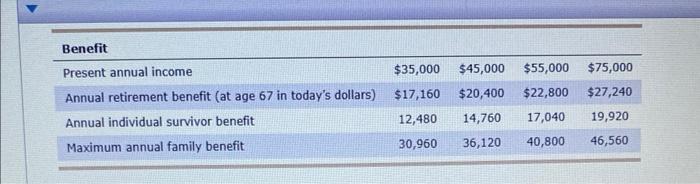

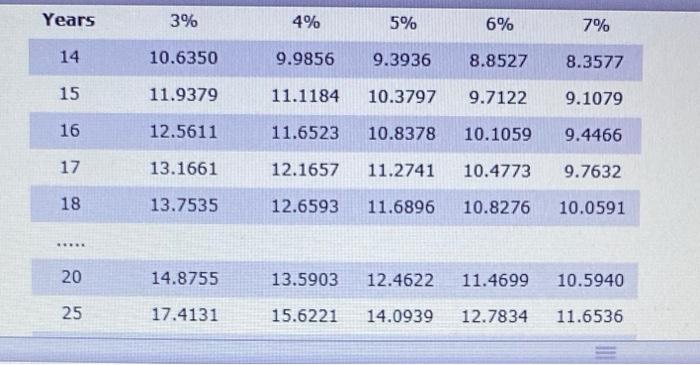

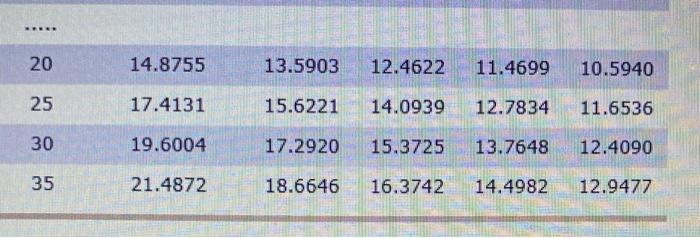

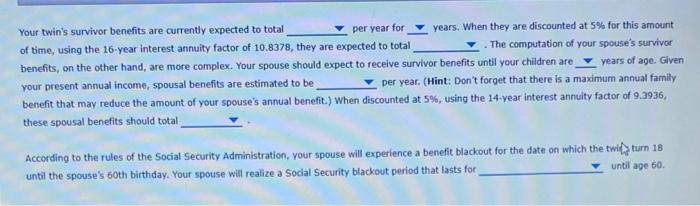

Your twini survivor benefits are ourtenty expected to total_ per year for 7 . years. When they are fiscounted at sos for this amount. of time. using the 16-year interest annuity factor of 10.8378, they are expected to total . The computation of your spousa's survivor benefits, on the other hand, ase more complex. Your spouse should expect to receive survivor benefite until your children are your present annual income, spousal benefits are estimated to be per yeac. (Hint: Don t forget that there is a maximumt annual family betelit that may reduce the amouch of yeur vooute's annual benefit.) When discounted at 5%, using the is-year interest anoulty factor of 9.3936, these spousal beriefta should total According to the rules of the Social Security. Administraton, rour isowe nill eciperience a beneft blackout for the date on which the twint turn is \begin{tabular}{lllll} \hline Benefit & & & \\ \hline Present annual income & $35,000 & $45,000 & $55,000 & $75,000 \\ \hline Annual retirement benefit (at age 67 in today's dollars) & $17,160 & $20,400 & $22,800 & $27,240 \\ Annual individual survivor benefit & 12,480 & 14,760 & 17,040 & 19,920 \\ \hline Maximum annual family benefit & 30,960 & 36,120 & 40,800 & 46,560 \\ \hline \end{tabular} \begin{tabular}{|ccccccc|} \hline Years & 3% & 4% & 5% & 6% & 7% \\ \hline 14 & 10.6350 & 9.9856 & 9.3936 & 8.8527 & 8.3577 \\ \hline 15 & 11.9379 & 11.1184 & 10.3797 & 9.7122 & 9.1079 \\ \hline 16 & 12.5611 & 11.6523 & 10.8378 & 10.1059 & 9.4466 \\ \hline 17 & 13.1661 & 12.1657 & 11.2741 & 10.4773 & 9.7632 \\ \hline 18 & 13.7535 & 12.6593 & 11.6896 & 10.8276 & 10.0591 \\ \hline \end{tabular} 202514.875517.413113.590315.622112.462214.093911.469912.783410.594011.6536 \begin{tabular}{|llllll|} \hline 20 & 14.8755 & 13.5903 & 12.4622 & 11.4699 & 10.5940 \\ \hline 25 & 17.4131 & 15.6221 & 14.0939 & 12.7834 & 11.6536 \\ \hline 30 & 19.6004 & 17.2920 & 15.3725 & 13.7648 & 12.4090 \\ \hline 35 & 21.4872 & 18.6646 & 16.3742 & 14.4982 & 12.9477 \end{tabular} Your twin's survivor benefits are currently expected to total per year for years. When they are discounted at 5% for this amount of time, using the 16-year interest annuity factor of 10.8378, they are expected to total computation of your spouse's survivor benefits, on the other hand, are more complex. Your spouse should expect to receive survivor benefits until your children are years of age. Given your present annual income, spousal benefits are estimated to be _ per year. (Hint: Don' forget that there is a maximum annual family benefit that may reduce the amount of your spouse's annual benefit.) When discounted at 5%, using the 14.year interest annuity factor of 9.3936, these spousal benefits should total According to the rules of the Social Security Administration, your spouse will experience a benefit blackout for the date on which the twil 3t turn 18 until the spouse's 60th