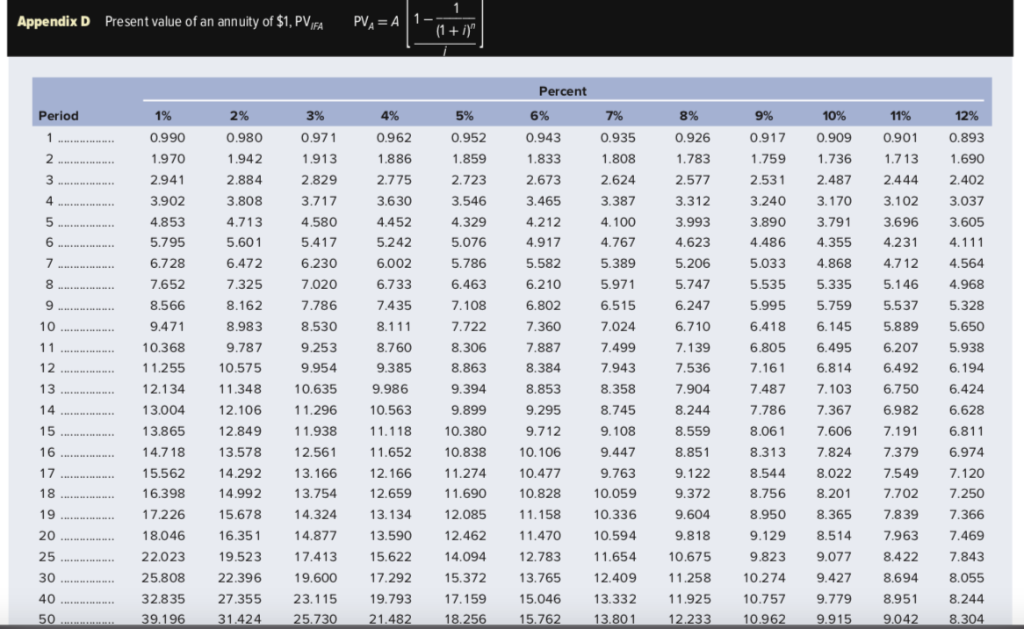

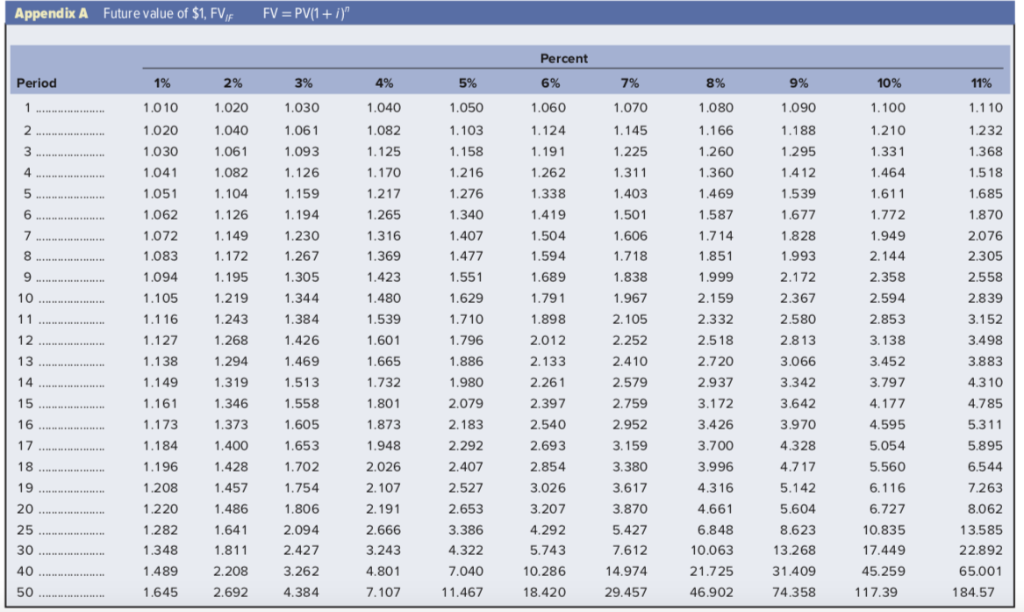

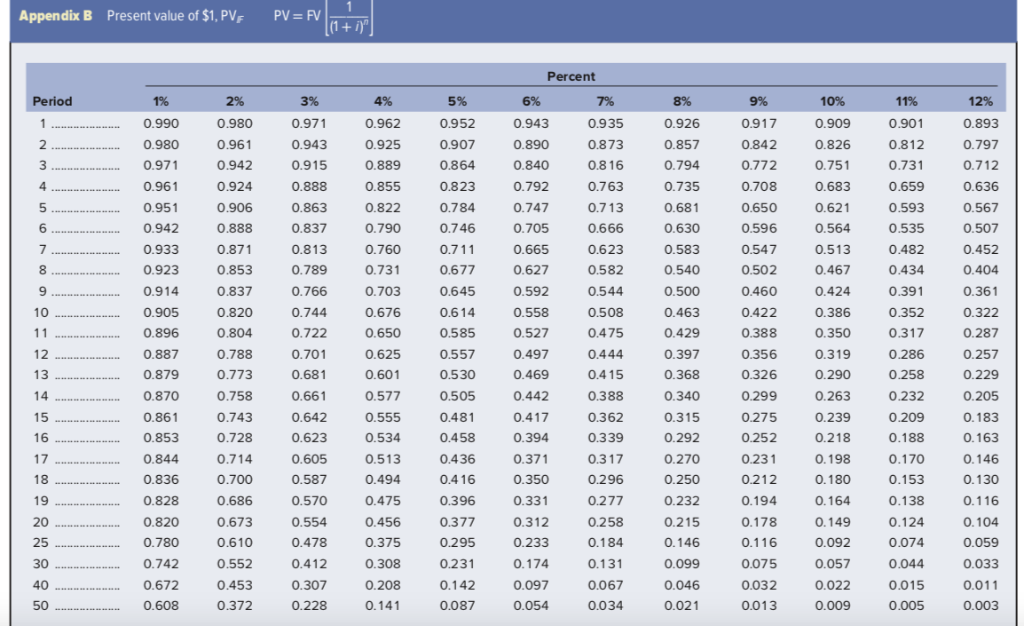

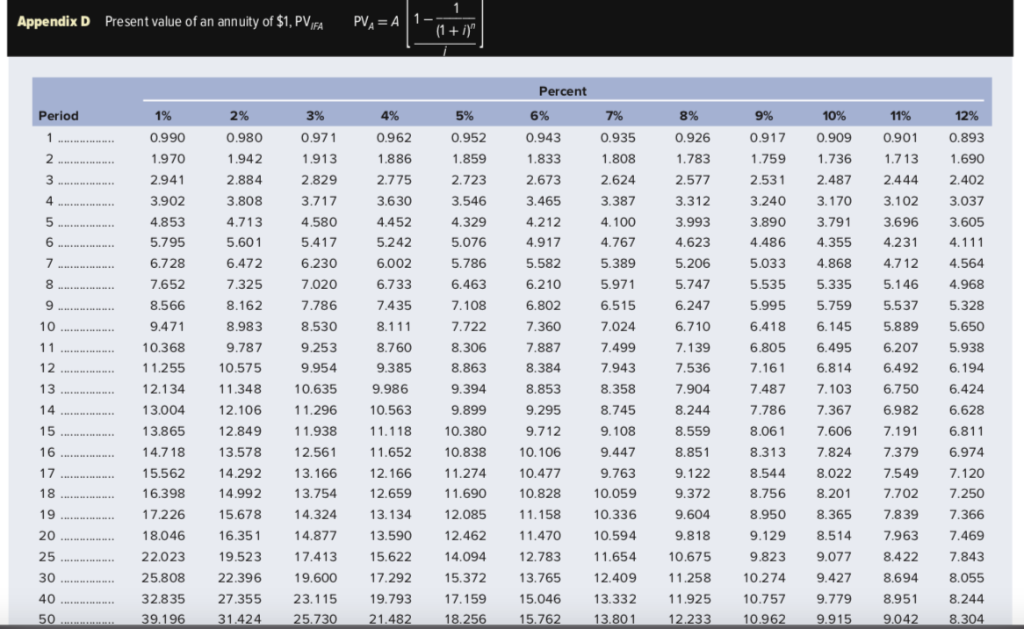

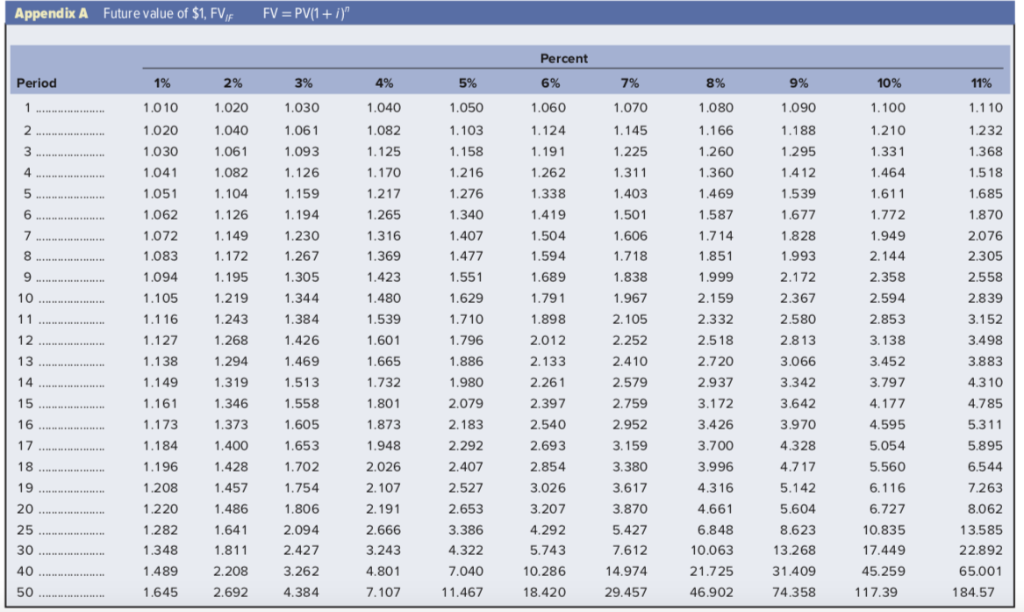

Your parents have accumulated a $140,000 nest egg. They have been planning to use this money to pay college costs to be incurred by you and your sister, Courtney. However, Courtney has decided to forgo college and start a nail salon. Your parents are giving Courtney $29,000 to help her get started, and they have decided to