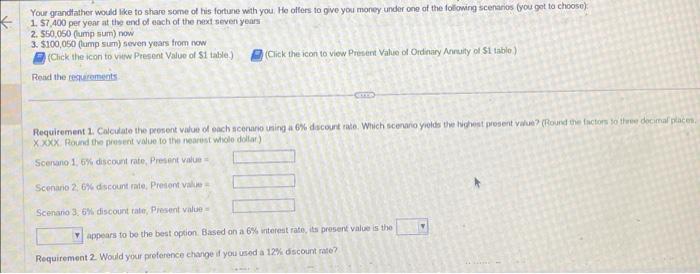

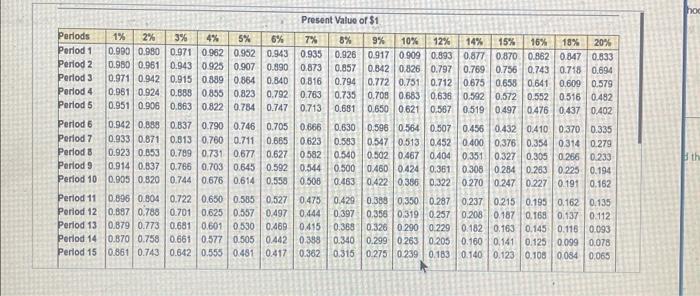

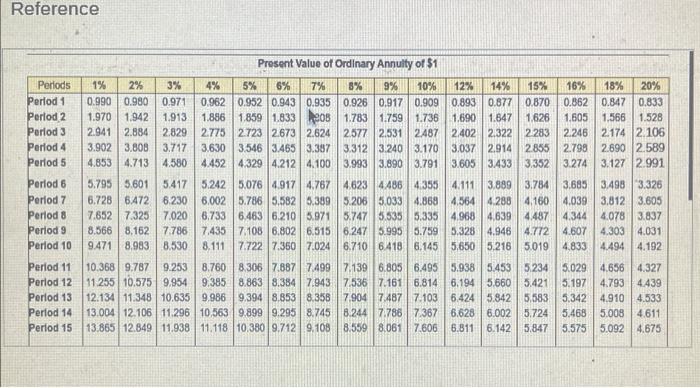

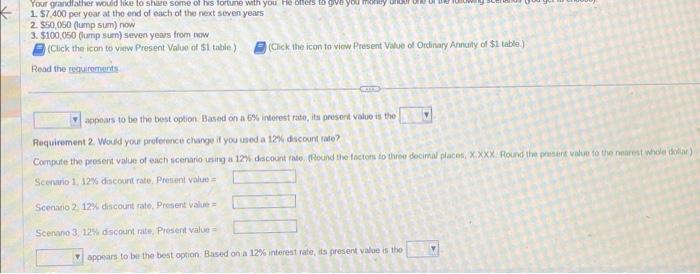

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose) 1. $7,400 per year at the end of each of the next seven years 2. $50,050 (lump sum) now 3. $100,050 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) Read the requirements (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Requirement 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? (Round the factors to three decimal places. XXXX. Round the present value to the nearest whole dollar) Scenano 1, 6% discount rate, Present value= Scenario 2, 6% discount rate, Present value Scenario 3, 6% discount rate, Present value= Yappears to be the best option. Based on a 6% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? hoo Present Value of $1 Periods 1% 2% Period 1 0.990 0.980 0.971 3% 4% 5% 6% 7% 0.962 0.952 0.943 0.935 8% 9% 10% 12% 0.926 0.917 0.909 0.893 14% 15% 16% 18% 20% 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694) Perlod 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.735 0.681 0,708 0.683 0.636 0.650 0.621 0.567 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.592 0.572 0.552 0.516 0.482 0.519 0.497 0.476 0.437 0.402 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 Period 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 Period 10 0.905 0.820 0.744 0.676 Period 11 0.896 0.804 0.722 0.650 0.585 Period 12 0.887 0.788 0.701 Period 13 0.879 0.773 0.681 0.601 0.530 Period 14 0.870 0.758 0.661 0.577 0.505 Perlod 15 0.861 0.743 0.642 0.555 0.481 0.614 0.558 0.508 0.463 0.630 0.596 0.564 0.507 0.456 0.432 0.547 0.513 0.452 0.400 0,376 0.354 0.314 0.279 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.422 0.386 0.322 0.270 0.247 th 0.227 0.191 0.162 0.527 0.475 0.429 0.388 0,350 0.287 0.237 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.215 0.195 0.162 0.135 0.187 0.168 0.137 0.112 0.469 0.415 0.442 0.388 0.417 0.362 0.368 0.326 0.290 0.229 0.182 0.340 0.299 0.263 0.205 0.160 0.315 0.275 0.239 0.183 0.140 0.163 0.145 0.116 0.093 0.141 0.125 0.099 0.078 0.123 0.108 0.084 0.065 Reference Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% Period 13 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 908 1.783 1.759 1.736 1.690 1.647 1.626 1.605 1,566 1.528 Period 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2487 2.402 2.322 2.283 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.690 2.589 Period 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 Period 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 Period 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 Period 10 9.471 8.983 8.530 8.111 7.722 7.350 7.024 Period 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 12.134 11.348 10.635 9.986 9.394 8.853 8.358 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 2.246 2.174 2.106 2.798 8.559 8.061 7.606 4.623 4.486 4.355 4.111 3.889 3.784 3.685 3.498 3.326 5.206 5.033 4.868 4.564 4.288 4.160) 4.039 3.812 3.605 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 7.139 6.805 6.495 5.938 5.453 5.234 5.029 4.656 4.327 7.536 7.161 6.814 6.194 5.660 5.421 5.197 4.793 4.439 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 6.811 6.142 5.847 5.575 5.092 4.675 Requirements 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? Round to the nearest whole dollar. 2. Would your preference change if you used a 12% discount rate? Print Done Your grandfather would like to share some of his fortune with you He offers to give you 1. $7,400 per year at the end of each of the next seven years 2. $50,050 (lump sum) now 3. $100,050 (lump sum) seven years from now (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements appears to be the best option. Based on a 6% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? Compute the present value of each scenario using a 12% discount rate. (Round the factors to three decimal places, X.XXX Round the present value to the nearest whole dollar) Scenario 1, 12% discount rate, Present value= Scenario 2 12% discount rate, Present value= Scenao 3, 12% discount rate, Present value= appears to be the best option. Based on a 12% interest rate, its present value is the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started