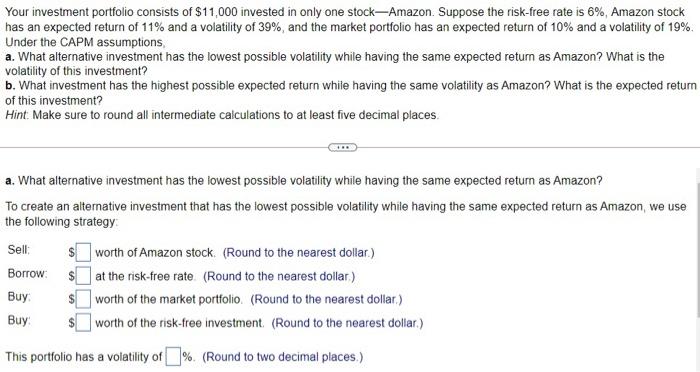

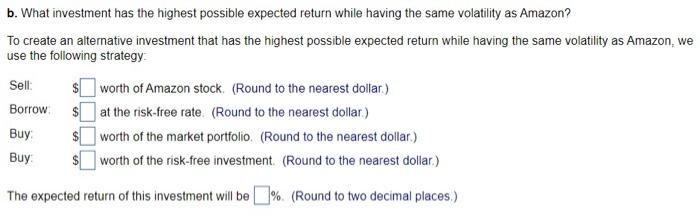

Your inwestorocosas of 11.000 invested in only one steck-Amaro Sapoose the risk trois 0%. Ai stocks expected return of 11% and a volatility of and the market portfolios expected return of 10% and a volatility of 19% Under the CAPM son What storstvenvestment has the lowest possible volatily while having the same expected return as Amazon? What is the volatility of this investment What investment has the highest possible de to have servitas Amaron? What is the expected num of this investment? Hint Make sure to sound al intermediate calculations to at least two decimal places a What stortvenvestment has the lowest possible vitity while having the same ageted rounas Aston to create an chomatis tevestment that has the lowest possible volatility while having the same expected ratum as Amazon, we use the foliowing strategy worth of Amazon stock Round to the newest dotar Borrow ja nerisk trole Round to the news dolet) Buy worth of the market portfolio Round to the needle Buy worth of the strivesment Round to the nearest dow) This promotes a latity of Roundtato decimal preces b. What investment at the responsable expected return thing the same voy a mo? To create an aterate investment that has the highest possia xpected to write navng the same volatya Arration, we use the following tog Sell wortho Acock (Runde wedsta at the risk. Weere Round to the rest ofat Buy worth of the old Round to the rest Buy worth of the risk from Round to the rest of The picture of this investment will be sound to decimos) Your investment portfolio consists of $11,000 invested in only one stock-Amazon. Suppose the risk-free rate is 6%, Amazon stock has an expected return of 11% and a volatility of 39%, and the market portfolio has an expected return of 10% and a volatility of 19%. Under the CAPM assumptions, a. What alternative investment has the lowest possible volatility while having the same expected return as Amazon? What is the volatility of this investment? b. What investment has the highest possible expected return while having the same volatility as Amazon? What is the expected return of this investment? Hint Make sure to round all intermediate calculations to at least five decimal places a. What alternative investment has the lowest possible volatility while having the same expected return as Amazon? To create an alternative investment that has the lowest possible volatility while having the same expected return as Amazon, we use the following strategy Sell worth of Amazon stock (Round to the nearest dollar.) Borrow at the risk-free rate (Round to the nearest dollar) Buy worth of the market portfolio (Round to the nearest dollar.) Buy worth of the risk-free investment (Round to the nearest dollar.) This portfolio has a volatility of % (Round to two decimal places.) b. What investment has the highest possible expected return while having the same volatility as Amazon? To create an alternative investment that has the highest possible expected return while having the same volatility as Amazon, we use the following strategy Sell worth of Amazon stock. (Round to the nearest dollar) Borrow $ at the risk-free rate. (Round to the nearest dollar) Buy worth of the market portfolio. (Round to the nearest dollar) Buy worth of the risk-free investment (Round to the nearest dollar) The expected return of this investment will be % (Round to two decimal places.)