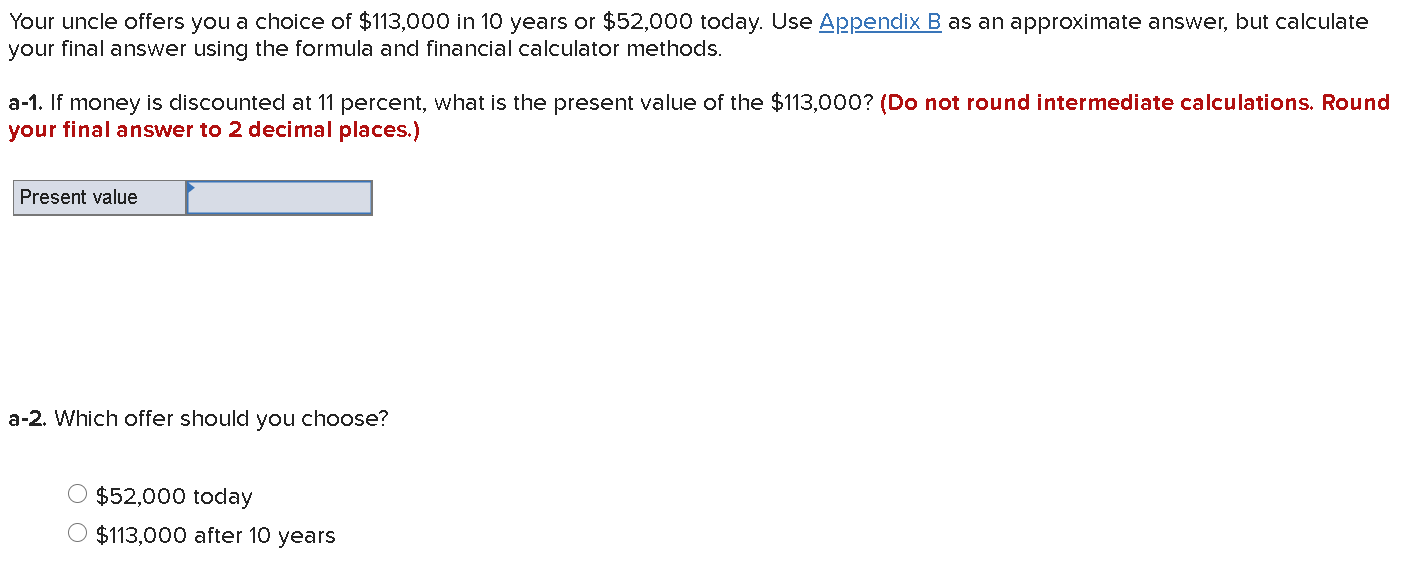

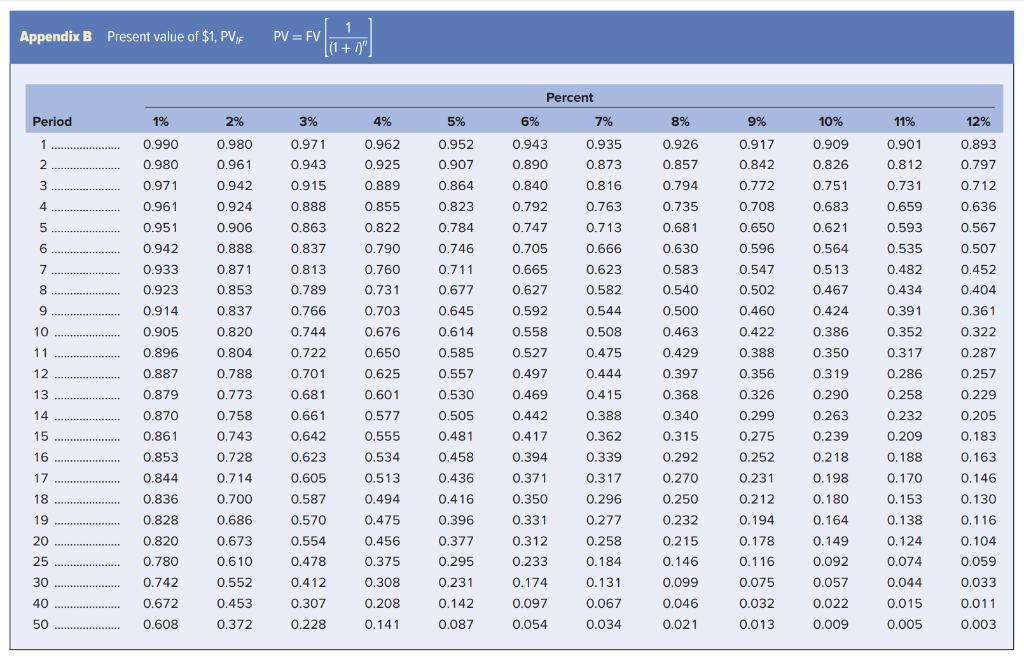

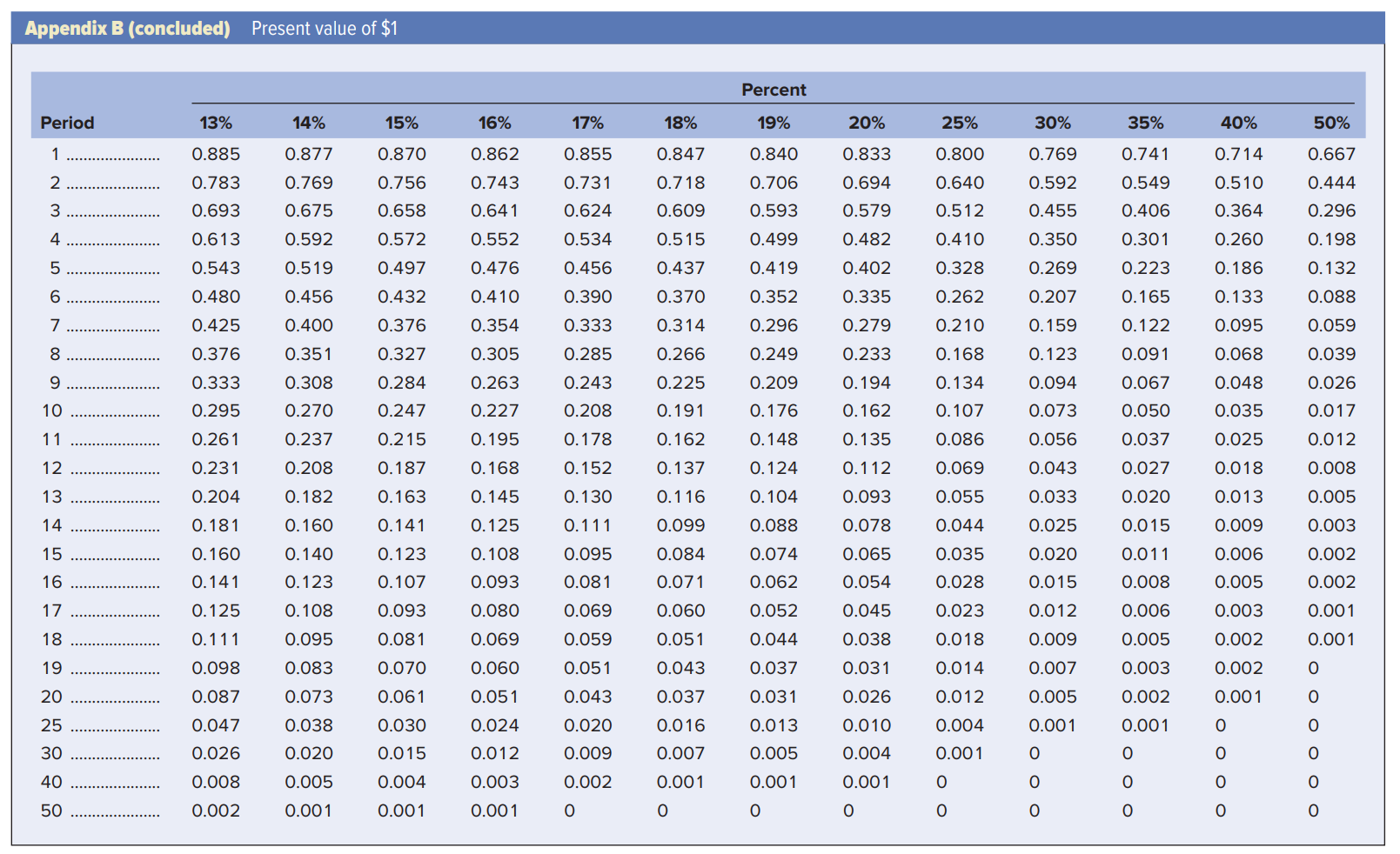

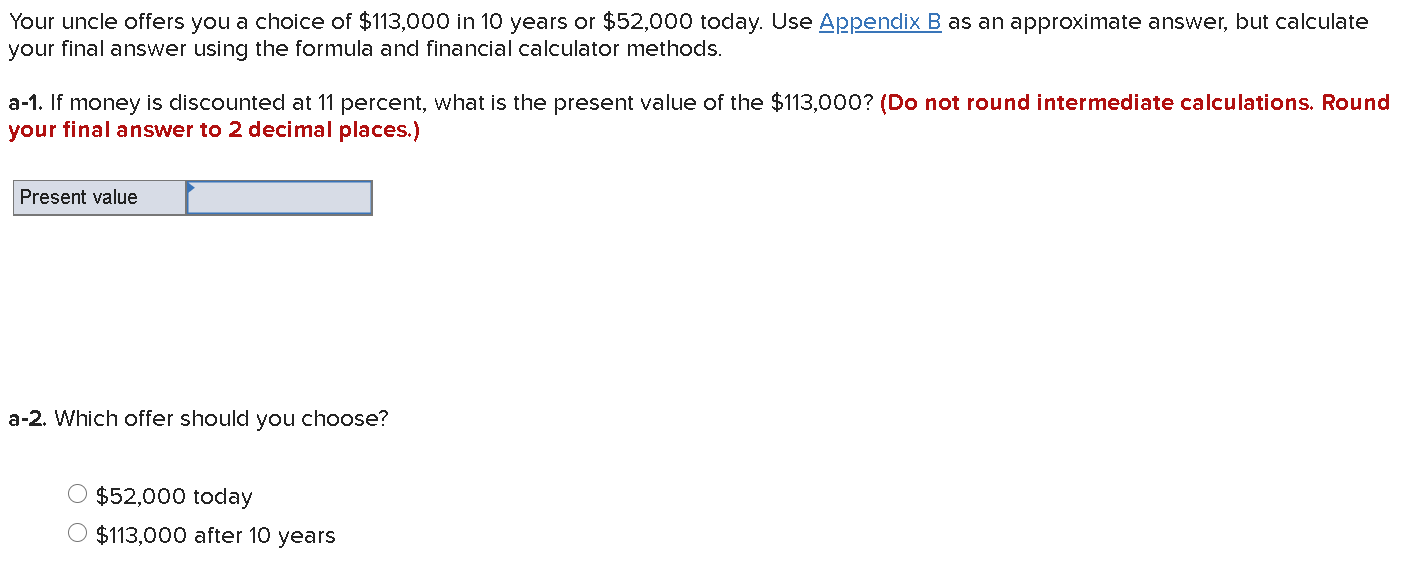

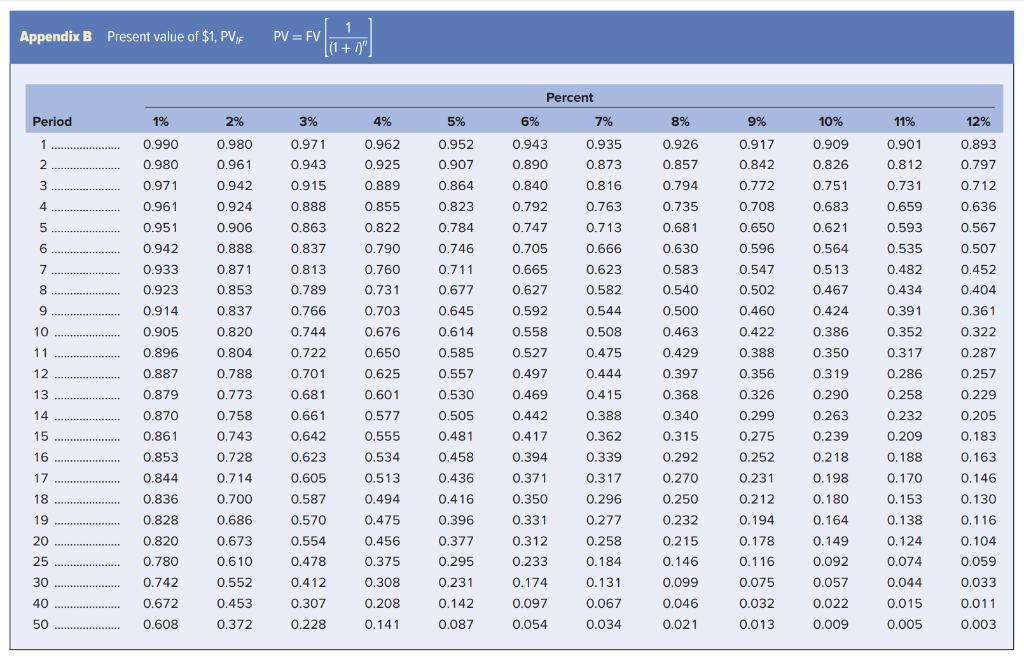

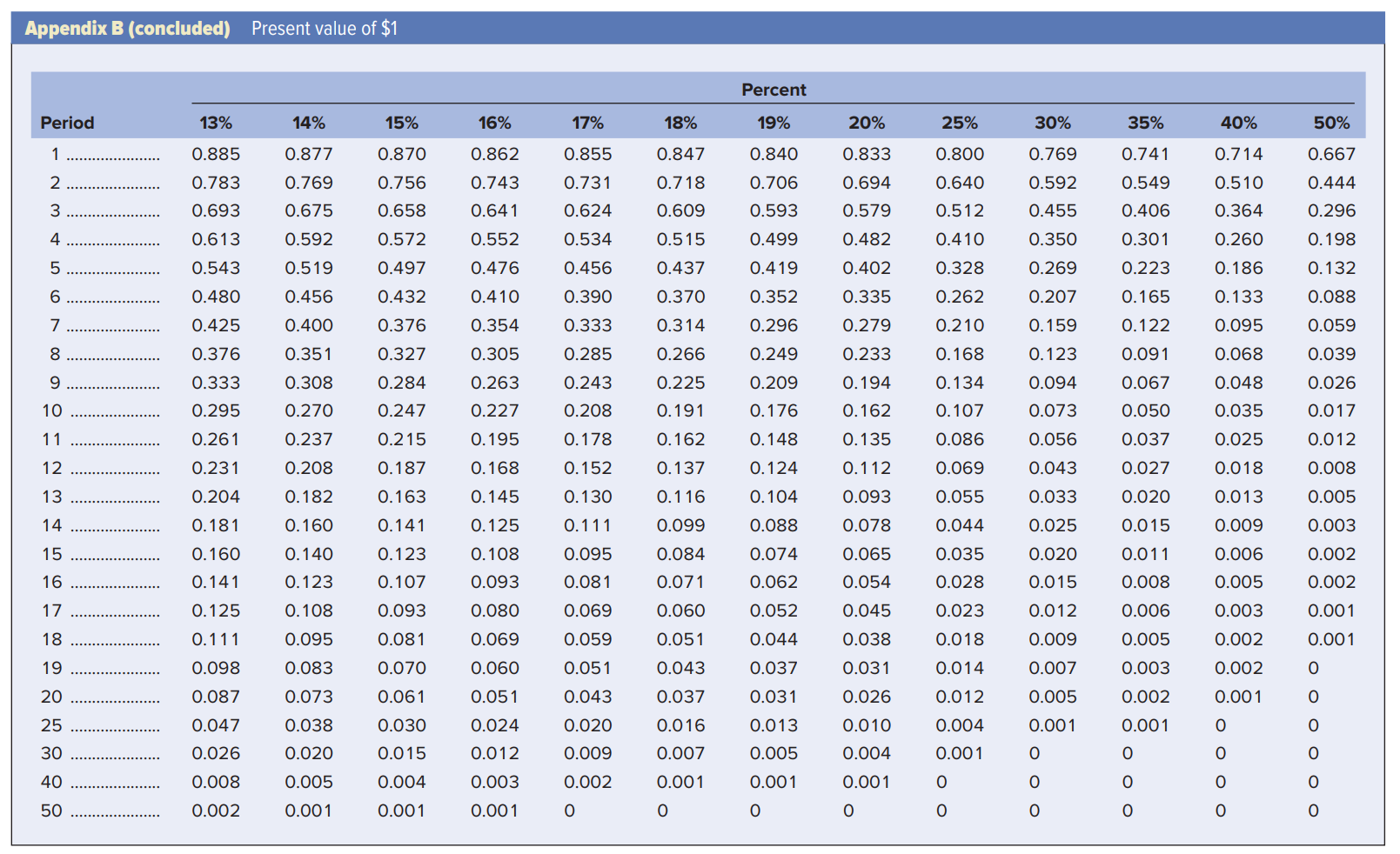

Your uncle offers you a choice of $113,000 in 10 years or $52,000 today. Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. If money is discounted at 11 percent, what is the present value of the $113,000? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value a-2. Which offer should you choose? O $52,000 today O $113,000 after 10 years 1 Appendix B Present value of $1, PVF PV = FV (1 + i)") Percent Period 2% 3% 4% 5% 6% 8% 9% 11% 12% 1 1% 