Question

Your parents run a farm and ranch with 1500 acres of cropland and 250-head cow-calf operation. The cropland is used in a hay, grain, potato

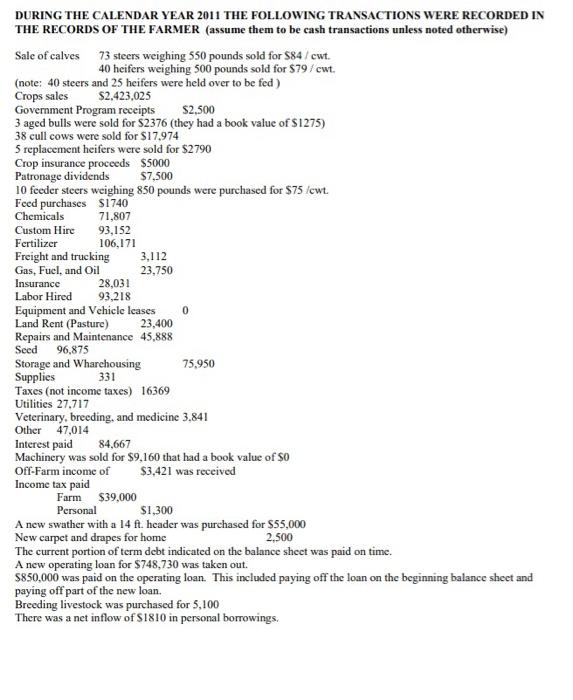

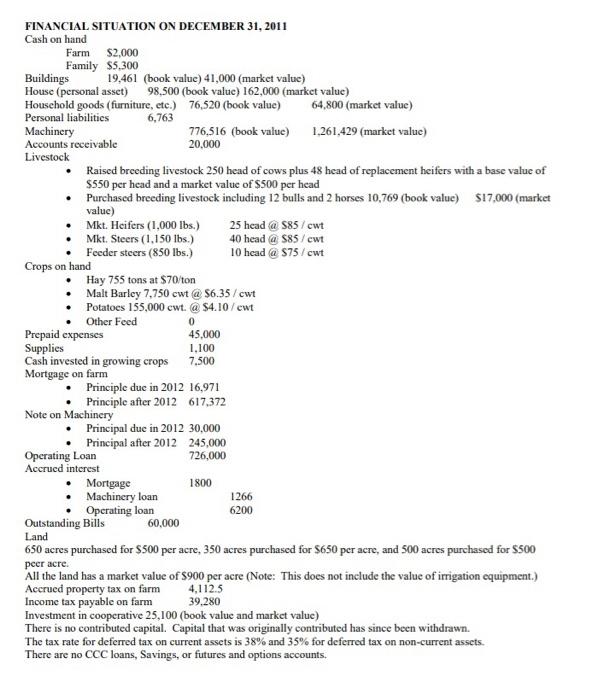

Your parents run a farm and ranch with 1500 acres of cropland and 250-head cow-calf operation. The cropland is used in a hay, grain, potato rotation. Calves are born in January – March. The top end of heifers will be kept as replacements. The remaining calves are sold in November. Bulls are purchased. Last year over Christmas your parents asked you to construct some financial statements for the farm. They thought all this education should be useful for something. They also wanted better information to take to the bank to get financing. You replied that you had not taken that class yet. However, you told them you remembered from the accounting class you had as a freshman that you needed a balance sheet at the beginning and end of year to construct an accurate income statement. You and your parents decided to take and inventory last year and gathered the information needed for a balance sheet on New Years Eve. The plan was that you would take APEC 5015 and become a financial statement expert. They would keep track of what they paid for different things. Then over Christmas break in December 2011 you would gather information for an ending balance sheet. Now it is January 2012. The notes that you took on December 31, 2011 and 2010 are below. Also, the information your parents gathered on transactions during 2010 are below. You feel this is a great time to apply what you learned in APEC 5015. Your parents will have a set of financial statements from which they can assess the farms financial position. You should assume that the farm is a proprietorship. You a(nd your parents decided to not capitalize and depreciate the cost of raised breeding livestock. Instead, you established a base value of $550 per head. You also discussed having financial statements that were for just the farm versus the farm and family combined. You and your parents could not agree on which would be more appropriate. You decided to prepare them both ways and then decide later. Everyone was in agreement that financial statements on both a cost basis and market value would be useful. The second project will be to analyze the financial statements that you create here. Use the information below to prepare the following financial statements, Balance sheets (6) Cost based beginning and ending farm and market value beginning and ending farm and consolidated. Income Statement (1) Cash flow Statement (2) for farm and consolidated . Owner’s equity statement (3) for farm both book value and market value. and consolidated. calculate ratios and write a 3-5 page paper.

