Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for

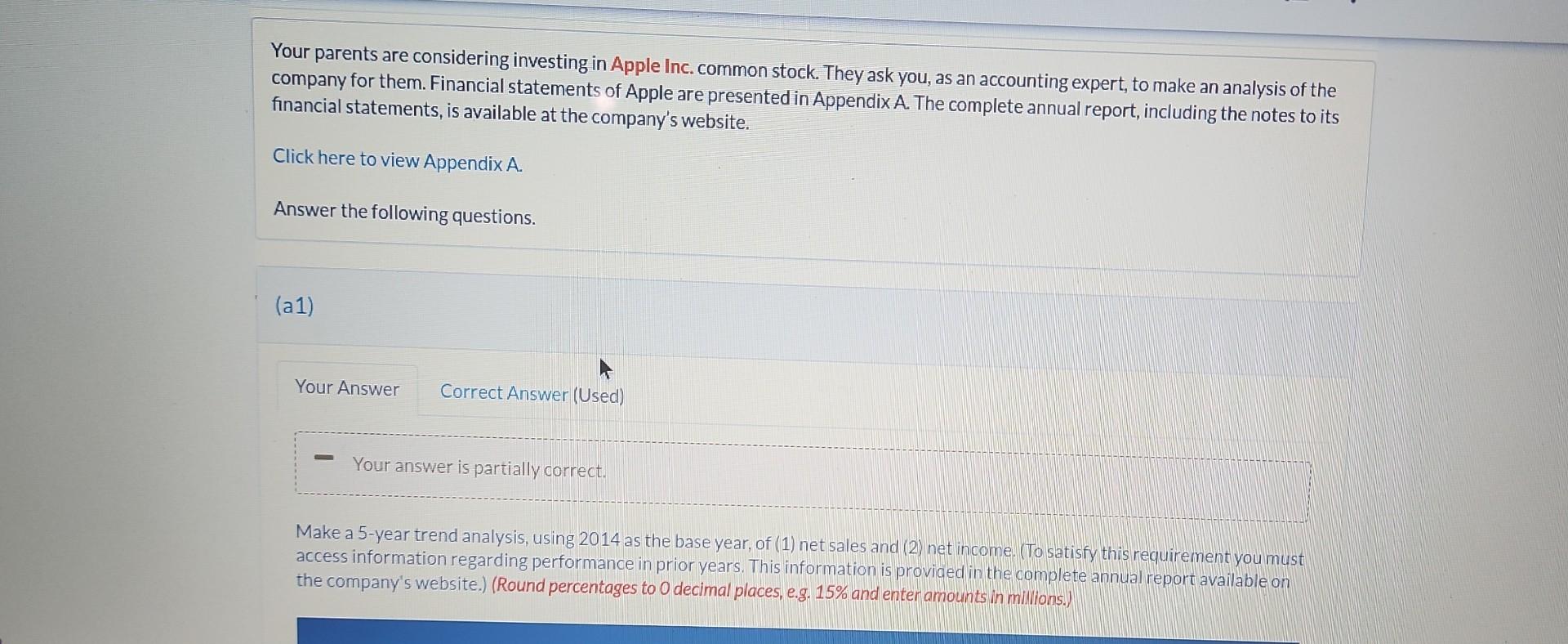

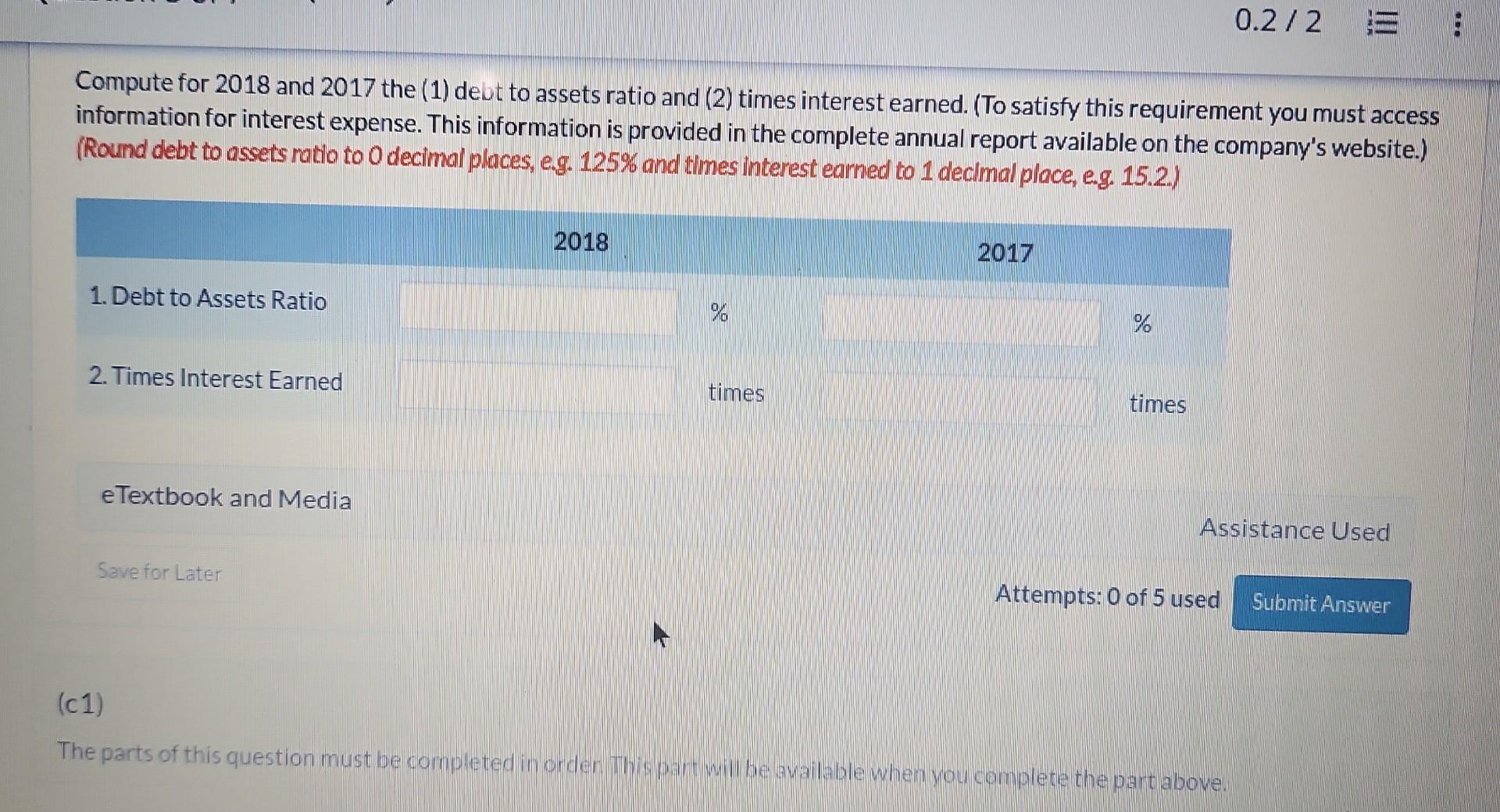

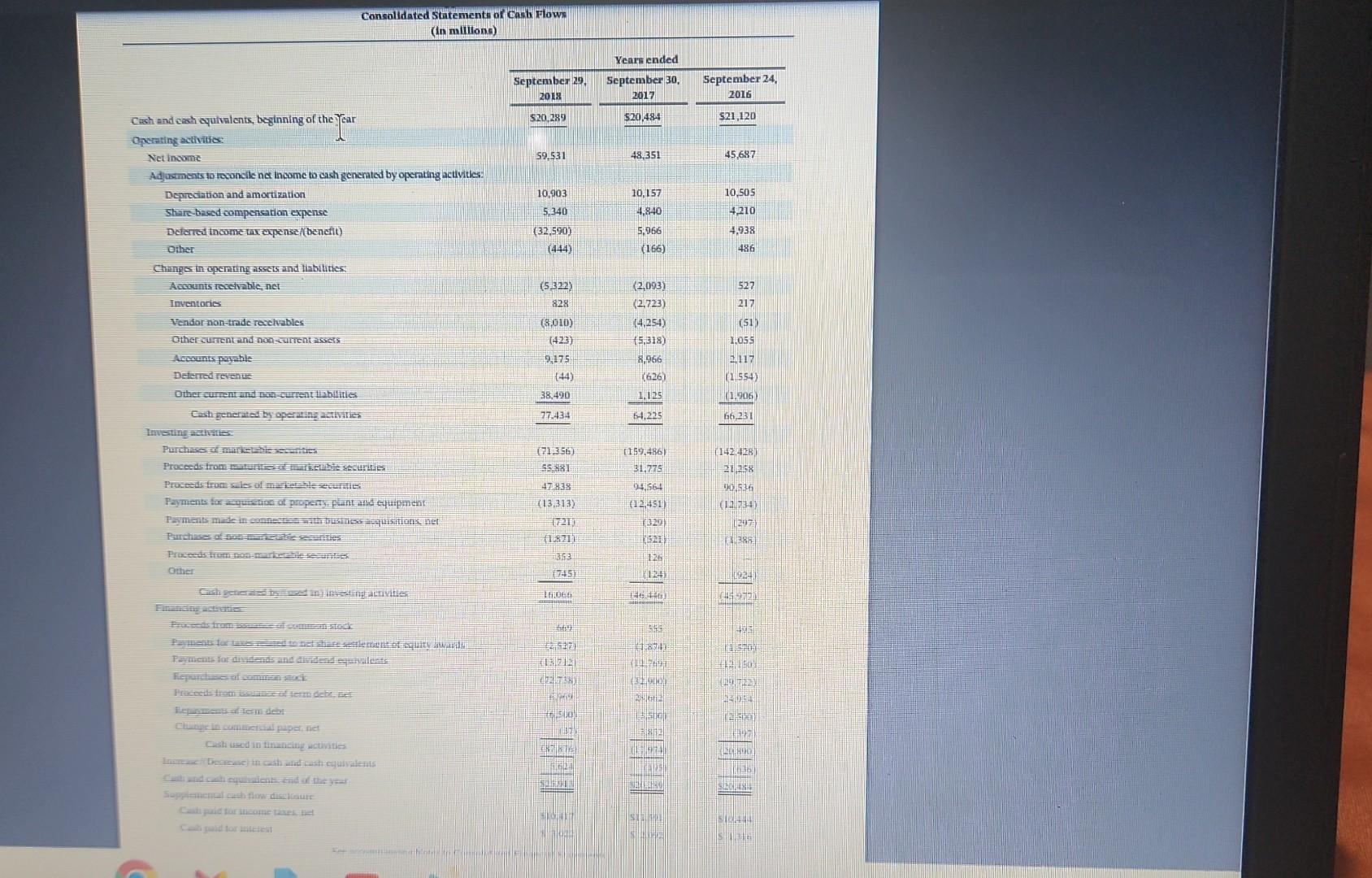

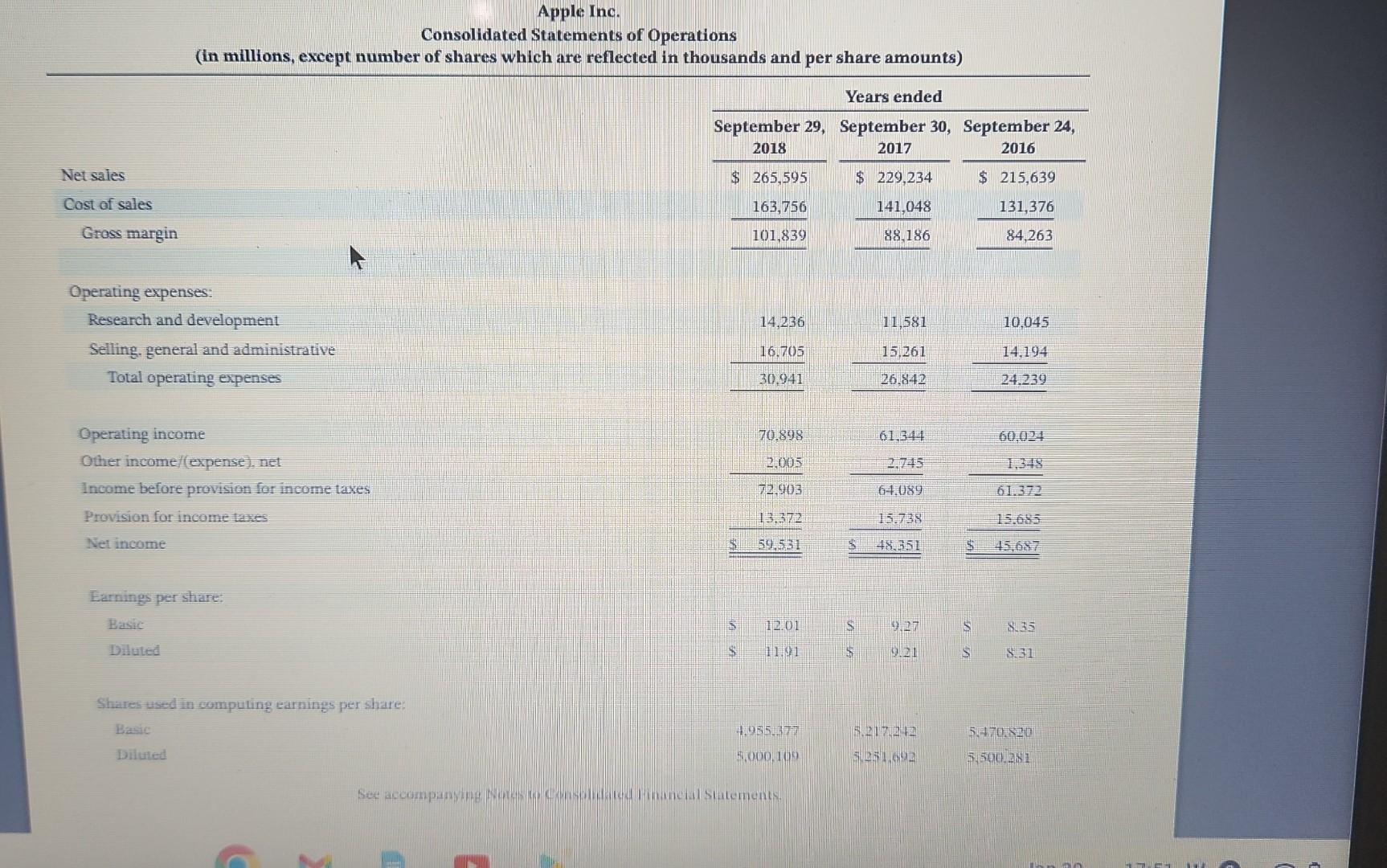

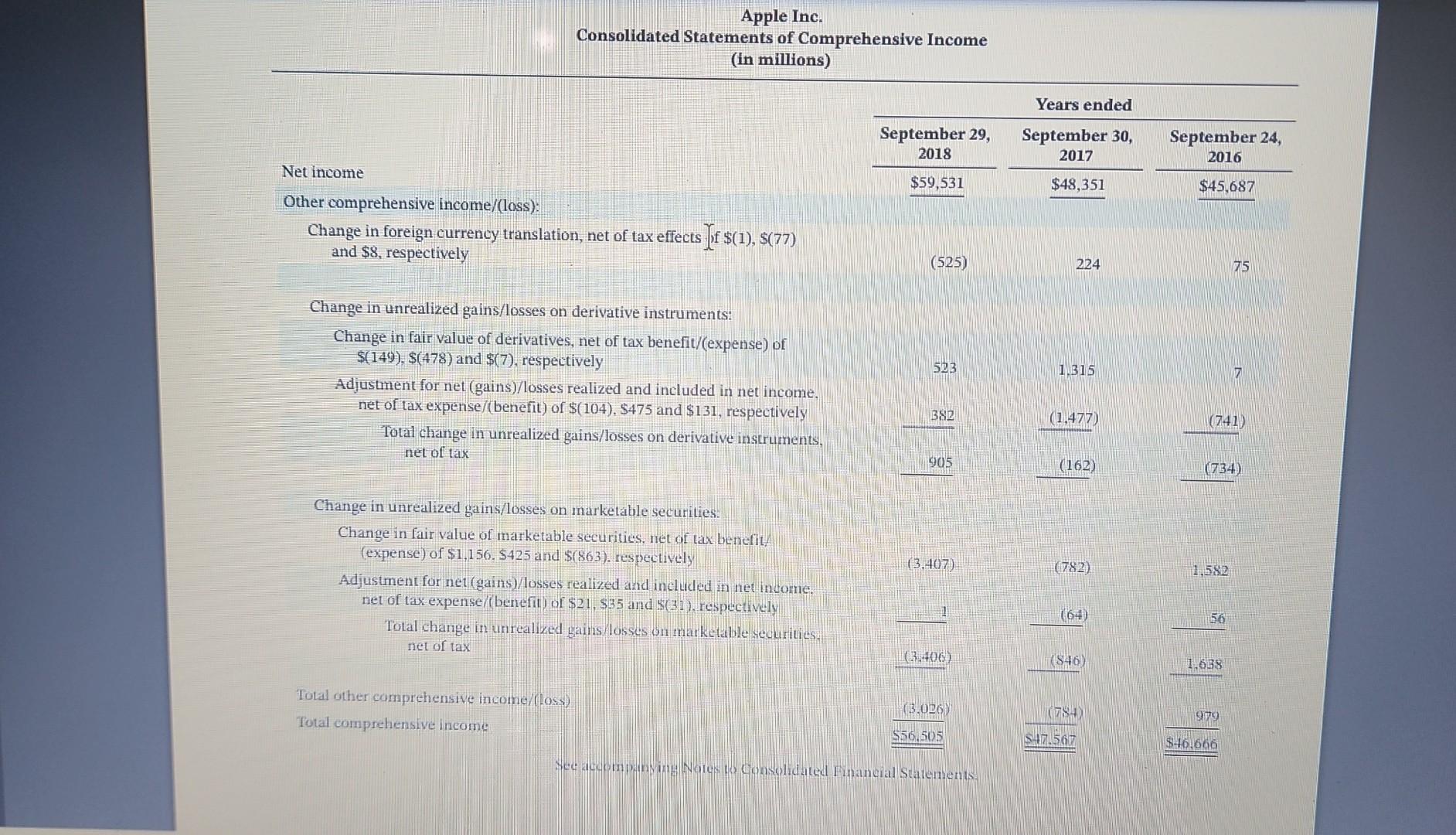

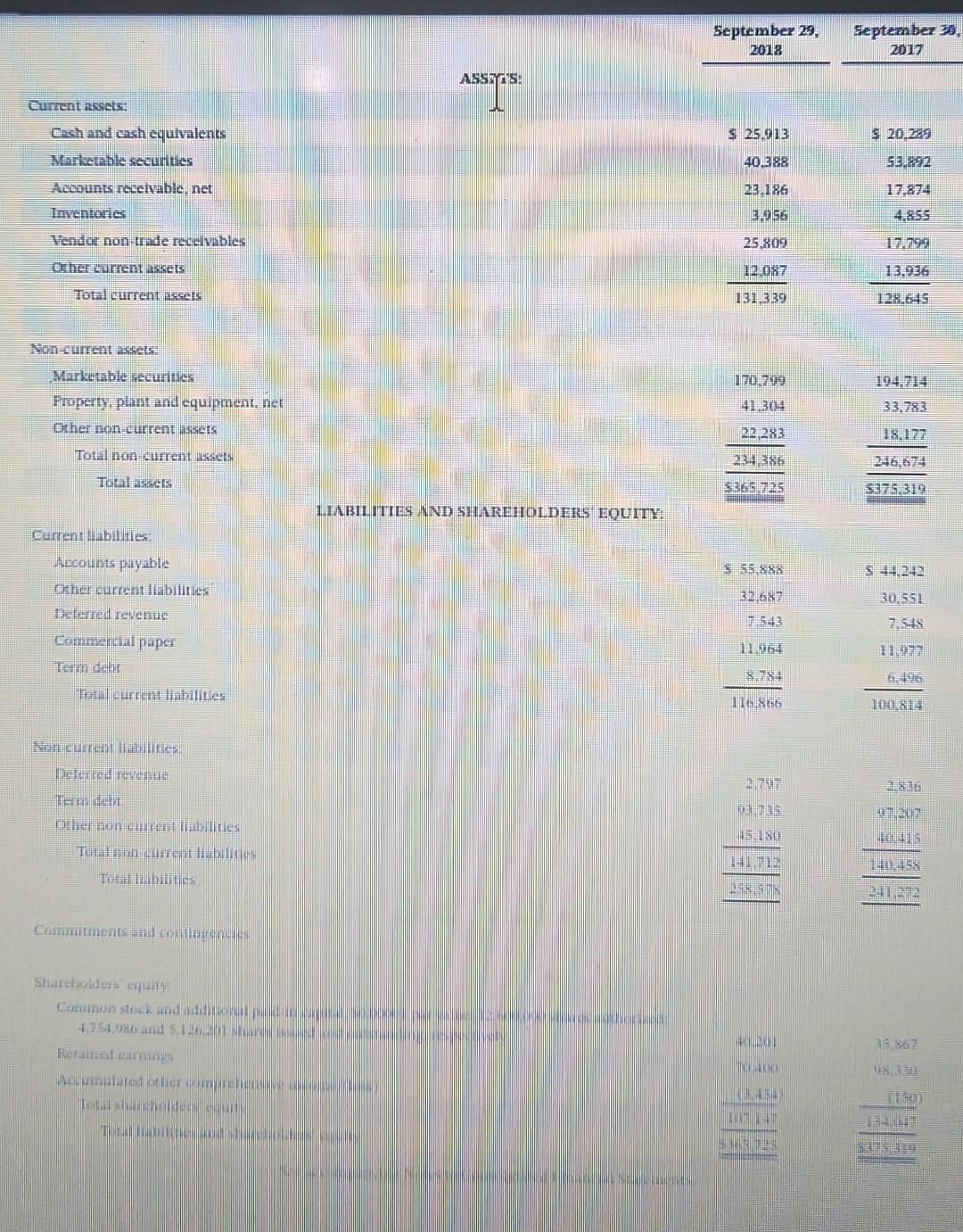

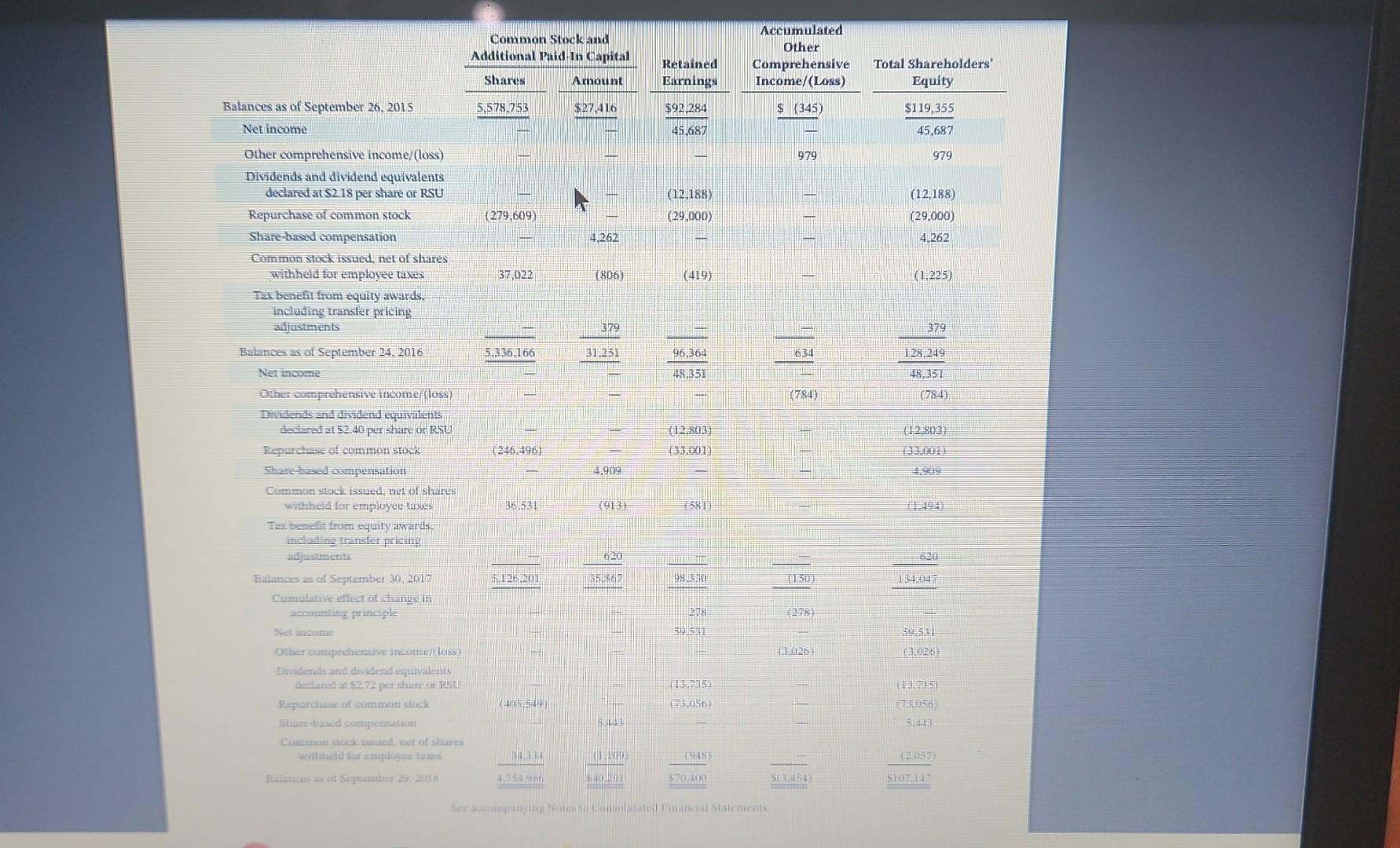

Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A. Answer the following questions. (a1) Your answer is partially correct. Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To satisfy this requirement you must access information regarding