Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In early 2021, PT A and PT B (the parties) made arrangements through PT X, a separate legal entity, with percentage of voting rights

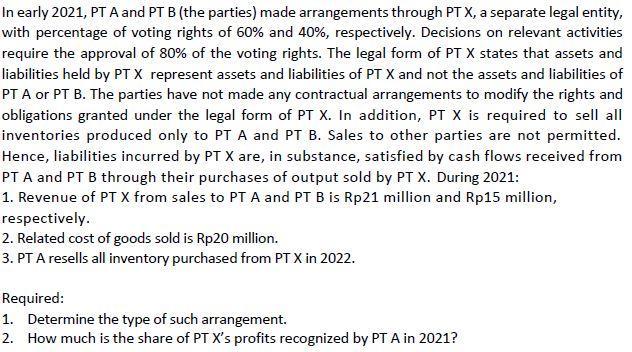

In early 2021, PT A and PT B (the parties) made arrangements through PT X, a separate legal entity, with percentage of voting rights of 60% and 40%, respectively. Decisions on relevant activities require the approval of 80% of the voting rights. The legal form of PT X states that assets and liabilities held by PT X represent assets and liabilities of PT X and not the assets and liabilities of PT A or PT B. The parties have not made any contractual arrangements to modify the rights and obligations granted under the legal form of PT X. In addition, PT X is required to sell all inventories produced only to PT A and PT B. Sales to other parties are not permitted. Hence, liabilities incurred by PT X are, in substance, satisfied by cash flows received from PT A and PT B through their purchases of output sold by PT X. During 2021: 1. Revenue of PT X from sales to PT A and PT B is Rp21 million and Rp15 million, respectively. 2. Related cost of goods sold is Rp20 million. 3. PT A resells all inventory purchased from PT X in 2022. Required: 1. Determine the type of such arrangement. 2. How much is the share of PT X's profits recognized by PT A in 2021?

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 A joint venture is a business arrangement in which two or more parties agree to cooperate in order to achieve a specific goal In a joint venture eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started