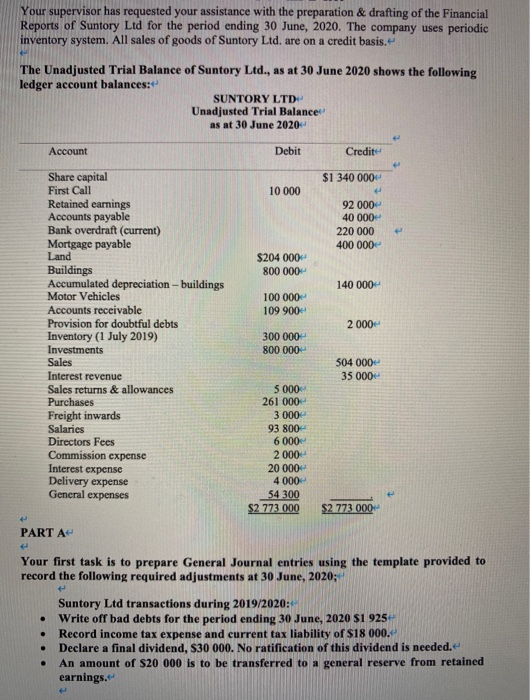

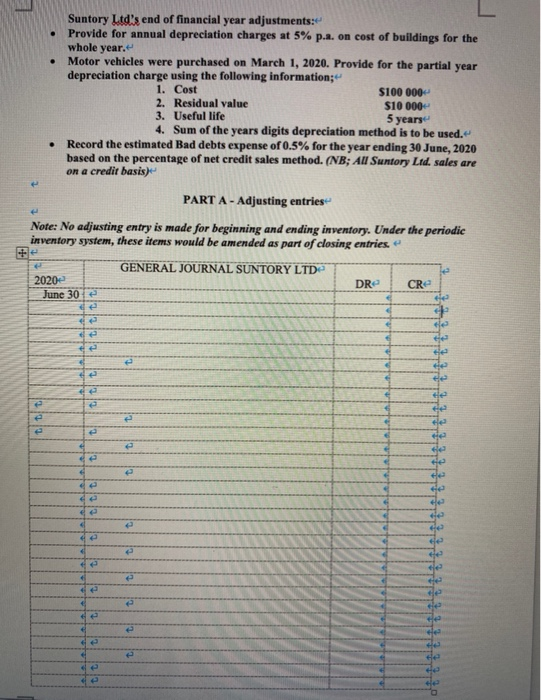

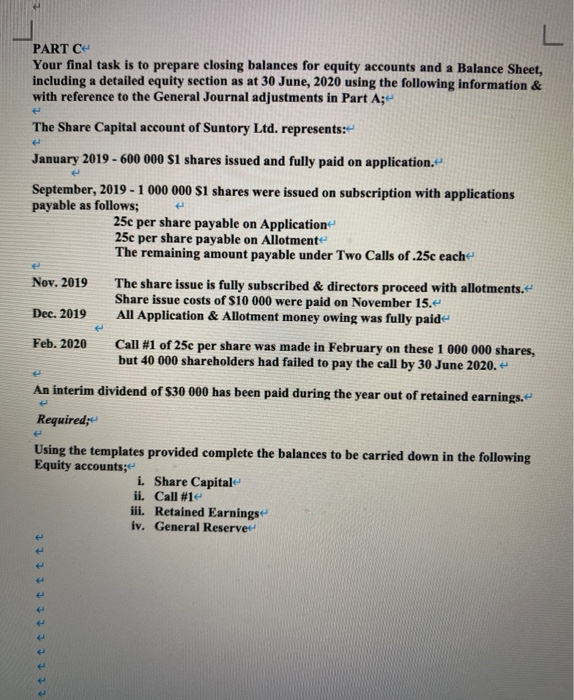

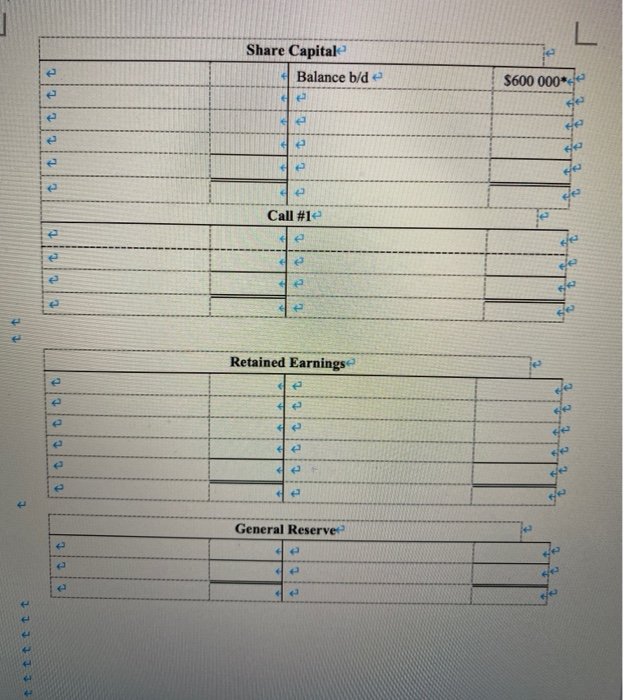

Your supervisor has requested your assistance with the preparation & drafting of the Financial Reports of Suntory Ltd for the period ending 30 June, 2020. The company uses periodic inventory system. All sales of goods of Suntory Ltd. are on a credit basis. The Unadjusted Trial Balance of Suntory Ltd., as at 30 June 2020 shows the following ledger account balances: SUNTORY LTD Unadjusted Trial Balance as at 30 June 2020 Account Debit Credite $1 340 000 10 000 92 000 40 000- 20 000 400 000 $204 000 800 000 140 000 100 000 109 900 2 000 Share capital First Call Retained earnings Accounts payable Bank overdraft (current) Mortgage payable Land Buildings Accumulated depreciation - buildings Motor Vehicles Accounts receivable Provision for doubtful debts Inventory (1 July 2019) Investments Sales Interest revenue Sales returns & allowances Purchases Freight inwards Salaries Directors Fees Commission expense Interest expense Delivery expense General expenses 300 000 800 000 504 000 35 000 5 000 261 000 3000- 93 800- 6 000 2000- 20 000 4000 54 300 $2 773 000 $2 773 000 PART A Your first task is to prepare General Journal entries using the template provided to record the following required adjustments at 30 June, 2020;- . . Suntory Ltd transactions during 2019/2020: Write off bad debts for the period ending 30 June, 2020 si 925 Record income tax expense and current tax liability of $18 000.- Declare a final dividend, S30 000. No ratification of this dividend is needed. An amount of $20 000 is to be transferred to a general reserve from retained earnings. . . Suntory Ltd's end of financial year adjustments: Provide for annual depreciation charges at 5% p.a. on cost of buildings for the whole year. Motor vehicles were purchased on March 1, 2020. Provide for the partial year depreciation charge using the following information; 1. Cost $100 000 2. Residual value $10 000 3. Useful life 5 years 4. Sum of the years