0.990 0.980 0.943 0.890 0.980 0.961 0.942 0.924 0.962 0.925 0.889 2 0.952 0.907 0.864 7% 0.935 0.873 0.816 10% 0.909 0.826 0.971 0.943 0.915 0.888 0.863 0.926 0.857 0.794 0.901 0.812 0.731 0.659 0.893 0.797 0.712 3 0.840 0.971 0.961 0.751 4 0.855 0.823 0.763 0.683 0.636 0.735 0.681 5 0.951 0.822 0.784 0.713 0.621 0.593 0.567 6 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.837 0.630 0.564 0.507 0.746 0.711 0.792 0.747 0.705 0.665 0.627 0.592 0.906 0.888 0.871 0.853 0.837 0.820 7 0.942 0.933 0.923 0.914 0.905 0.813 0.789 0.766 8 0.583 0.540 0.666 0.623 0.582 0.544 0.508 0.535 0.482 0.434 0.391 0.677 0.513 0.467 0.424 0.386 0.452 0.404 0.361 9 0.645 0.500 0.463 10 0.744 0.614 0.558 0.352 0.322 11 0.896 0.722 0.475 0.429 0.350 12 0.804 0.788 0.773 0.887 0.879 0.397 0.585 0.557 0.530 0.701 0.681 0.661 0.527 0.497 0.469 0.442 0.444 0.415 0.388 0.356 0.326 0.319 0.290 0.317 0.286 0.258 0.287 0.257 0.229 13 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.368 14 0.870 0.299 0.232 0.505 0.481 15 0.417 0.275 16 0.861 0.853 0.844 0.836 0.828 0.642 0.623 0.605 0.587 0.263 0.239 0.218 0.198 17 0.388 0.362 0.339 0.317 0.296 0.394 0.371 0.350 0.458 0.436 0.416 0.396 0.377 0.340 0.315 0.292 0.270 0.250 0.232 0.215 18 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 0.180 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.209 0.188 0.170 0.153 0.138 0.124 0.074 19 0.252 0.231 