take year-end vacations costing $11,000 per year for the next four years. Use 7 percent as the appropriate interest rate throughout this problem. Use Appendix A and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

a. How much money will your parents have at the end of four years to help you with graduate school, which you will start then? (Round your final answer to 2 decimal places.)

b. You plan to work on a masters and perhaps a PhD. If graduate school costs $28,220 per year, approximately how long will you be able to stay in school based on these funds? (Round your final answer to 2 decimal places.)

Beasley Ball Bearings paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 6 percent over the next four years. The required rate of return is 19 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.

a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)

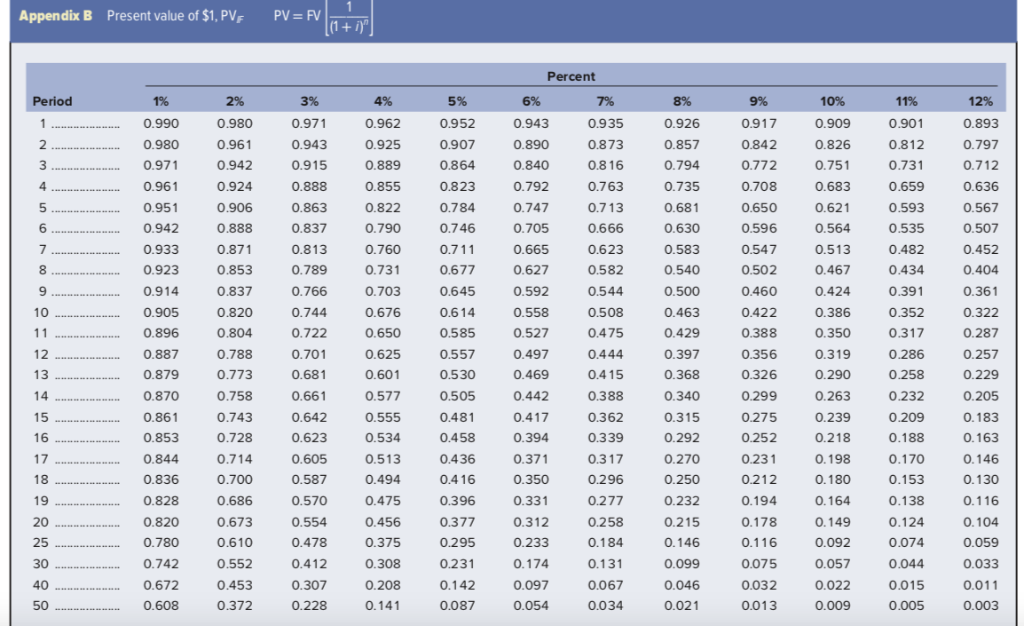

b. Calculate the present value of each of the anticipated dividends at a discount rate of 19 percent. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)

