Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your neighbor has just won the state lottery and may choose from three award options. He can elect to receive a lump sum payment today

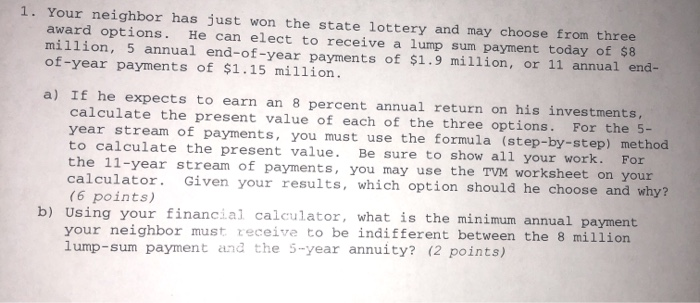

Your neighbor has just won the state lottery and may choose from three award options. He can elect to receive a lump sum payment today of $8 million, 5 annual end-of-year payments of $1.9 million, or 11 annual end-of-year payments of $1.15 million.

a) If he expects to earn an 8% annual return on his investments, calculate the present value of each of the three options. For the 5-year stream of payments, you must use the formula (step-by-step) method to calculate the present value. Be sure to show all your work. For the 11-year stream of payments, you may use the TVM worksheet on your calculator. Given your results, which option ahould he choose and why?

b) Using your financial calculator, what is the minimum annual payment your neighbor must receive to be indifferent between the 8 million lump-sum payment and the 5-year annuity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started