Answered step by step

Verified Expert Solution

Question

1 Approved Answer

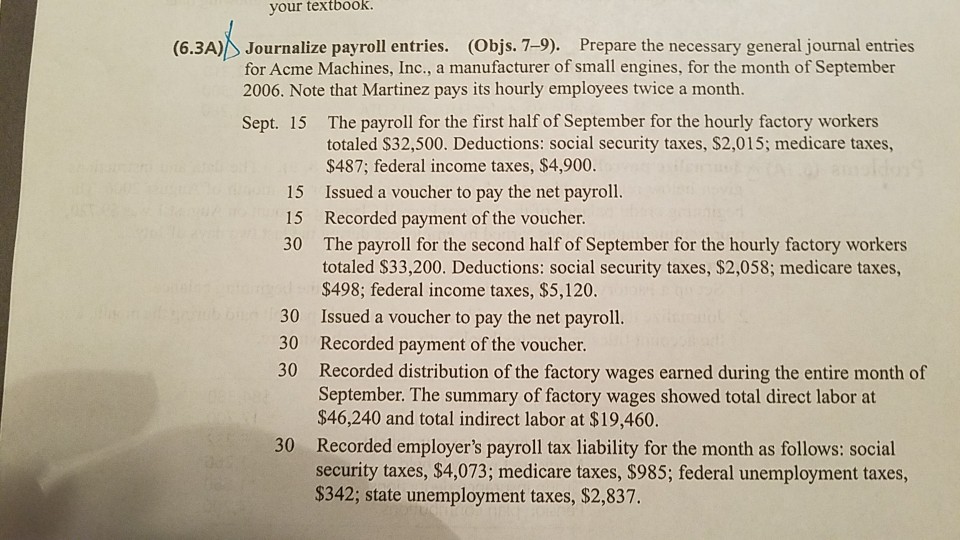

your textbook. (6.3A) Journalize payroll entries. (Objs 7-9). Prepare the necessary general journal entries 2006. Note that Martinez pays its hourly employees twice a month.

your textbook. (6.3A) Journalize payroll entries. (Objs 7-9). Prepare the necessary general journal entries 2006. Note that Martinez pays its hourly employees twice a month. Sept. 15 The payroll for the first half of September for the hourly factory workers totaled $32,500. Deductions: social security taxes, $2,015; medicare taxes, $487; federal income taxes, $4,900. Issued a voucher to pay the net payroll Recorded payment of the voucher. The payroll for the second half of September for the hourly factory workers totaled S33,200. Deductions: social security taxes, $2,058; medicare taxes, $498; federal income taxes, $5,120. Issued a voucher to pay the net payroll Recorded payment of the voucher. 15 15 30 30 30 September. The summary of factory wages showed total direct labor at $46,240 and total indirect labor at $19,460. Recorded employer's payroll tax liability for the month as follows: social security taxes, $4,073; medicare taxes, $985; federal unemployment taxes, $342; state unemployment taxes, $2,837 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started