birthday. Your spouse will realize a Social Security blackout period that lasts for Your twini survivor benefits are ourtenty expected to total_ per year for 7 . years. When they are fiscounted at sos for this amount. of time. using the 16-year interest annuity factor of 10.8378, they are expected to total . The computation of your spousa's survivor benefits, on the other hand, ase more complex. Your spouse should expect to receive survivor benefite until your children are your present annual income, spousal benefits are estimated to be per yeac. (Hint: Don t forget that there is a maximumt annual family betelit that may reduce the amouch of yeur vooute's annual benefit.) When discounted at 5%, using the is-year interest anoulty factor of 9.3936, these spousal beriefta should total According to the rules of the Social Security. Administraton, rour isowe nill eciperience a beneft blackout for the date on which the twint turn is \begin{tabular}{lllll} \hline Benefit & & & \\ \hline Present annual income & $35,000 & $45,000 & $55,000 & $75,000 \\ \hline Annual retirement benefit (at age 67 in today's dollars) & $17,160 & $20,400 & $22,800 & $27,240 \\ Annual individual survivor benefit & 12,480 & 14,760 & 17,040 & 19,920 \\ \hline Maximum annual family benefit & 30,960 & 36,120 & 40,800 & 46,560 \\ \hline \end{tabular} \begin{tabular}{|ccccccc|} \hline Years & 3% & 4% & 5% & 6% & 7% \\ \hline 14 & 10.6350 & 9.9856 & 9.3936 & 8.8527 & 8.3577 \\ \hline 15 & 11.9379 & 11.1184 & 10.3797 & 9.7122 & 9.1079 \\ \hline 16 & 12.5611 & 11.6523 & 10.8378 & 10.1059 & 9.4466 \\ \hline 17 & 13.1661 & 12.1657 & 11.2741 & 10.4773 & 9.7632 \\ \hline 18 & 13.7535 & 12.6593 & 11.6896 & 10.8276 & 10.0591 \\ \hline \end{tabular} 202514.875517.413113.590315.622112.462214.093911.469912.783410.594011.6536 \begin{tabular}{|llllll|} \hline 20 & 14.8755 & 13.5903 & 12.4622 & 11.4699 & 10.5940 \\ \hline 25 & 17.4131 & 15.6221 & 14.0939 & 12.7834 & 11.6536 \\ \hline 30 & 19.6004 & 17.2920 & 15.3725 & 13.7648 & 12.4090 \\ \hline 35 & 21.4872 & 18.6646 & 16.3742 & 14.4982 & 12.9477 \end{tabular} Your twin's survivor benefits are currently expected to total per year for years. When they are discounted at 5% for this amount of time, using the 16-year interest annuity factor of 10.8378, they are expected to total computation of your spouse's survivor benefits, on the other hand, are more complex. Your spouse should expect to receive survivor benefits until your children are years of age. Given your present annual income, spousal benefits are estimated to be _ per year. (Hint: Don' forget that there is a maximum annual family benefit that may reduce the amount of your spouse's annual benefit.) When discounted at 5%, using the 14.year interest annuity factor of 9.3936, these spousal benefits should total According to the rules of the Social Security Administration, your spouse will experience a benefit blackout for the date on which the twil 3t turn 18 until the spouse's 60th birthday. Your spouse will realize a Social Security blackout period that lasts for