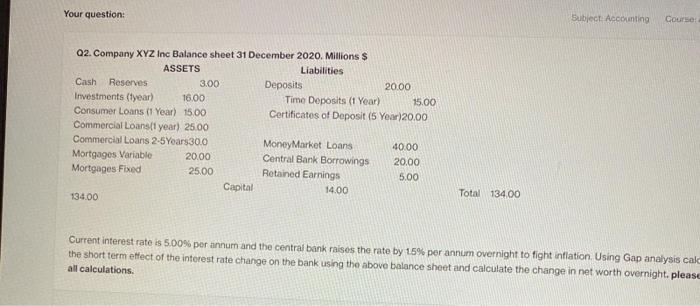

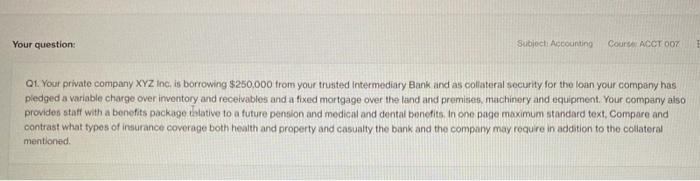

Your question: Subject Accounting Course Q2. Company XYZ Inc Balance sheet 31 December 2020. Millions $ ASSETS Liabilities Cash Reserves 3.00 Deposits 20.00 Investments (year) 16.00 Time Deposits (1 Year) 15.00 Consumer Loans (1 Year) 15.00 Certificates of Deposit (5 Year)20.00 Commercial Loansit year) 25.00 Commercial Loans 2-5Years 30.0 Money Market Loans 40.00 Mortgages Variable 20.00 Central Bank Borrowings 20.00 Mortgages Fixed 25.00 Retained Earnings 5.00 Capital 14.00 134.00 Total 134.00 Current interest rate is 5.00% per annum and the central bank raises the rate by 15% per annum Overnight to fight inflation Using Gap analysis calc the short term effect of the interest rate change on the bank using the above balance sheet and calculate the change in net worth overnight, please all calculations Your question: Subject Accounting Courte ACOT 007 Q1. Your private company XYZ Inc. is borrowing $250.000 from your trusted intermediary Bank and as collateral security for the loan your company has pledged a variable charge over inventory and receivables and a fixed mortgage over the land and promises, machinery and equipment. Your company also provides staff with a benefits package tatative to a future pension and medical and dental benefits in one page maximum standard text, Compare and contrast what types of insurance coverage both health and property and casunity the bank and the company may requre in addition to the collateral mentioned Your question: Subject Accounting Course Q2. Company XYZ Inc Balance sheet 31 December 2020. Millions $ ASSETS Liabilities Cash Reserves 3.00 Deposits 20.00 Investments (year) 16.00 Time Deposits (1 Year) 15.00 Consumer Loans (1 Year) 15.00 Certificates of Deposit (5 Year)20.00 Commercial Loansit year) 25.00 Commercial Loans 2-5Years 30.0 Money Market Loans 40.00 Mortgages Variable 20.00 Central Bank Borrowings 20.00 Mortgages Fixed 25.00 Retained Earnings 5.00 Capital 14.00 134.00 Total 134.00 Current interest rate is 5.00% per annum and the central bank raises the rate by 15% per annum Overnight to fight inflation Using Gap analysis calc the short term effect of the interest rate change on the bank using the above balance sheet and calculate the change in net worth overnight, please all calculations Your question: Subject Accounting Courte ACOT 007 Q1. Your private company XYZ Inc. is borrowing $250.000 from your trusted intermediary Bank and as collateral security for the loan your company has pledged a variable charge over inventory and receivables and a fixed mortgage over the land and promises, machinery and equipment. Your company also provides staff with a benefits package tatative to a future pension and medical and dental benefits in one page maximum standard text, Compare and contrast what types of insurance coverage both health and property and casunity the bank and the company may requre in addition to the collateral mentioned