Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your second job at your new employer, the Soprano VC Fund, is to value the following company with these cash flow projections. You need to

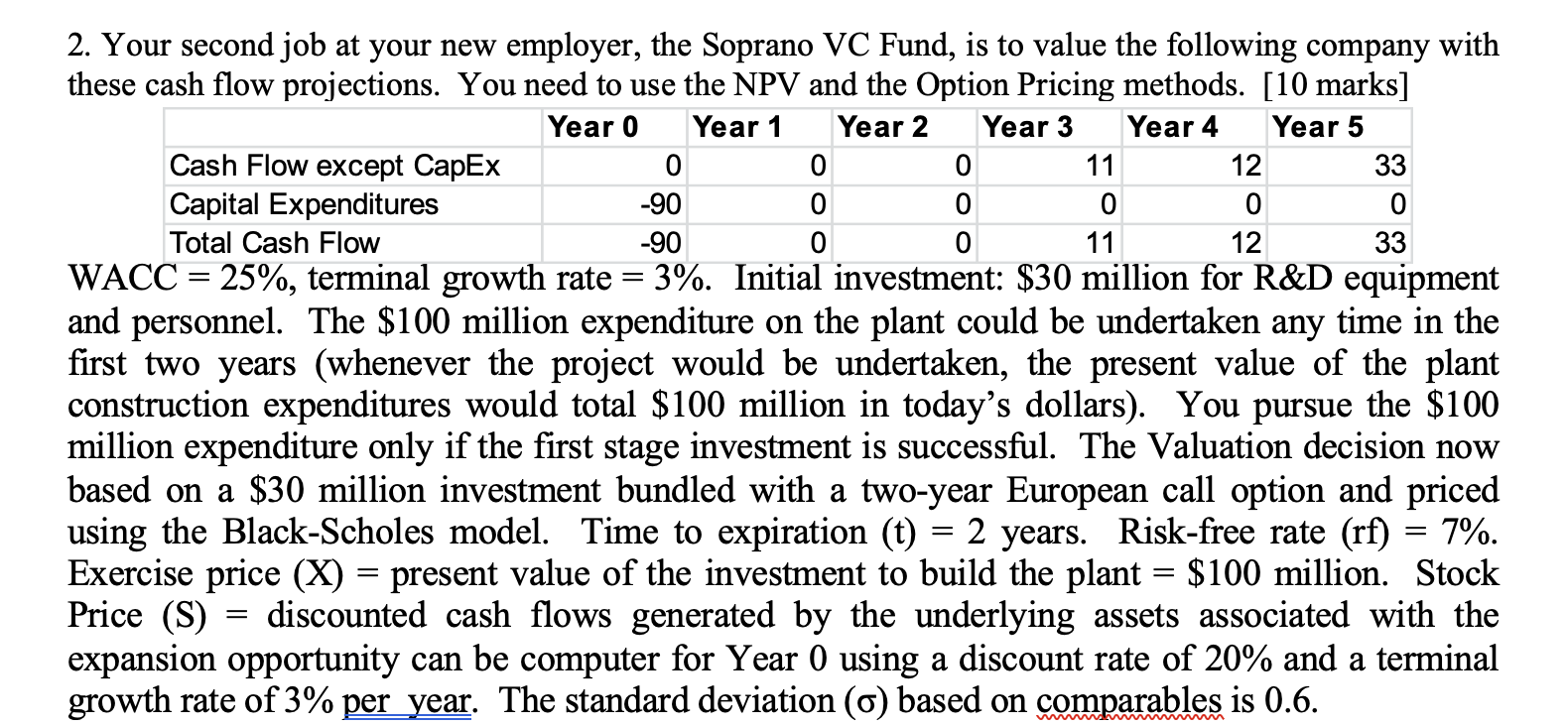

Your second job at your new employer, the Soprano VC Fund, is to value the following company with

these cash flow projections. You need to use the NPV and the Option Pricing methods. marks

WACC terminal growth rate Initial investment: $ million for R&D equipment

and personnel. The $ million expenditure on the plant could be undertaken any time in the

first two years whenever the project would be undertaken, the present value of the plant

construction expenditures would total $ million in today's dollars You pursue the $

million expenditure only if the first stage investment is successful. The Valuation decision now

based on a $ million investment bundled with a twoyear European call option and priced

using the BlackScholes model. Time to expiration years. Riskfree rate

Exercise price present value of the investment to build the plant $ million. Stock

Price discounted cash flows generated by the underlying assets associated with the

expansion opportunity can be computer for Year using a discount rate of and a terminal

growth rate of per year. The standard deviation based on comparables is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started