Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you

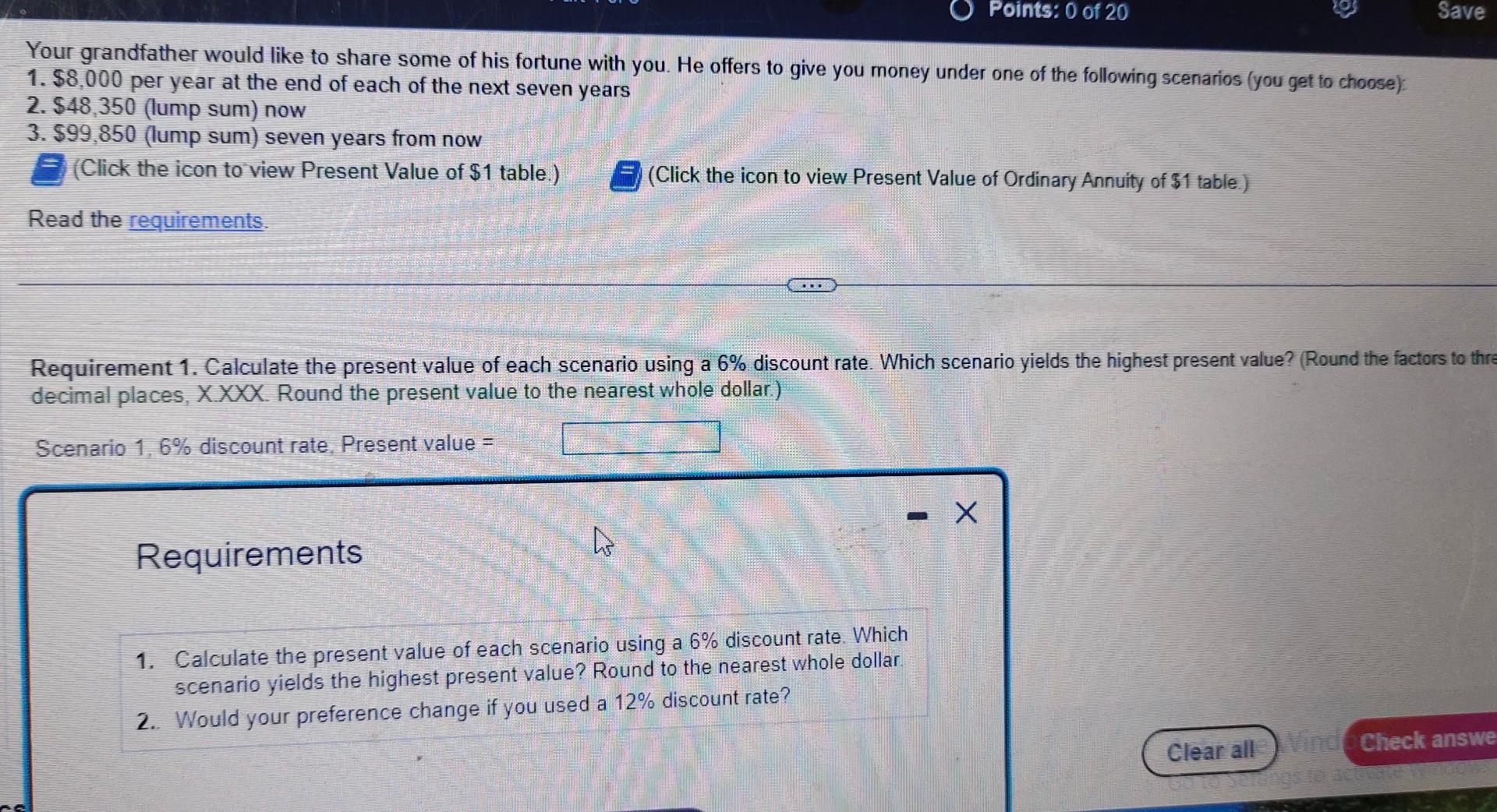

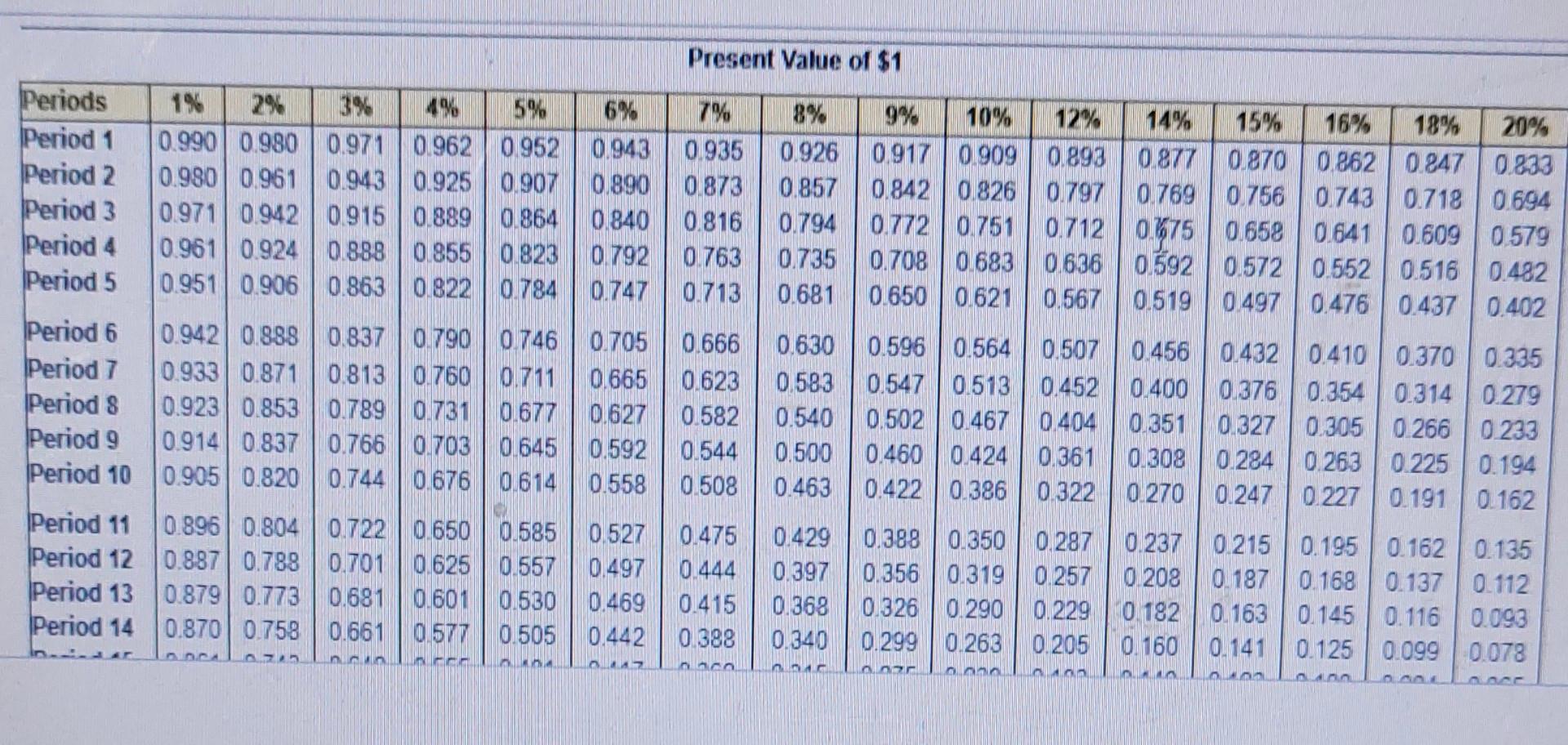

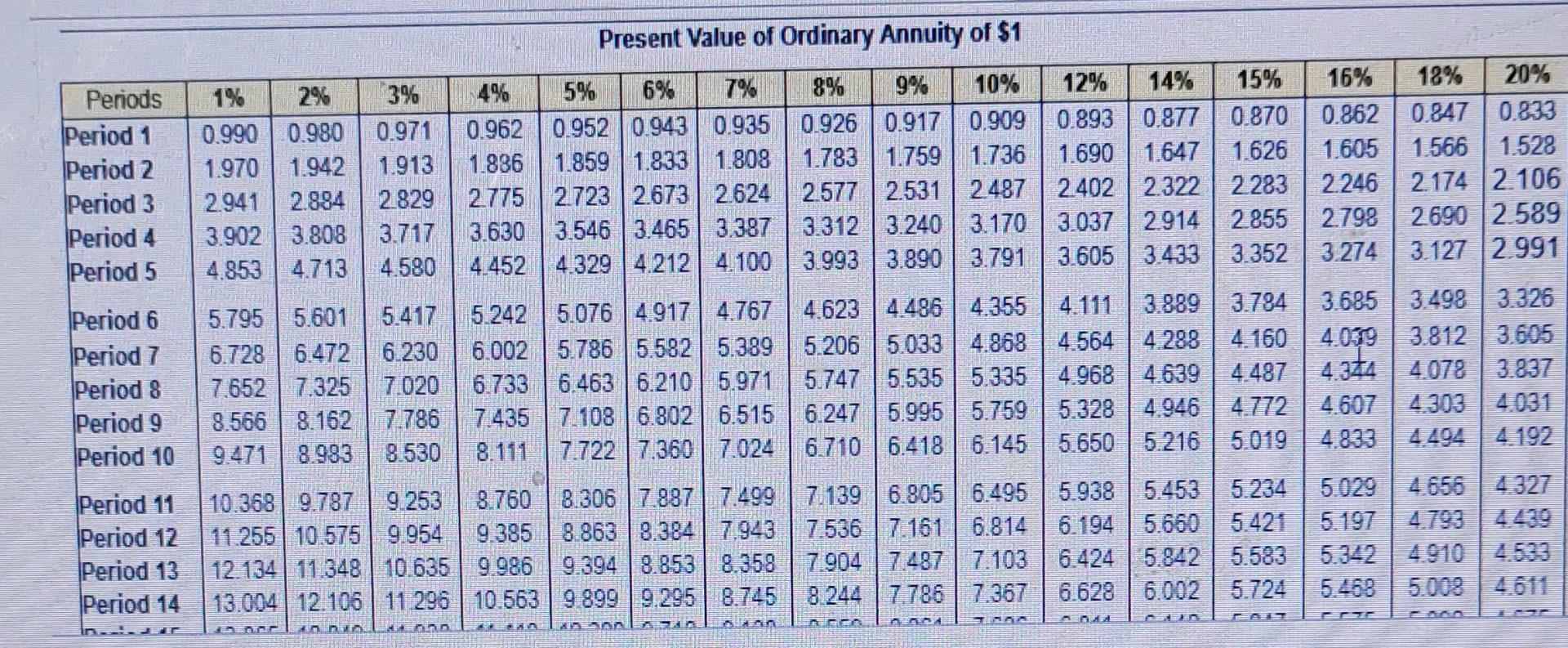

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose) 1. $8,000 per year at the end of each of the next seven years 2. $48,350 (lump sum) now 3. $99,850 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? (Round the factors to thr decimal places, XXXX. Round the present value to the nearest whole dollar.) Scenario 1, 6% discount rate. Present value = Requirements 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? Round to the nearest whole dollar. 2. Would your preference change if you used a 12% discount rate? Present Value of $1 Drenent Malua of Rrdinary Annuity of \$1 Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose) 1. $8,000 per year at the end of each of the next seven years 2. $48,350 (lump sum) now 3. $99,850 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? (Round the factors to thr decimal places, XXXX. Round the present value to the nearest whole dollar.) Scenario 1, 6% discount rate. Present value = Requirements 1. Calculate the present value of each scenario using a 6% discount rate. Which scenario yields the highest present value? Round to the nearest whole dollar. 2. Would your preference change if you used a 12% discount rate? Present Value of $1 Drenent Malua of Rrdinary Annuity of \$1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started