Question

Your line manager has provided you with the following information: Two different clients are facing regular monthly problems with matching the cash balance of the

Your line manager has provided you with the following information:

Two different clients are facing regular monthly problems with matching the cash balance of the bank statement with the cash balance found on their business's records. For this, your line manager has asked you to help these clients to handle and solve this issue by performing bank reconciliations for these two businesses (A & B) by using the available information in table 4&5.

- Instructions: in this task you have to:

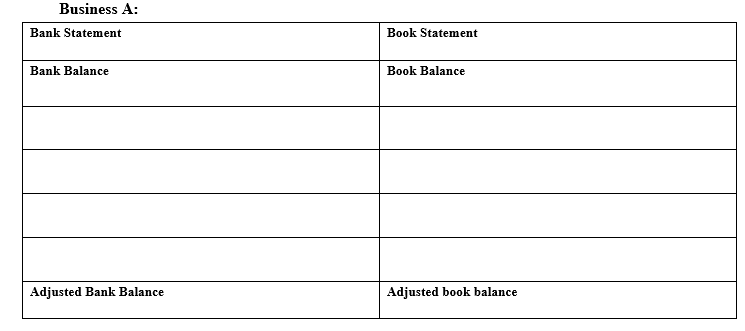

- Apply the bank reconciliation process for business (A) for the month ended November.30.2021 by using information from table 4.

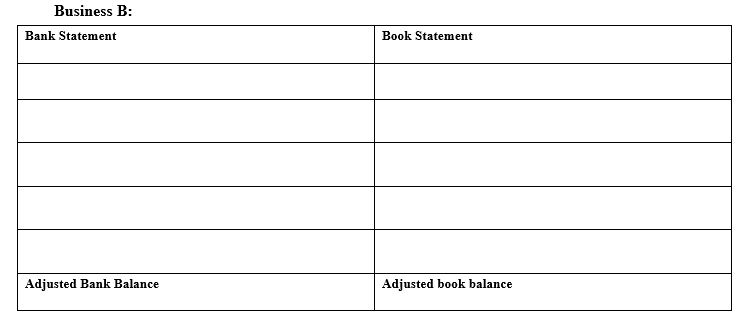

- Apply the bank reconciliation process for business (B) for the month ended November.30.2021 by using information from table 5.

- Demonstrate the use of deposit in transit, outstanding checks and Not Sufficient Funds (NSF) in the reconciliation process.

- Appraise the bank reconciliation process identifying errors and omissions from a bank statement and cashbook

- Show that the two bank reconciliations have been accurately prepared by using appropriate tools and techniques.

Table 4: Business (A) Available information for bank reconciliation

Business (A) Available information for bank reconciliation

| 1 | Business A's bank statement dated December 31, 2021 shows a cash balance of 35,060. |

| 2 | The business's cash records on the same date show a balance of 33,990. |

| 3 | Following checks issued by the business to its suppliers are still outstanding: No. 200 issued on December 27 430. No. 204 issued on December 28 195. No. 201 issued on December 28 280. No. 205 issued on December 29 70. |

| 4 | A deposit of 1,425 made on December 31 does not appear on bank statement. |

| 5 | Interest income earned on the business's average cash balance at bank was 1,040 |

| 6 | A deposit of 230 was incorrectly entered as 320 in the business's cash records. |

| 7 | The bank collected a note receivable on behalf of the business. Amount received by the bank on the note was 2,600. The bank charged a collection fee of 80. |

| 8 | A NSF check of 1,880 was returned by the bank with the bank statement. |

| 9 | The bank charged 70 as service fee. |

Business (B) Available information for bank reconciliation

| 1 | The bank statement of business (B) company shows a balance of 12,530 on December 31, 2021. |

| 2 | The businesss ledger shows a balance of 10,925 on the same date. |

| 3 | The following checks issued during the month of December have not yet been cleared by the bank. Check No: 301, Issue date: 26 December 2021 Amount 220. Check No: 302, Issue date: 27 December 2021 Amount 54. Check No: 307, Issue date: 28 December 2021, Amount 165. Check No: 310, Issue date: 29 December 2021, Amount 390.. |

| 4 | An amount of 2,340 sent to the bank for deposit on December 31 does not appear in the bank statement. |

| 5 | A note receivable amounting to 2,445 has been collected by bank for the business. The bank has charged 15 for the collection of note. |

| 6 | The bank statement shows that interest amounting to 978 has been earned on average account balance during December. |

| 7 | A check of 250 deposited by the business has been charged back as NSF. |

| 8 | An amount of 15 has been deducted by bank as service charges for the month of December. |

| 9 | The check no. 320 was issued to pay the business electricity. The check was in the amount of 147 but was erroneously recorded in the cash payments journal as 174. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started