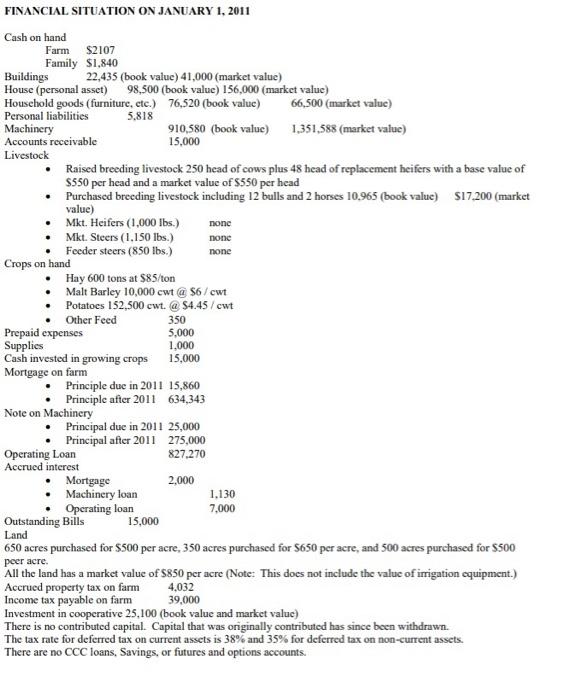

FINANCIAL SITUATION ON JANUARY 1, 2011 Cash on hand Farm Family Buildings House (personal asset) $2107 $1,840 Household goods (furniture, etc.) Personal liabilities 5,818 22,435 (book value) 41,000 (market value) 98,500 (book value) 156,000 (market value) 76,520 (book value) Machinery Accounts receivable Livestock Crops on hand Prepaid expenses Supplies Cash invested in growing crops Mortgage on farm Raised breeding livestock 250 head of cows plus 48 head of replacement heifers with a base value of $550 per head and a market value of $550 per head Purchased breeding livestock including 12 bulls and 2 horses 10,965 (book value) $17.200 (market value) Mkt. Heifers (1,000 lbs.) Mkt. Steers (1,150 lbs.) Feeder steers (850 lbs.) Principle due in 2011 Principle after 2011 Hay 600 tons at $85/ton Malt Barley 10,000 cwt @ $6/cwt Potatoes 152,500 cwt. @ $4.45/cwt Other Feed Note on Machinery . Operating Loan Accrued interest Principal due in 2011 Principal after 2011 Outstanding Bills Mortgage Machinery loan Operating loan 910,580 (book value) 15,000 15,000 350 5,000 1,000 15,000 15,860 634,343 25,000 275,000 827,270 2,000 none none none 4,032 39,000 66,500 (market value) 1,351,588 (market value) 1,130 7,000 Land 650 acres purchased for $500 per acre, 350 acres purchased for $650 per acre, and 500 acres purchased for $500 peer acre. All the land has a market value of $850 per acre (Note: This does not include the value of irrigation equipment.) Accrued property tax on farm Income tax payable on farm Investment in cooperative 25,100 (book value and market value) There is no contributed capital. Capital that was originally contributed has since been withdrawn. The tax rate for deferred tax on current assets is 38% and 35% for deferred tax on non-current assets. There are no CCC loans, Savings, or futures and options accounts.

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheets 6 CostBased Balance Sheet Beginning of Year ASSETS Cash 10000 Accounts Receivable 0 Inventory 1000 Cropland 210000 Equipment 20000 Livestock 137500 Total Assets 378500 Liabilities Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started