Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. On January 1, 2017 Tal company purchased a machine for $720,000. The machine is depreciated based on the units of production method for

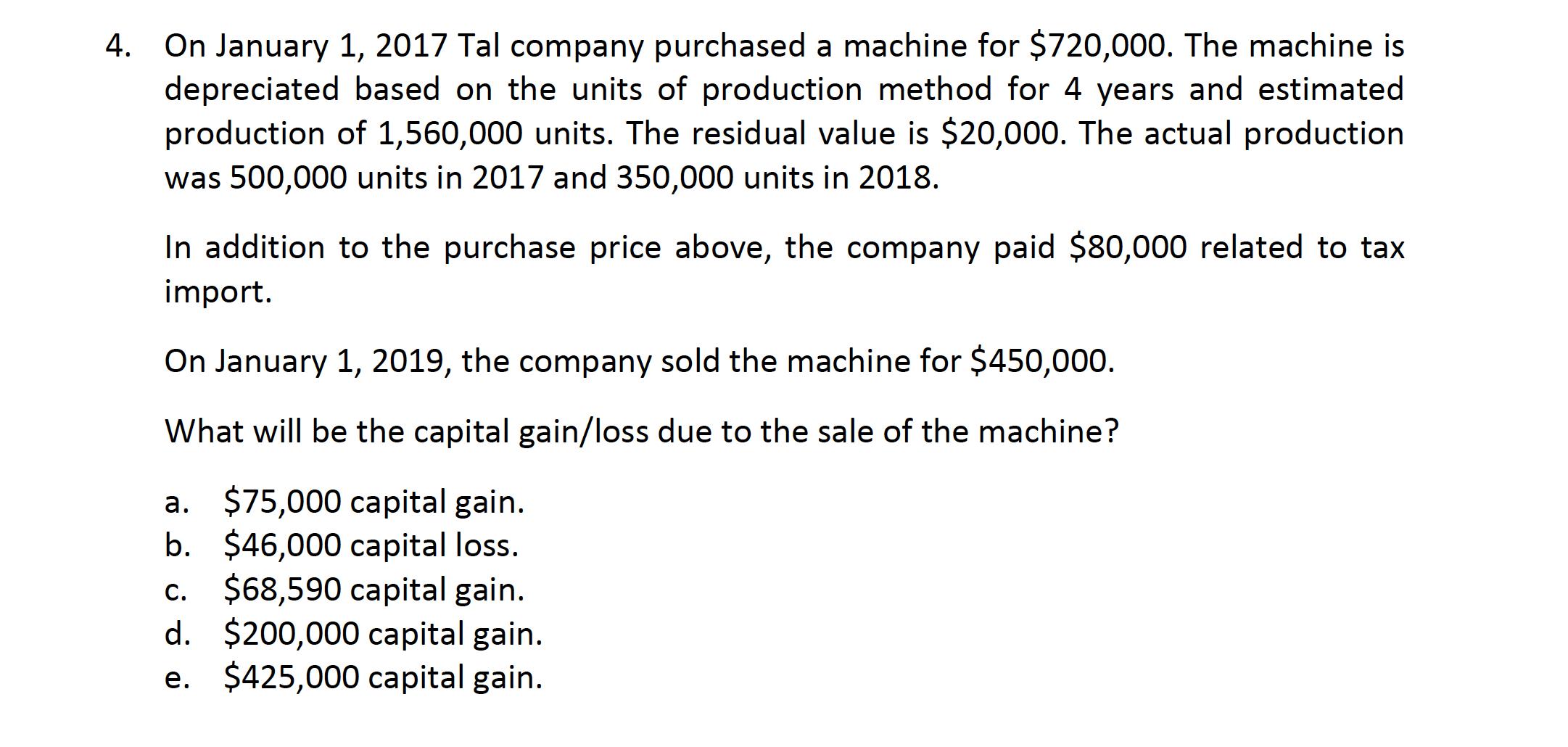

4. On January 1, 2017 Tal company purchased a machine for $720,000. The machine is depreciated based on the units of production method for 4 years and estimated production of 1,560,000 units. The residual value is $20,000. The actual production was 500,000 units in 2017 and 350,000 units in 2018. In addition to the purchase price above, the company paid $80,000 related to tax import. On January 1, 2019, the company sold the machine for $450,000. What will be the capital gain/loss due to the sale of the machine? a. $75,000 capital gain. b. $46,000 capital loss. c. $68,590 capital gain. d. $200,000 capital gain. $425,000 capital gain. e.

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 1 Describe and provide examples of the importance and the distinction between internal and external equity External equity refers to an employees perception of being treated similarly to empl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started