Answered step by step

Verified Expert Solution

Question

1 Approved Answer

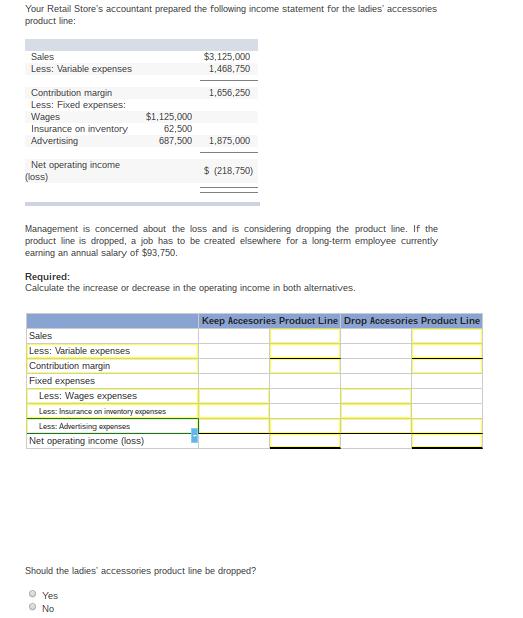

Your Retail Store's accountant prepared the following income statement for the ladies' accessories product line: Sales Less: Variable expenses Contribution margin Less: Fixed expenses:

Your Retail Store's accountant prepared the following income statement for the ladies' accessories product line: Sales Less: Variable expenses Contribution margin Less: Fixed expenses: Wages Insurance on inventory Advertising Net operating income (loss) $1,125,000 62,500 687,500 Sales Less: Variable expenses Contribution margin Fixed expenses $3,125,000 1,468,750 1,656,250 Management is concerned about the loss and is considering dropping the product line. If the product line is dropped, a job has to be created elsewhere for a long-term employee currently earning an annual salary of $93,750. Less: Wages expenses Less: Insurance on inventory expenses Less: Advertising expenses Net operating income (loss) 1,875,000 Required: Calculate the increase or decrease in the operating income in both alternatives. $ (218,750) Keep Accesories Product Line Drop Accesories Product Line Should the ladies' accessories product line be dropped? Yes No.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 STATEMENT TO DETERMINE INCREASE DECREASE IN NET OPERATING INCOME ALL AMOUNT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started