performance in prior years. This information is provided in the complete annual report available on the company's website.) (Round percentages to 0 decimal places, e.g. 15% and enter amounts in millions.) Compute for 2018 and 2017 the (1) debt to assets ratio and (2) times interest earned. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website.) (Round debt to assets ratio to 0 decimal places, eg. 125% and times interest earned to 1 decimal place, e.g. 15.2.) Apple Inc. Consolidated Statements of Operations (in millions, except number of shares which are reflected in thousands and per share amounts) Apple Inc. Consolidated Statements of Comprehensive Income (in millions) Current irssets: September 29, September 30 . Cash and eash equivalents Markeathle securities Assons: Accounts recelvable, net liventories Vendor non-trade receivablesh Qher current assets Total current assets Non-current assets: Marketable securilies Property, plant and equipment, net Orher non current assets Total non curreat asseth Toul assets IIAH.TTES NND SHARFHELDEFS FOUTTY: \begin{tabular}{rr} 525,913 & 520,289 \\ 40,388 & 53.692 \\ 23,186 & 17.874 \\ 3,956 & 4.855 \\ 25,809 & 17,799 \\ 12.087 & 13,936 \\ \hline 131,339 & 128.645 \end{tabular} Current Mabil ites. Fran curcan liabiliries limefored rewarmen Trim dett Trefill liwhilitier Comminments and conititudenation Shartholdere' equily Eommon stosk and waskona if Pecainat ournions Balances as of September 26,2015 Net income Other comprehensive income/(loss) Dividends and dividend equivalents declard at S2.18 per share or RSU Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A. Answer the following questions. (a1) Your answer is partially correct. Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (To satisfy this requirement you must access information regarding performance in prior years. This information is provided in the complete annual report available on the company's website.) (Round percentages to 0 decimal places, e.g. 15% and enter amounts in millions.) Compute for 2018 and 2017 the (1) debt to assets ratio and (2) times interest earned. (To satisfy this requirement you must access information for interest expense. This information is provided in the complete annual report available on the company's website.) (Round debt to assets ratio to 0 decimal places, eg. 125% and times interest earned to 1 decimal place, e.g. 15.2.) Apple Inc. Consolidated Statements of Operations (in millions, except number of shares which are reflected in thousands and per share amounts) Apple Inc. Consolidated Statements of Comprehensive Income (in millions) Current irssets: September 29, September 30 . Cash and eash equivalents Markeathle securities Assons: Accounts recelvable, net liventories Vendor non-trade receivablesh Qher current assets Total current assets Non-current assets: Marketable securilies Property, plant and equipment, net Orher non current assets Total non curreat asseth Toul assets IIAH.TTES NND SHARFHELDEFS FOUTTY: \begin{tabular}{rr} 525,913 & 520,289 \\ 40,388 & 53.692 \\ 23,186 & 17.874 \\ 3,956 & 4.855 \\ 25,809 & 17,799 \\ 12.087 & 13,936 \\ \hline 131,339 & 128.645 \end{tabular} Current Mabil ites. Fran curcan liabiliries limefored rewarmen Trim dett Trefill liwhilitier Comminments and conititudenation Shartholdere' equily Eommon stosk and waskona if Pecainat ournions Balances as of September 26,2015 Net income Other comprehensive income/(loss) Dividends and dividend equivalents declard at S2.18 per share or RSU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started