Question

Your international investment banking firm has been approached by a diversifiedhealthcarecompanybasedinFrance,Levinson Admirateurs Unis S.A. (LAU). The company is owned by a Portuguese private equity firm,

Your international investment banking firm has been approached by a diversifiedhealthcarecompanybasedinFrance,Levinson Admirateurs Unis S.A. ("LAU"). The company is owned by a Portuguese private equity firm, Parceiros deCapital Azul ("PCA"), that acquired the business when it was struggling in 2017.Since the business has successfully beenturned around, though it's still not fully optimized, PCA is ready to monetize its ownership in LAU to provide a return toitsinvestors.

However,LAU'sseniormanagers,PatrickandPierre,areveryconcernedthatanewownermaytrytosavecostsbycuttingalotofstaffandpossiblyshuttingdownormovingsomeofthecompany'slessprofitableinfrastructureoutofFrance.While PCA expects any buyer who is willing to acquire LAU for the price the firm has in mind will want to reduceheadcount and optimize inefficient facilities, keeping Patrick and Pierrehappy and involved with the ongoing operationsof the company is critical.The two executives know the intricacies of the complex business better than anyone and whilethey both have become quite wealthy working at LAU over the years, they feel the company still has lots of future growthpotentialandhavenointerestinretiringunlesstheyarenotstrategicallyalignedwiththenewownersofthecompany.

AbouttheCompany

LAUiscomprisedofthreebusinessgroups:BrandedPharmaceuticals,GenericPharmaceuticals,andAnimalHealth.

- The Branded Pharmaceuticals business group sells prescription drugs that treat parasitic diseases. Thesehigh-marginpromotedproductssoldintheUnitedStatesandWesternEurope typicallyhavepatentexclusivity and are well-known among prescribers as innovative treatments that effectively treatconditionswithvery limitedside effects.

- The Generic Pharmaceuticals business group sells prescription products worldwide that are off-patent.There are many other competitors selling these same non-promoted products with high volume demandbut thin profit margins.These medications are typically used to treat common conditions in manydifferenttherapeuticcategorieswithlargepatientpopulations.

- The Animal Health business group sells medications for companion animals.Many of the sameformulations used in the company's Branded Pharmaceuticals products are repackaged into dosesappropriate for animals that suffer the same types of parasitic conditions.These high-margin productsarepromotedandsoldintheUnitedStatesandWesternEurope.

Objective

Knowingyourfirmspecializesinstrategicalternatives,PCAhashiredyoutodetermineavaluationofLAUandanoptimaltransaction structure that would make everyone happy.Using the attached income statement, online research,assumptions in places where you don't have complete information, and your critical thinking skills, put together in a single pageyour recommendation, assumptions,and anything else you think is most important, such as highlights of your valuation.Please remember to providesources/footnotes for any third-party information you use.Apart from this, give an Excel file valuation and numerical analysis along with your analysis and recommendation for PCA and LAU.

