Answered step by step

Verified Expert Solution

Question

1 Approved Answer

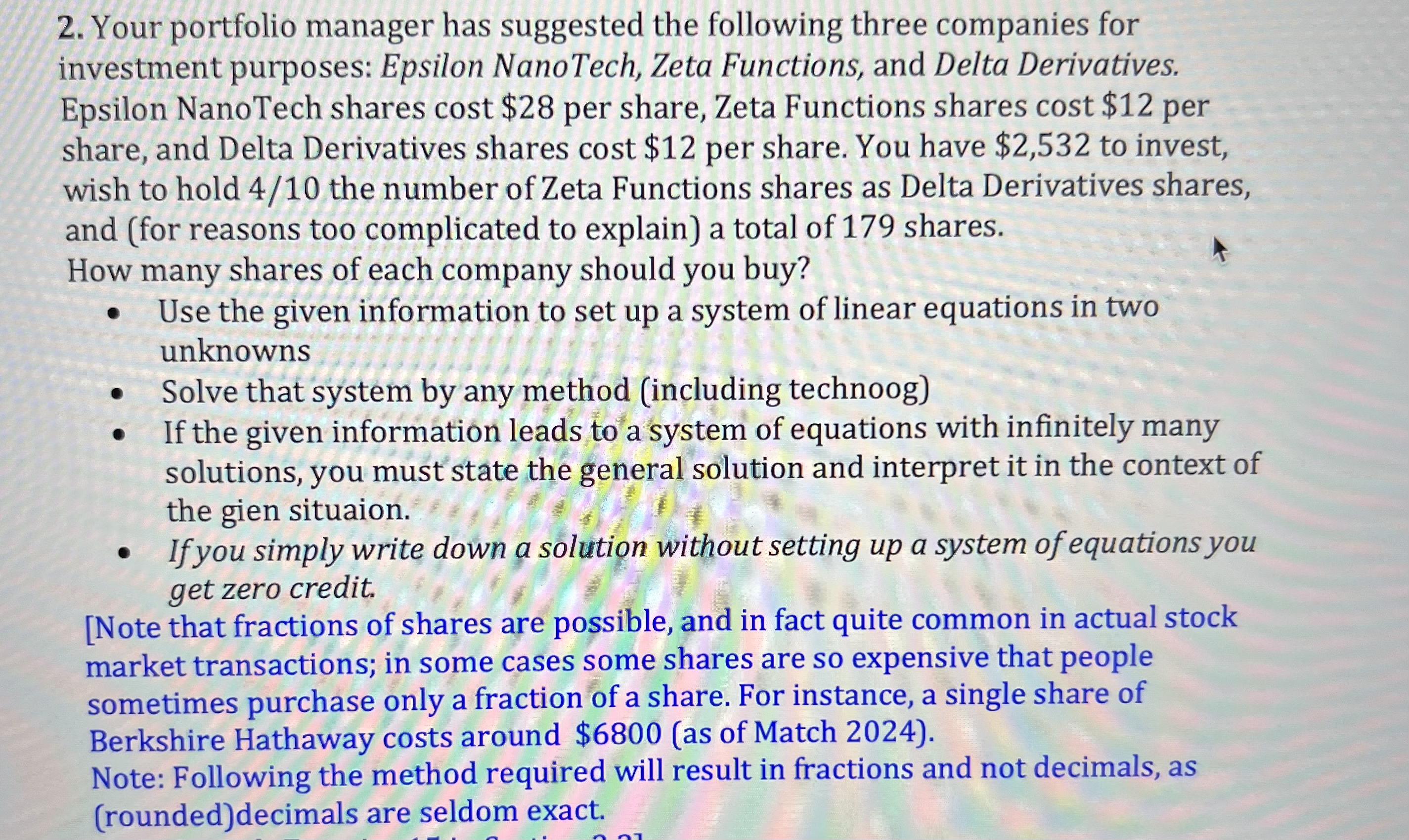

Your portfolio manager has suggested the following three companies for investment purposes: Epsilon NanoTech, Zeta Functions, and Delta Derivatives. Epsilon NanoTech shares cost $ 2

Your portfolio manager has suggested the following three companies for investment purposes: Epsilon NanoTech, Zeta Functions, and Delta Derivatives. Epsilon NanoTech shares cost $ per share, Zeta Functions shares cost $ per share, and Delta Derivatives shares cost $ per share. You have $ to invest, wish to hold the number of Zeta Functions shares as Delta Derivatives shares, and for reasons too complicated to explain a total of shares.

How many shares of each company should you buy?

Use the given information to set up a system of linear equations in two unknowns

Solve that system by any method including technoog

If the given information leads to a system of equations with infinitely many solutions, you must state the general solution and interpret it in the context of the gien situaion.

Ifyou simply write down a solution without setting up a system of equations you get zero credit.

Note that fractions of shares are possible, and in fact quite common in actual stock market transactions; in some cases some shares are so expensive that people sometimes purchase only a fraction of a share. For instance, a single share of Berkshire Hathaway costs around $as of Match

Note: Following the method required will result in fractions and not decimals, as roundeddecimals are seldom exact. Text in picture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started