Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your sand and gravel company is looking at expanding operations in an existing plant to accommodate a new product (top dressing or fine sand

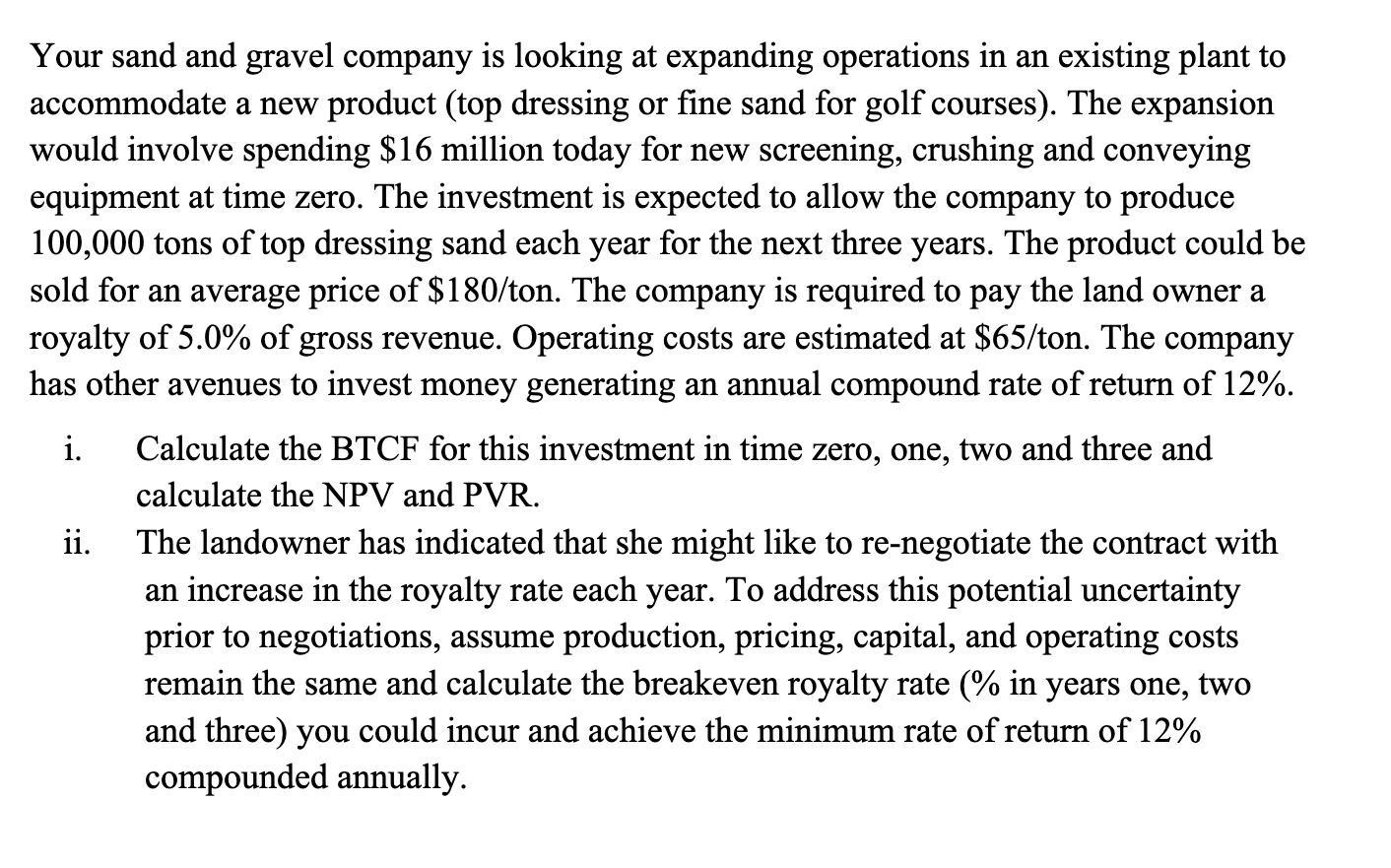

Your sand and gravel company is looking at expanding operations in an existing plant to accommodate a new product (top dressing or fine sand for golf courses). The expansion would involve spending $16 million today for new screening, crushing and conveying equipment at time zero. The investment is expected to allow the company to produce 100,000 tons of top dressing sand each year for the next three years. The product could be sold for an average price of $180/ton. The company is required to pay the land owner a royalty of 5.0% of gross revenue. Operating costs are estimated at $65/ton. The company has other avenues to invest money generating an annual compound rate of return of 12%. i. ii. Calculate the BTCF for this investment in time zero, one, two and three and calculate the NPV and PVR. The landowner has indicated that she might like to re-negotiate the contract with an increase in the royalty rate each year. To address this potential uncertainty prior to negotiations, assume production, pricing, capital, and operating costs remain the same and calculate the breakeven royalty rate (% in years one, two and three) you could incur and achieve the minimum rate of return of 12% compounded annually.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started