Question

A loader is being considered to tram material from a stockpile. The cost of the machine is estimated at $1,400,000 with an estimated salvage

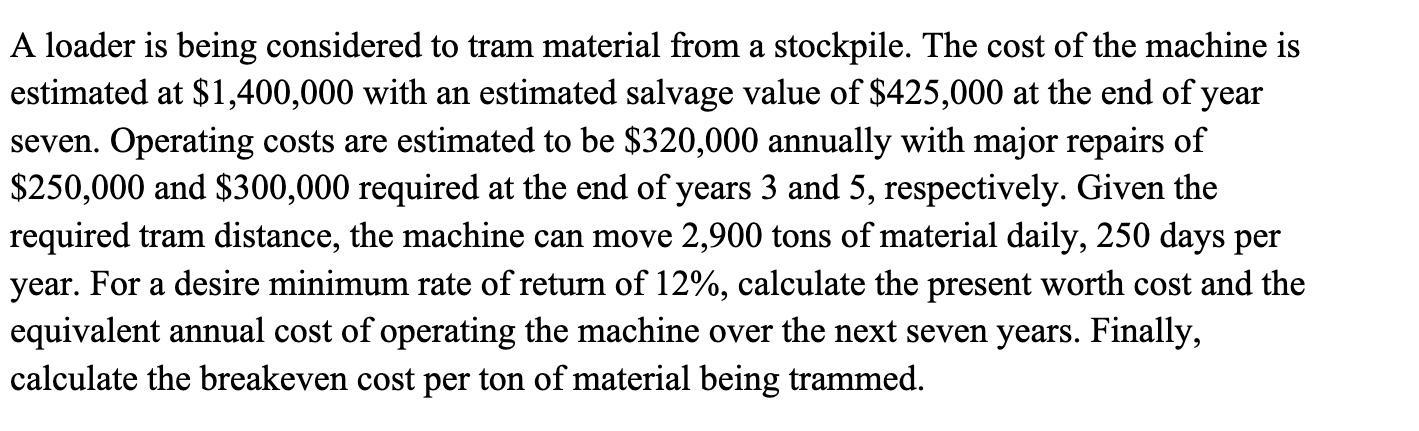

A loader is being considered to tram material from a stockpile. The cost of the machine is estimated at $1,400,000 with an estimated salvage value of $425,000 at the end of year seven. Operating costs are estimated to be $320,000 annually with major repairs of $250,000 and $300,000 required at the end of years 3 and 5, respectively. Given the required tram distance, the machine can move 2,900 tons of material daily, 250 days per year. For a desire minimum rate of return of 12%, calculate the present worth cost and the equivalent annual cost of operating the machine over the next seven years. Finally, calculate the breakeven cost per ton of material being trammed.

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App