Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your job is to determine whether HP should produce a high-end smart phone. The project lasts 6 years. Investments $30 million in year 0 for

Your job is to determine whether HP should produce a high-end smart phone. The project lasts 6 years.

Investments

- $30 million in year 0 for machinery. Assume straight-line depreciation over 6 years. After 6 years, the book value of this machinery is zero. Machinery will be sold for $2.5 million at the projects end.

- NWC of $3 million to begin the project, which will increase at a 4% rate each year.

Revenue and cost estimates

- $50 million in year 1, growing at 10% yearly after

- Annual operating costs of (a) $30 million fixed, and (b) variable costs of 30% of annual revenues

Other information

- Tax rate = 30%

- Discount rate = 12%

The following questions will help you calculate the NPV of this project.

- Enter all numbers in $ millions (e.g. in case of 30 million, simply enter 30.)

- Round off your answers to two decimal digits.

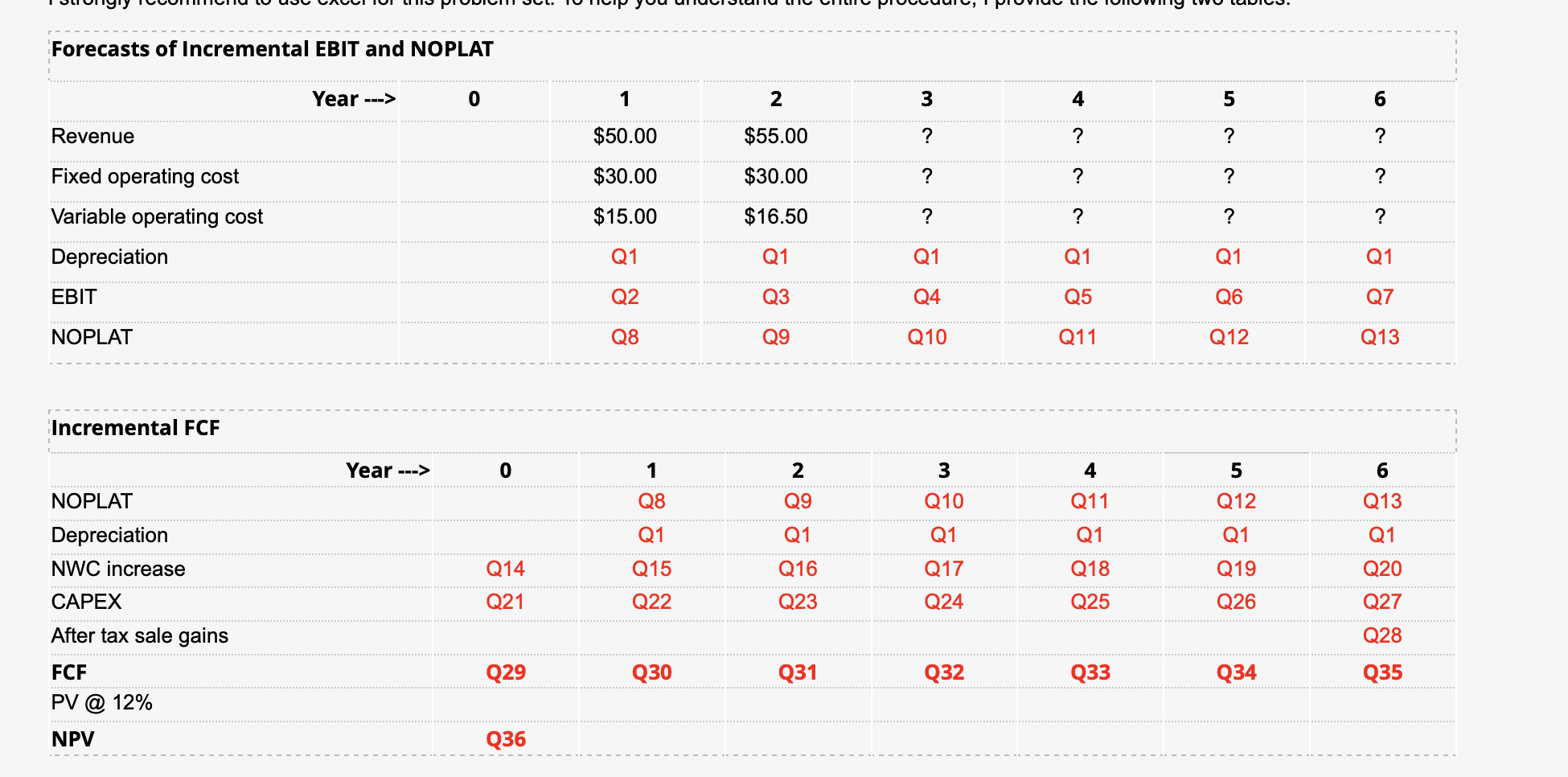

I strongly recommend to use excel for this problem set. To help you understand the entire procedure, I provide the following two tables:

Please enter numbers exactly in the order of the table. Thank you so much!!

I JUULyly TCUICUIU O UO CACCI UI IUILIIJ PIUVICII Jl. TUNICIP youuuuuluuiu l LII IUIUVVIII Forecasts of Incremental EBIT and NOPLAT Year ---> 0 2 Revenue $50.00 $55.00 Fixed operating cost Variable operating cost Depreciation $30.00 $15.00 $30.00 $16.50 Q1 Q1 EBIT Q2 Q3 NOPLAT Q8 09 Q10 Q11 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = Incremental FCF Year ---> 1 2 3 4 5 6 Q8 09 Q11 Q12 Q13 NOPLAT Depreciation NWC increase Q1 Q1 Q1 Q1 Q10 Q1 Q17 Q24 Q1 Q15 Q22 Q14 Q16 Q18 Q19 Q20 CAPEX Q21 Q23 Q25 Q26 After tax sale gains Q27 Q28 Q35 Q29 Q30 31 Q32 Q33 034 FCF PV @ 12% NPV NPV Q36 950 ... .......................................................................------------Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started