Question

Your Research has produced the following for the ABC COMPANY: ABC's most recent dividend per share was $2 and you have forecasted a dividend growth

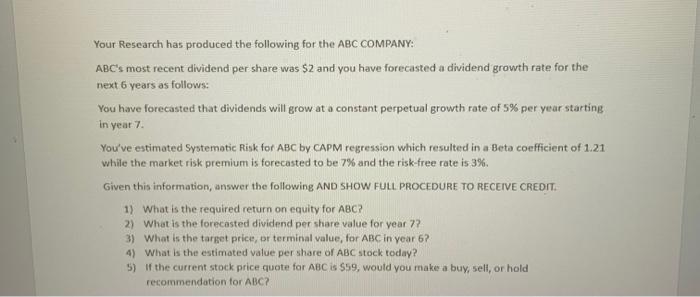

Your Research has produced the following for the ABC COMPANY:

ABC's most recent dividend per share was $2 and you have forecasted a dividend growth rate for the next 6 vears as follows:

You have forecasted that dividends will grow at a constant perpetual growth rate of 5% per year starting in year 7.

You've estimated Systematic Risk for ABC by CAPM regression which resulted in a Beta coefficient of 1.21 while the market risk premium is forecasted to be 7% and the risk-free rate is 3%.

Given this information, answer the following AND SHOW FULL PROCEDURE TO RECEIVE CREDIT.

- What is the required return on equity for ABCP

- What is the forecasted dividend per share value for ear 7?

- What is the target price, or terminal value, for ABC in year 6?

- What is the estimated value per share of ABC stock today?

- If the current stock price quote for ABC is $59, would you make a buy, sell, or hold recommendation for ABC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started