Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your help is need, stumped on : Annuities & Credit Cards Clearly and neatly show all work for each problem. Round all final answers to

Your help is need, stumped on : Annuities & Credit Cards

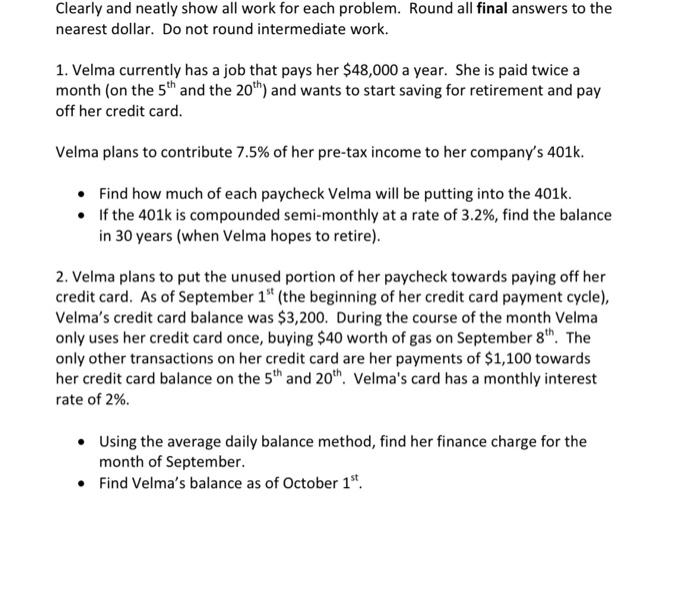

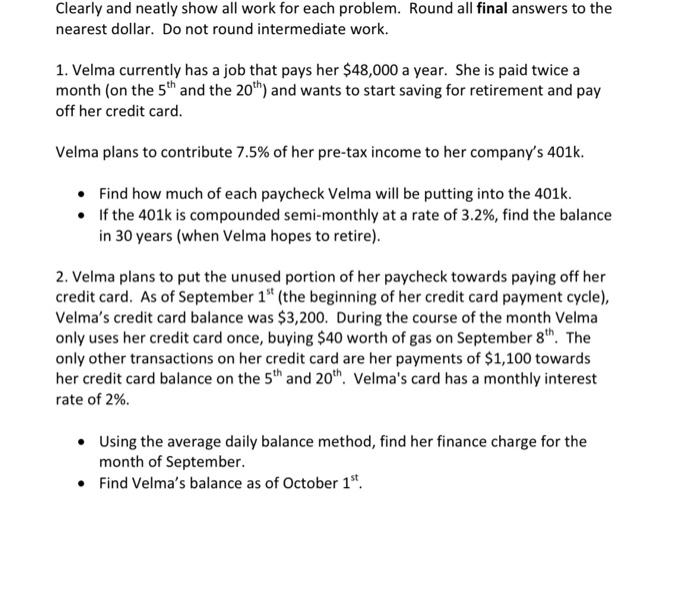

Clearly and neatly show all work for each problem. Round all final answers to the nearest dollar. Do not round intermediate work. 1. Velma currently has a job that pays her $48,000 a year. She is paid twice a month (on the 5th and the 20th ) and wants to start saving for retirement and pay off her credit card. Velma plans to contribute 7.5% of her pre-tax income to her company's 401k. - Find how much of each paycheck Velma will be putting into the 401k. - If the 401k is compounded semi-monthly at a rate of 3.2%, find the balance in 30 years (when Velma hopes to retire). 2. Velma plans to put the unused portion of her paycheck towards paying off her credit card. As of September 15t (the beginning of her credit card payment cycle), Velma's credit card balance was $3,200. During the course of the month Velma only uses her credit card once, buying $40 worth of gas on September 8th. The only other transactions on her credit card are her payments of $1,100 towards her credit card balance on the 5th and 20th. Velma's card has a monthly interest rate of 2%. - Using the average daily balance method, find her finance charge for the month of September. - Find Velma's balance as of October 1st

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started