c. Compute the price of the stock at the end of the fourth year (P4). (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

d. Calculate the present value of the year 4 stock price at a discount rate of 19 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

f. Use the formula given below to show that it will provide approximately the same answer as part e. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

g. If current EPS were equal to $5.70 and the P/E ratio is 20% higher than the industry average of 5, what would the stock price be? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

h. By what dollar amount is the stock price in part g different from the stock price in part f? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

i. With regard to the stock price in part f, indicate which direction it would move if:

Wilson Oil Company issued bonds five years ago at $1,000 per bond. These bonds had a 25-year life when issued and the annual interest payment was then 16 percent. This return was in line with the required returns by bondholders at that point in time as described below:

| | | |

| Real rate of return | 10 | % |

| Inflation premium | 3 | |

| Risk premium | 3 | |

| Total return | 16 | % |

| |

Assume that 10 years later, due to bad publicity, the risk premium is now 7 percent and is appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have 15 years remaining until maturity.

Compute the new price of the bond. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.

You are called in as a financial analyst to appraise the bonds of Olsens Clothing Stores. The $1,000 par value bonds have a quoted annual interest rate of 8 percent, which is paid semiannually. The yield to maturity on the bonds is 10 percent annual interest. There are 20 years to maturity. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

a. Compute the price of the bonds based on semiannual analysis. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

b. With 15 years to maturity, if yield to maturity goes down substantially to 6 percent, what will be the new price of the bonds? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). However, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due).

