Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your help is much appreciated. Thank you tons! Green Energy Co. (GEC), an environmental energy company, is looking to purchase a new methane burning furnace,

Your help is much appreciated. Thank you tons!

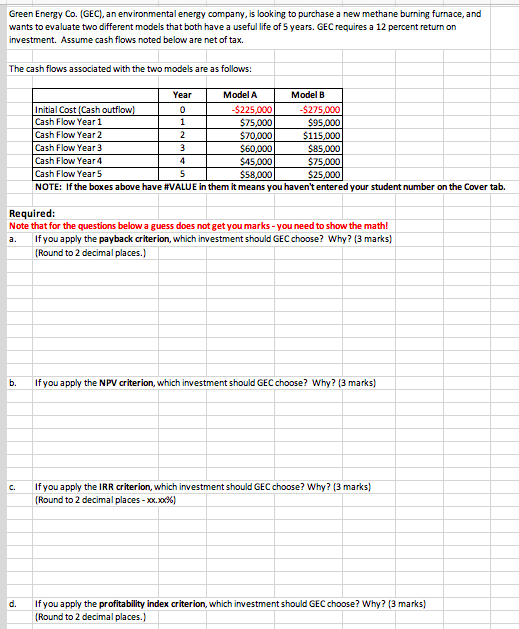

Green Energy Co. (GEC), an environmental energy company, is looking to purchase a new methane burning furnace, and wants to evaluate two different models that both have a useful life of 5 years. GEC requires a 12 percent return on investment. Assume cash flows noted below are net of tax. The cash flows associated with the two models are as follows: Year Model A Model B Initial Cost (Cash outflow) 0 -$225,000 -$275,000 Cash Flow Year 1 1 $75,000 $95,000 Cash Flow Year 2 2 $70,000 $115,000 Cash Flow Year 3 3 $60,000 $85,000 Cash Flow Year 4 4 $45,000 $75,000 Cash Flow Year 5 5 $58,000 $25,000 NOTE: If the boxes above have #VALUE in them it means you haven't entered your student number on the Cover tab. Required: Note that for the questions below a guess does not get you marks - you need to show the math! a. If you apply the payback criterion, which investment should GEC choose? Why? (3 marks) (Round to 2 decimal places.) b. If you apply the NPV criterion, which investment should GEC choose? Why? (3 marks) c. If you apply the IRR criterion, which investment should GEC choose? Why? (3 marks) (Round to 2 decimal places - xx.xx%) d. If you apply the profitability index criterion, which investment should GEC choose? Why? (3 marks) (Round to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started