Question

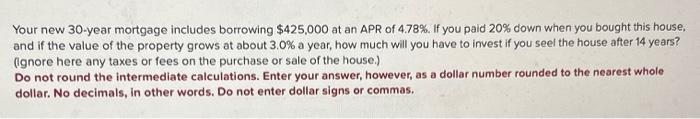

Your new 30-year mortgage includes borrowing $425,000 at an APR of 4.78%. If you paid 20% down when you bought this house, and if

Your new 30-year mortgage includes borrowing $425,000 at an APR of 4.78%. If you paid 20% down when you bought this house, and if the value of the property grows at about 3.0 % a year, how much will you have to invest if you seel the house after 14 years? (ignore here any taxes or fees on the purchase or sale of the house.) Do not round the intermediate calculations. Enter your answer, however, as a dollar number rounded to the nearest whole dollar. No decimals, in other words. Do not enter dollar signs or commas.

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App