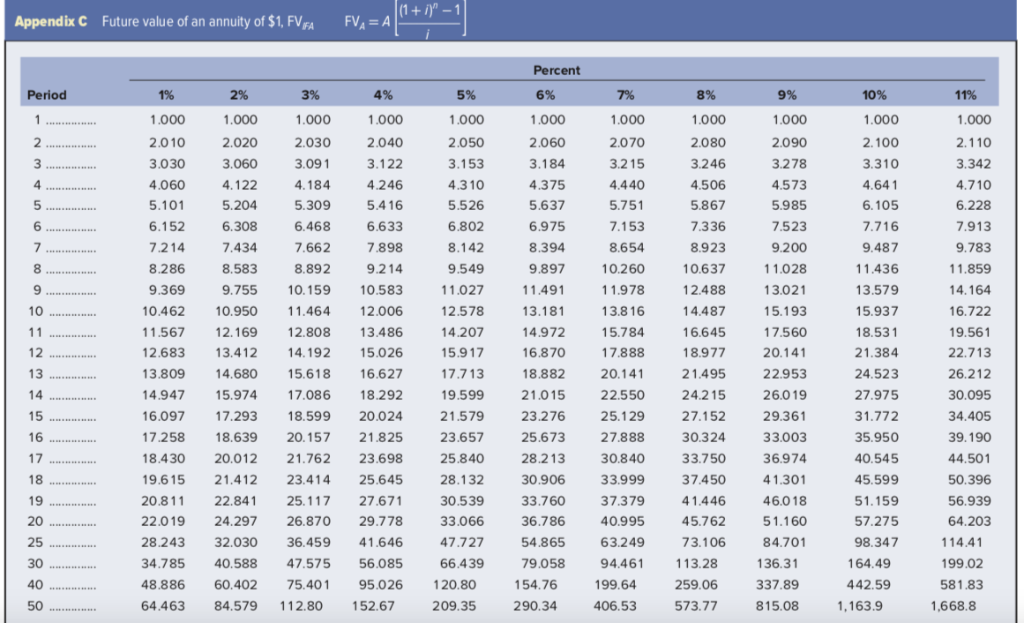

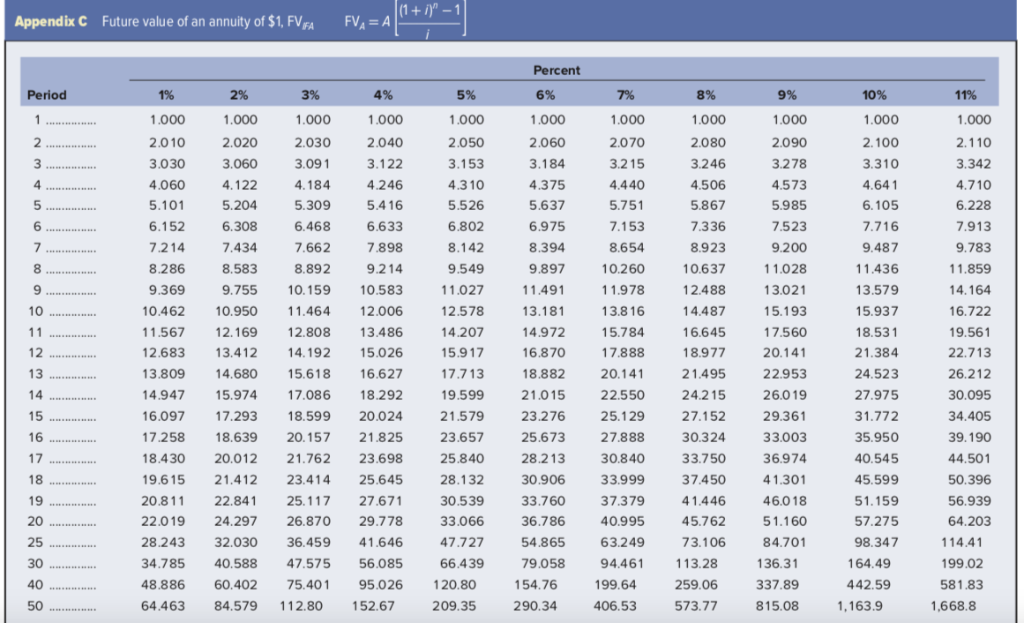

What is the future value of a 18-year annuity of $2,000 per period where payments come at the beginning of each period? The interest rate is 5 percent. Use Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. To find the future value of an annuity due when using the Appendix tables, add 1 to n and subtract 1 from the tabular value. For example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to Appendix C for n = 6 and i = 10 percent. Look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 6.716). (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