digits depreciation method is to be used. Record the estimated Bad debts expense of 0.5% for the year ending 30 June, 2020 based on the percentage of net credit sales method. (NB; All Suntory Ltd. sales are on a credit basis) PART A- Adjusting entries Note: No adjusting entry is made for beginning and ending inventory. Under the periodic inventory system, these items would be amended as part of closing entries. GENERAL JOURNAL SUNTORY LTD 2020- June 30e DR. CRe 1919 de te ce e de de e die ce ce PART CH Your final task is to prepare closing balances for equity accounts and a Balance Sheet, including a detailed equity section as at 30 June, 2020 using the following information & with reference to the General Journal adjustments in Part A; The Share Capital account of Suntory Ltd. represents: January 2019 - 600 000 $1 shares issued and fully paid on application. September, 2019 - 1 000 000 $1 shares were issued on subscription with applications payable as follows; 25c per share payable on Application 25 per share payable on Allotment The remaining amount payable under Two Calls of 250 each Nov. 2019 The share issue is fully subscribed & directors proceed with allotments. Share issue costs of $10 000 were paid on November 15.- Dec. 2019 All Application & Allotment money owing was fully paid Feb. 2020 Call #1 of 25c per share was made in February on these 1 000 000 shares, but 40 000 shareholders had failed to pay the call by 30 June 2020. An interim dividend of $30 000 has been paid during the year out of retained earnings. Required Using the templates provided complete the balances to be carried down in the following Equity accounts; i. Share Capitale ii. Call #1 iii. Retained Earnings iv. General Reserved t t t t I t I ? t t t. Share Capitale Balance b/de $600 000*4 e He ge e 6 Call #12 2213 e t e Retained Earnings 4 e General Reserve ttttttt Prepare a Classified Balance Sheet for Suntory Ltd as at 30 June, 2020 also with reference to the General Journal adjustments in Part A. SUNTORY LTD Balance Sheet as at 30 June 2020 e de le de e de ge de de It/t/t/0/0/0/0/0/0/t/t/