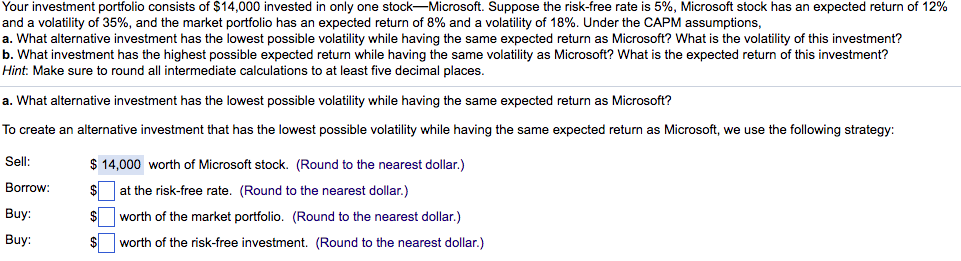

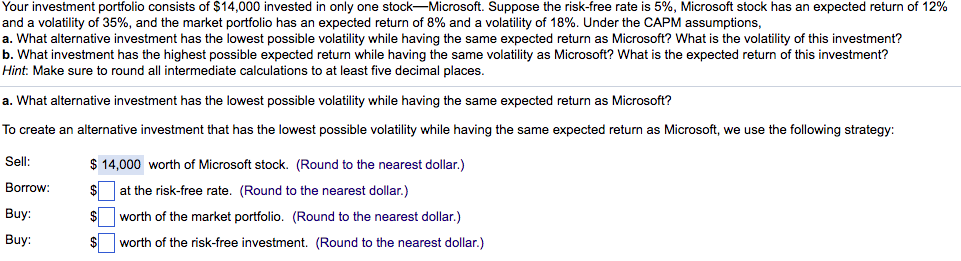

Your investment portfolio consists of $14,000 invested in only one stock Microsoft. Suppose the risk-free rate is 5%, Microsoft stock has an expected return of 12 and a volatility of 35%, and the market portfolio has an expected return of 8% and a volatility of 18%. Under the CAPM assumptions. a. What alternative investment has the lowest possible volatility while having the same expected return as Microsoft? What is the volatility of this investment? b. What investment has the highest possible expected return while having the same volatility as Microsoft? What is the expected return of this investment? Hint Make sure to round all intermediate calculations to at least five decimal places. a. What alternative investment has the lowest possible volatility while having the same expected return as Microsoft? To create an alternative investment that has the lowest possible volatility while having the same expected return as Microsoft, we use the following strategy: Sell: 14,000 worth of Microsoft stock. (Round to the nearest dollar.) Buy: Buy: at the risk-free rate. (Round to the nearest dollar.) worth of the market portfolio. (Round to the nearest dollar.) worth of the risk-free investment. (Round to the nearest dollar.) SO Your investment portfolio consists of $14,000 invested in only one stock Microsoft. Suppose the risk-free rate is 5%, Microsoft stock has an expected return of 12 and a volatility of 35%, and the market portfolio has an expected return of 8% and a volatility of 18%. Under the CAPM assumptions. a. What alternative investment has the lowest possible volatility while having the same expected return as Microsoft? What is the volatility of this investment? b. What investment has the highest possible expected return while having the same volatility as Microsoft? What is the expected return of this investment? Hint Make sure to round all intermediate calculations to at least five decimal places. a. What alternative investment has the lowest possible volatility while having the same expected return as Microsoft? To create an alternative investment that has the lowest possible volatility while having the same expected return as Microsoft, we use the following strategy: Sell: 14,000 worth of Microsoft stock. (Round to the nearest dollar.) Buy: Buy: at the risk-free rate. (Round to the nearest dollar.) worth of the market portfolio. (Round to the nearest dollar.) worth of the risk-free investment. (Round to the nearest dollar.) SO