Question

Your group manages an investment fund. Your job is to advise clients on what portfolio best suits their needs, given their characteristics. You have three

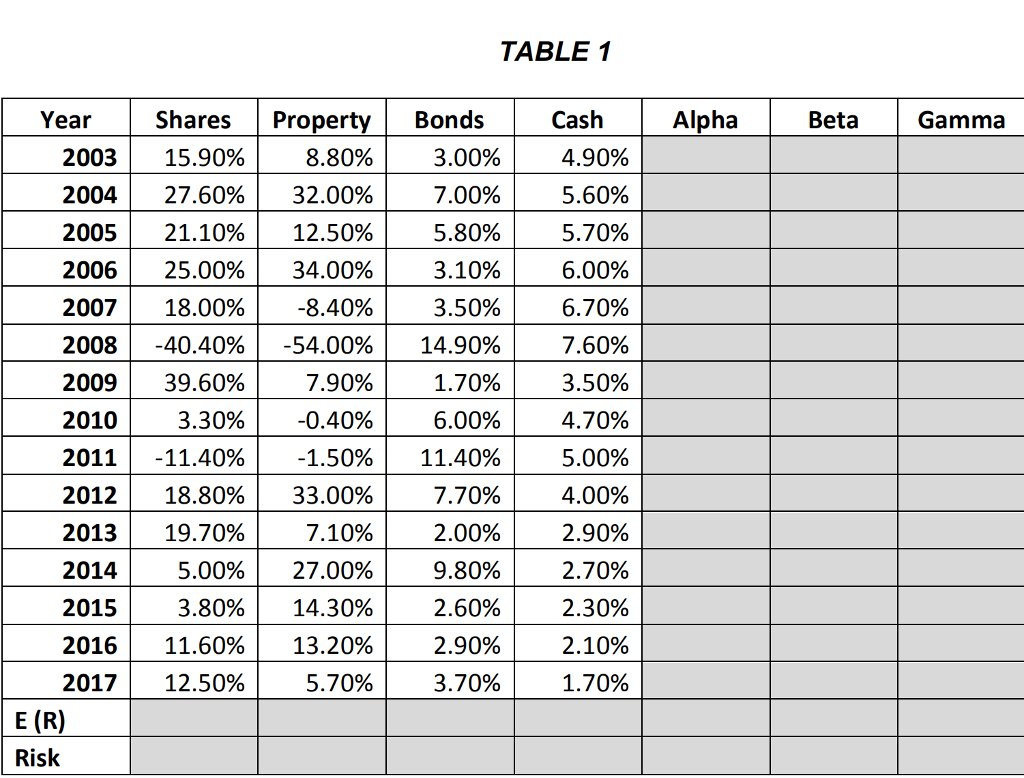

Your group manages an investment fund. Your job is to advise clients on what portfolio best suits their needs, given their characteristics. You have three different customer types: I. A young Deakin Commerce graduate (Stephanie) with a long and successful career ahead of her. II. A middle-aged couple (Harold and Meredith) who are high income earners. They plan to retire in 10 years time. III. An older member of the work force (Akhter) who is hoping to retire in the next 18 months. There are 3 different portfolio packages that you offer your clients: PORTFOLIO ALPHA: 70% shares; 20% property; 10% cash. PORTFOLIO BETA: 50% bonds; 30% shares; 20% property. PORTFOLIO GAMMA: 50% cash; 30% bonds; 20% property. Your task is to answer the following questions by referring to your textbook, other finance books, the media, the internet etc.: 1. By using the information in TABLE 1: (a) Calculate the historical returns for each of the above portfolios for the years between 2003 and 2017. Present the answersumbers in the table. (b) Calculate the expected (average) return, denoted by E(R), and risk (standard deviation), denoted by , for each of the four asset classes as well as those three portfolios. Present your answers in Table 1. The completed table SHOULD be submitted with your assignment. Students are encouraged to employ Microsoft Excel for these workings. (5 marks) 2. Explain what is meant by expected return and risk in finance. You need to address the relationship between these two concepts in your explanation. Use your answers from Question 1 (for both assets and portfolios) above to illustrate this relationship. (5 marks) 3. Discuss the meaning of diversification in finance and how it impacts the risk and the return. You need to address the concept of correlation and how the correlation coefficient impacts on the risk of a portfolio in your discussion. Refer to your answers from Question 1 to illustrate diversification. (5 marks)4. How do we measure the systematic risk component of an asset? Assets A and B have betas of 0.5 and 2 respectively. Which asset is riskier? If the market return decreases/increases by 10%, how would such movement impact Assets A and B? (5 marks) 5. It is assumed that your investors are risk averse. Explain what is meant by risk aversion as it relates to finance. Is risk aversion related to different stages of investing life cycle? (5 marks) 6. For each of the three customer types that you have, recommend the most suitable portfolio option and justify your choice. Use language here that the customers wilunderstand. You should use a graph here to show the historical return performance of each of your portfolios to assist with your recommendation. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started