(1 + i)" - Future value of an annuity of $1, FV,FA Appendix C FV=A Percent 11 % 19% Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 4.122 4.246 4.506 4.710 4 4.060 4.184 4.3 10 4.375 4.440 4.573 4.641 5.309 5.416 5.637 5.751 6.105 6.228 5.101 5.204 5.526 5.867 5.985 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 7.. . 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 9.755 9.369 10.159 10.583 11.027 11,491 11.978 12.488 13.021 13.579 14,164 10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 11 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 12 12.683 13.412 14.192 17.888 20.141 21.384 22.713 15.026 15.917 16.870 18.977 13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 15.974 14 14.947 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 15 16.097 21.579 23.276 25.129 17.293 18.599 20.024 27.152 29.361 31.772 34.405 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 37.450 18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 41.301 45.599 50.396 25.117 56.939 19 20.811 22.841 27.671 30.539 33.760 37.379 41.446 46.0 18 51.159 20 26.870 45.762 51.160 22.019 24,297 29.778 33.066 36.786 40.995 57.275 64.203 25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84,701 98.347 114.41 30 34.785 40.588 47.575 56.085 66.439 79.058 94.461 113.28 136.31 164,49 199.02 40 48.886 75.401 120.80 154.76 199.64 259.06 442.59 581.83 60.402 95.026 337.89 64.463 406.53 50 84.579 1,163.9 112.80 152.67 209.35 290.34 573.77 815.08 1,668.8 ..... u Present value of $1, PVF PV= FV Appendix B (1+ i)" Percent 6% Period 1% 2% 3% 4% 5% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.842 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.826 0.812 0.797 0.971 0.942 0.915 0.889 0.864 0.840 0.8 16 0.794 0.772 0.751 0.731 0.712 0.961 0.924 0.888 0.855 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.823 4 0.951 0.906 0.863 0.822 0.784 0.747 0.7 13 0.681 0.650 0.593 0.567 0.621 6 0.942 0.888 0.837 0.790 O.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.933 0.871 0.813 0.760 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.711 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 1 1 0.317 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 13 0.879 0.773 0.681 0.601 0.469 0.368 0.326 0.290 0.258 0.229 0.530 0.415 0.870 0.758 0.388 0.299 0.263 0.232 0.205 14 0.661 0.577 0.505 0.442 0.340 15 0.861 0.642 0.555 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.743 0.481 16 0.394 0.292 0.252 0.218 0.163 0.853 0.728 0.623 0.534 0.458 0.339 0.188 0.231 0.170 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.198 0.146 18 0.494 0.350 0.180 0.836 O.700 0.587 0.416 0.296 0.250 0.212 0.153 0.130 19 0.828 0.686 0.570 0.331 0.277 0.232 0.164 0.138 0.116 0.475 0.396 0.194 0.820 0.673 0.456 0.312 0.178 20 0.554 0.377 0.258 0.215 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.412 0.308 0.174 0.057 0.552 0.231 0.131 0.099 0.075 0.044 0.033 0.307 40 0.672 0.453 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.608 0.141 0.087 0.021 0.013 0.003 0.372 0.228 0.054 0.034 0.009 0.005 1 Present value of an annuity of $1, PVIFA PV A 1- Appendix D (1+i Percent 6% 9% 10% Period 1% 2% 3% 4% 5% 7% 8% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.917 0.909 0,893 0.935 0.901 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 2 1.713 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.53 2.487 2.444 2,402 3.808 3.717 3.465 3.312 4 3.902 3.630 3.546 3.387 3.240 3.170 3.102 3.037 4.853 4,713 4.580 4.452 4,329 4.212 4.100 3.993 3.890 3.791 5 3.696 3.605 6 5.795 5.601 5.417 5.242 5.076 4,917 4.767 4.623 4.486 4.355 4.231 4.111 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.7 12 4.564 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 7.108 6.247 8.566 8.162 7.786 7.435 6.802 6.515 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 8.111 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 12 11.255 9.385 8.384 7.161 10.575 9.954 8.863 7.943 7.536 6.814 6.492 6.194 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 14 7.786 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.367 6.982 6.628 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6,811 16 14.7 18 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 17 8.544 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.022 7.549 7.120 12.659 18 16.398 14.992 13.754 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 19 17.226 15.678 13.134 12.085 11.158 10.336 9.604 8.950 7.366 14.324 8.365 7.839 20 18.046 14.877 13.590 12.462 10.594 9.818 9.129 8.514 7.963 7.469 16.35 11.470 7.843 25 17.413 14.094 12.783 11.654 9.823 8.422 22.023 19.523 15.622 10.675 9.077 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25,730 21,482 18,256 15.762 13.80 12.233 10.962 9.915 9.042 8.304 Appendix A Future value of $1, FV FV= PV(1+ i)" Percent 5% Period 1% 2% 3% 4% 6% 7% 8% 9% 10% 11% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.110 1.1 66 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.188 1.210 1.232 3 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.33 1 1.368 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.518 4 1.464 5 1.051 1.104 1.159 1.217 1.403 1.469 1.539 1.685 1.276 1.338 1.61 1 1.062 1.194 1.340 1.677 1.772 1.126 1.265 1.419 1.501 1.587 1.870 1.072 1.230 1.316 1.407 1.714 1.828 1.149 1.504 1.606 1.949 2.076 1.477 1,083 1.172 1.369 1.993 1.267 1.594 1.718 1.851 2.144 2.305 1.094 1.195 1.305 1.423 1.551 1,689 1.838 1.999 2.172 2.358 2.558 10 1.629 2.367 1.105 1.219 1.344 1.480 1.791 1.967 2.159 2.594 2.839 1.710 2.580 11 1.116 1.243 1.384 1.539 1.898 2.105 2.332 2.853 3.152 12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 3.498 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 3.883 14 1.149 1.319 1.513 1.732 1.980 2.26 2.579 2.937 3.342 3.797 4.310 15 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 4.785 16 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.9 70 4.595 5.311 17 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 5.895 1.196 1.428 1.702 2.407 2.854 3.380 4.717 18 2.026 3.996 5.560 6.544 1.208 1.457 1.754 2.107 2.527 3.026 3.617 5.142 19 4.316 6.116 7.263 20 1,220 4.661 1.486 1.806 2.191 2.653 3.207 3.870 5.604 6.727 8.062 25 3.386 1,282 1.641 2.094 2.666 4.292 5.427 6.848 8.623 10.835 13.585 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 22.892 10.286 21.725 4 1,489 2.208 3.262 4,801 7.040 14.974 31.409 45.259 65.001 50 1.645 2.692 4,384 7.107 11.467 18,420 29,457 46.902 74.358 117.39 184,57 .....uaa