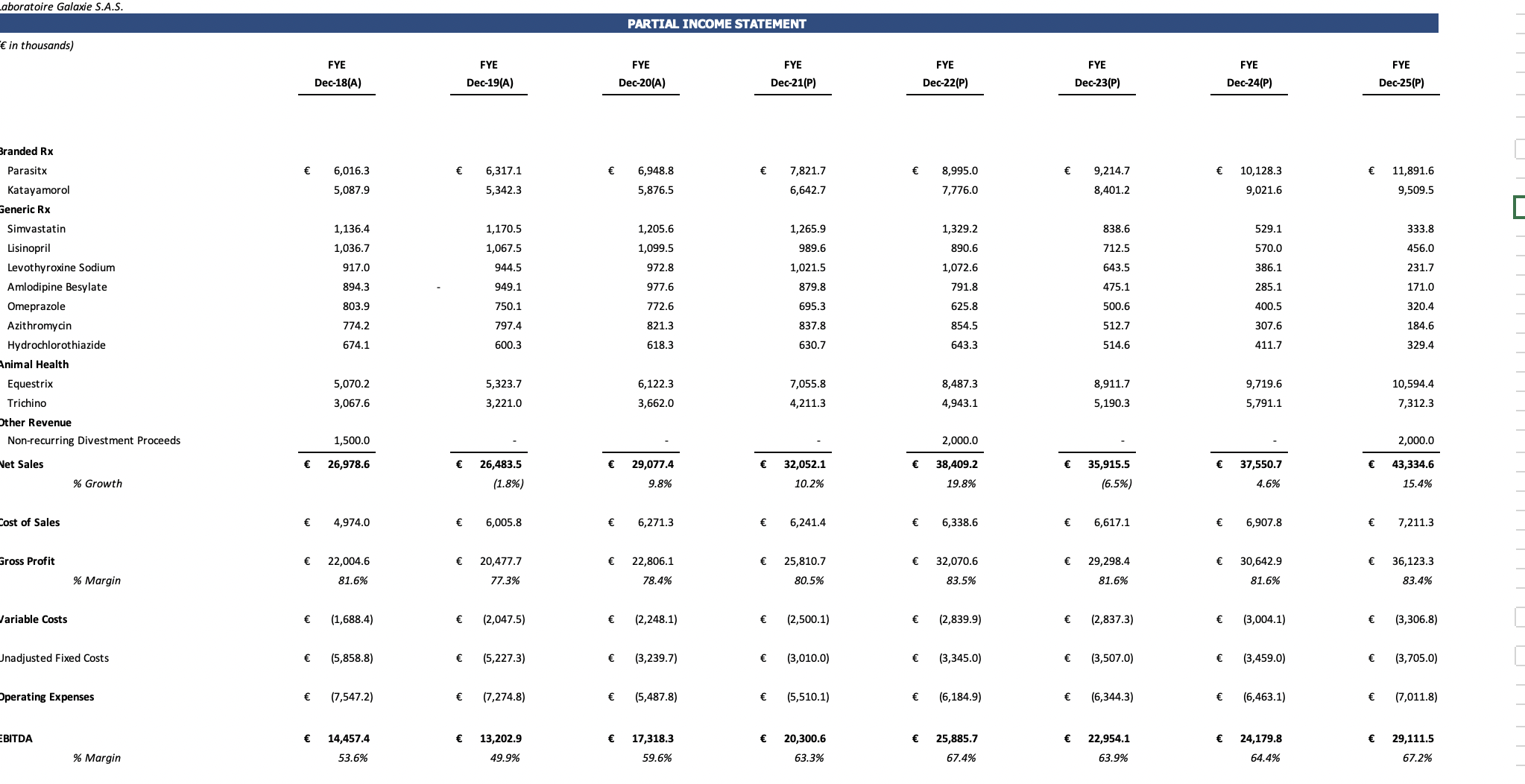

Laboratoire Galaxie S.A.S. in thousands) Branded Rx Parasitx Katayamorol Generic Rx Simvastatin Lisinopril Levothyroxine Sodium Amlodipine Besylate Omeprazole Azithromycin Hydrochlorothiazide Animal Health Equestrix Trichino Other Revenue Non-recurring Divestment Proceeds Net Sales % Growth Cost of Sales PARTIAL INCOME STATEMENT FYE Dec-18(A) FYE FYE Dec-19(A) Dec-20(A) FYE Dec-21(P) FYE Dec-22(P) FYE Dec-23(P) FYE FYE Dec-24(P) Dec-25(P) 6,016.3 5,087.9 6,317.1 5,342.3 6,948.8 5,876.5 7,821.7 6,642.7 8,995.0 7,776.0 9,214.7 8,401.2 10,128.3 9,021.6 11,891.6 9,509.5 1,136.4 1,170.5 1,205.6 1,265.9 1,329.2 838.6 529.1 333.8 1,036.7 1,067.5 1,099.5 989.6 890.6 712.5 570.0 456.0 917.0 944.5 972.8 1,021.5 1,072.6 643.5 386.1 231.7 894.3 949.1 977.6 879.8 791.8 475.1 285.1 171.0 803.9 750.1 772.6 695.3 625.8 500.6 400.5 320.4 774.2 797.4 821.3 837.8 854.5 512.7 307.6 184.6 674.1 600.3 618.3 630.7 643.3 514.6 411.7 329.4 5,070.2 5,323.7 6,122.3 7,055.8 8,487.3 8,911.7 3,067.6 3,221.0 3,662.0 4,211.3 4,943.1 5,190.3 9,719.6 5,791.1 10,594.4 7,312.3 1,500.0 2,000.0 2,000.0 26,978.6 26,483.5 (1.8%) 29,077.4 9.8% 32,052.1 38,409.2 35,915.5 10.2% 19.8% (6.5%) 37,550.7 4.6% 43,334.6 15.4% 4,974.0 6,005.8 6,271.3 6,241.4 6,338.6 6,617.1 6,907.8 7,211.3 Gross Profit 22,004.6 % Margin 81.6% 20,477.7 77.3% 22,806.1 78.4% 25,810.7 80.5% 32,070.6 83.5% 29,298.4 81.6% 30,642.9 81.6% 36,123.3 83.4% Variable Costs (1,688.4) (2,047.5) (2,248.1) (2,500.1) (2,839.9) (2,837.3) (3,004.1) (3,306.8) Unadjusted Fixed Costs (5,858.8) (5,227.3) (3,239.7) (3,010.0) (3,345.0) (3,507.0) (3,459.0) (3,705.0) Operating Expenses (7,547.2) (7,274.8) (5,487.8) (5,510.1) (6,184.9) (6,344.3) (6,463.1) (7,011.8) EBITDA 14,457.4 13,202.9 17,318.3 20,300.6 25,885.7 22,954.1 24,179.8 % Margin 53.6% 49.9% 59.6% 63.3% 67.4% 63.9% 64.4% 29,111.5 67.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started