Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your preliminary analysis of two stocks has yielded the information set forth below. Theb. As an equity portfolio manager, you may use certain risk -

Your preliminary analysis of two stocks has yielded the information set forth below. Theb. As an equity portfolio manager, you may use certain riskadjusted performance measures.

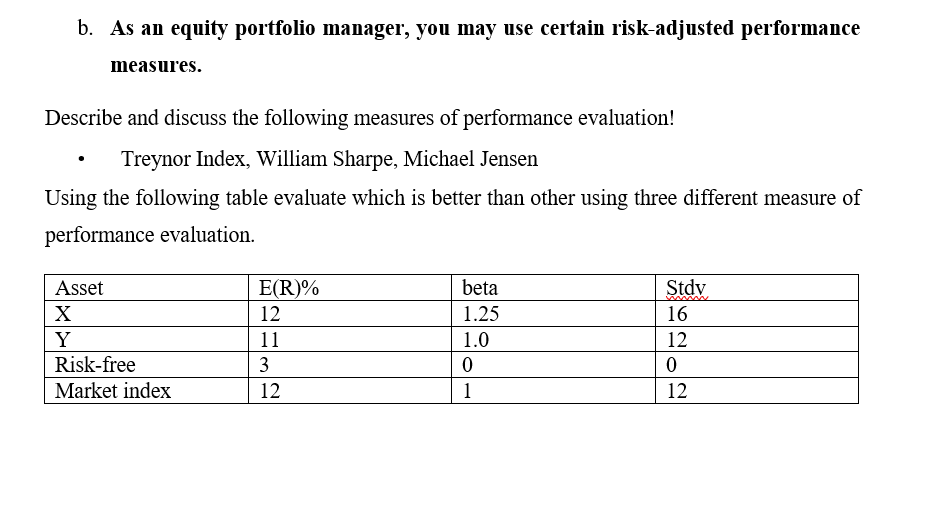

Describe and discuss the following measures of performance evaluation!

Treynor Index, William Sharpe, Michael Jensen

Using the following table evaluate which is better than other using three different measure of performance evaluation.

tableAssetbeta,StdvRiskfree,Market index,

return for the market is percent and the riskfree rate is percent.

i Calculate the required rate of return using CAPM model and identify the growth

rate for the dividend.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started