0.212 0.194 0.178 0.116 0.075 20 0.570 0.554 0.478 0.331 0.312 0.233 0.820 0.780 0.742 0.277 0.258 0.184 0.164 0.149 0.092 25 0.146 0.295 0.231 30 0.412 0.131 0.099 0.057 0.044 0.033 0.308 0.208 0.174 0.097 40 0.307 0.046 0.032 0.011 0.672 0.608 0.142 0.087 0.067 0.034 0.022 0.009 0.015 0.005 50 0.228 0.141 0.054 0.021 0.013 0.003 Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.800 0.769 0.714 2 0.783 0.756 0.743 0.731 0.718 0.706 0.640 0.592 0.769 0.675 0.694 0.579 0.741 0.549 0.406 0.510 0.364 0.667 0.444 0.296 3 0.693 0.658 0.641 0.624 0.609 0.593 0.512 0.455 4 0.613 0.592 0.552 0.534 0.410 0.350 0.301 0.260 0.198 0.572 0.497 0.515 0.437 5 0.543 0.519 0.476 0.499 0.419 0.352 0.482 0.402 0.335 0.328 0.269 0.186 0.132 0.223 0.165 6 0.456 0.390 0.333 0.480 0.410 0.370 0.262 0.133 0.432 0.376 .088 0.207 0.159 7 0.425 0.354 0.314 0.279 0.210 0.095 0.296 0.249 0.456 0.400 0.351 0.308 0.270 0.059 0.039 8 0.376 0.327 0.285 0.266 0.123 0.068 9 0.284 0.333 0.295 0.305 0.263 0.227 0.243 0.208 0.209 0.176 0.233 0.194 0.162 0.135 0.094 0.073 .048 0.035 10 0.168 0.134 0.107 0.086 0.069 0.225 0.191 0.162 0.137 0.247 0.026 .017 0.012 0.008 11 0.215 0.195 0.148 0.056 0.025 0.261 0.231 0.237 0.208 0.122 0.091 0.067 .050 0.037 0.027 0.020 0.015 .011 0.008 0.178 0.152 12 0.187 0.168 0.112 0.043 0.018 0.124 0.104 13 0.204 0.182 0.145 0.130 0.093 0.055 0.033 .013 0.005 14 0.078 0.181 0.160 0.141 0.163 0.141 0.123 0.107 0.160 0.140 0.123 15 0.125 0.108 0.093 0.1 16 0.099 0.084 .071 0.111 0.095 0.081 0.088 0.074 0.062 0.025 0.020 0.065 0.054 0.044 0.035 0.028 .023 0.009 0.006 0.005 16 0.015 0.003 0.002 0.002 0.001 .001 17 0.125 0.108 .093 0.080 0.069 .060 .052 0.012 .006 0.003 0.045 0.038 18 0.111 0.095 0.069 .059 .018 0.009 .005 .081 0.070 .051 0.043 0.002 0.002 19 .098 0.060 0.044 0.037 0.031 0.014 0.007 0.083 .073 .003 .051 .043 0.031 0.026 20 .061 .037 0.012 0.005 0.002 0.00 1 0.087 0.047 0.051 0.024 25 0.038 .030 0.013 0.001 0.001 .020 0.009 0.004 0.001 30 0.020 .015 0.016 .007 0.001 0.012 0.010 0.004 0.001 0.026 0.008 0.005 40 0.005 0.004 0.003 0.002 0.001 50 0.002 0.001 0.001 0.001