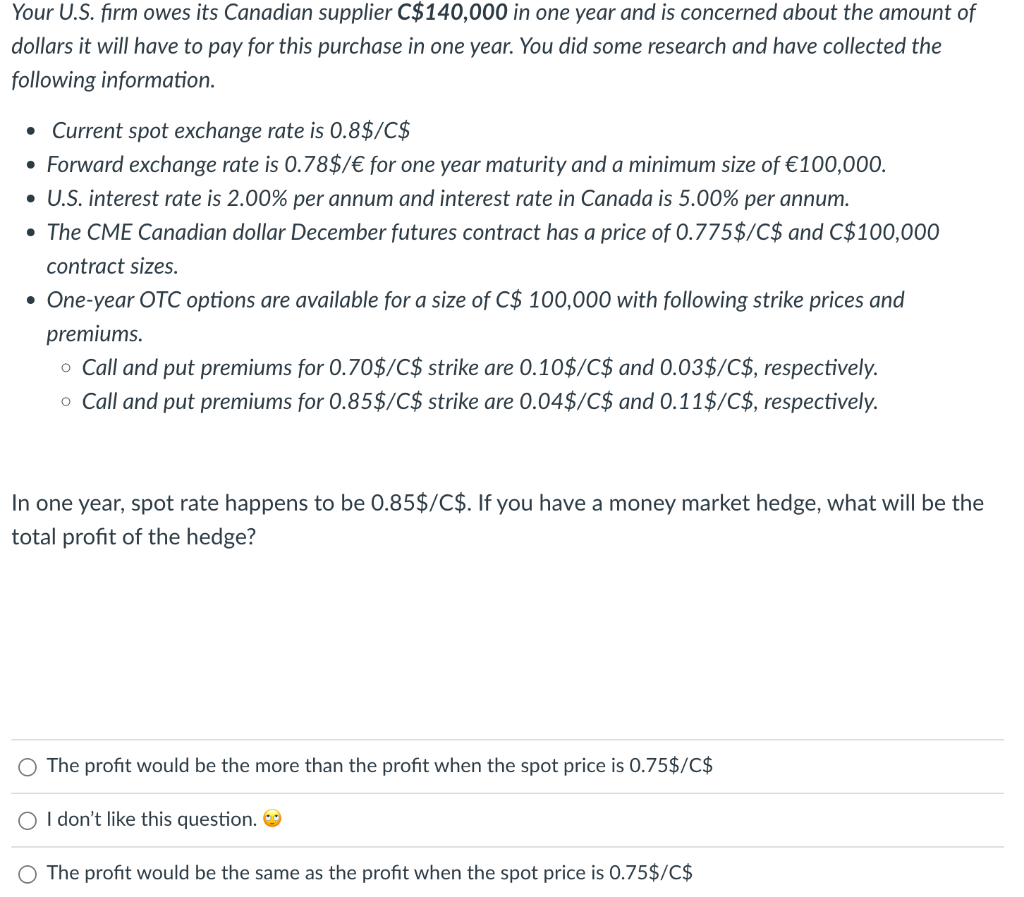

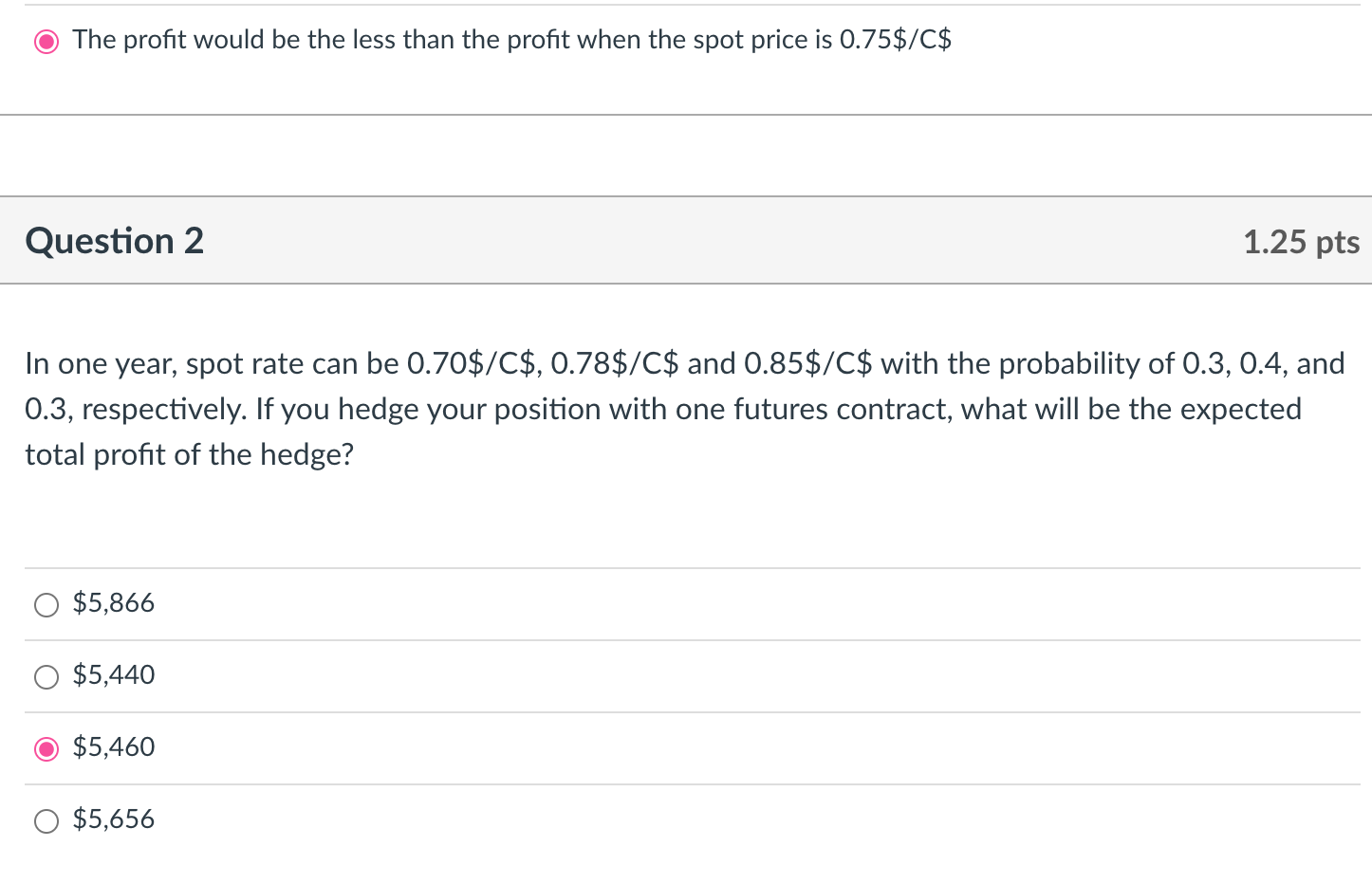

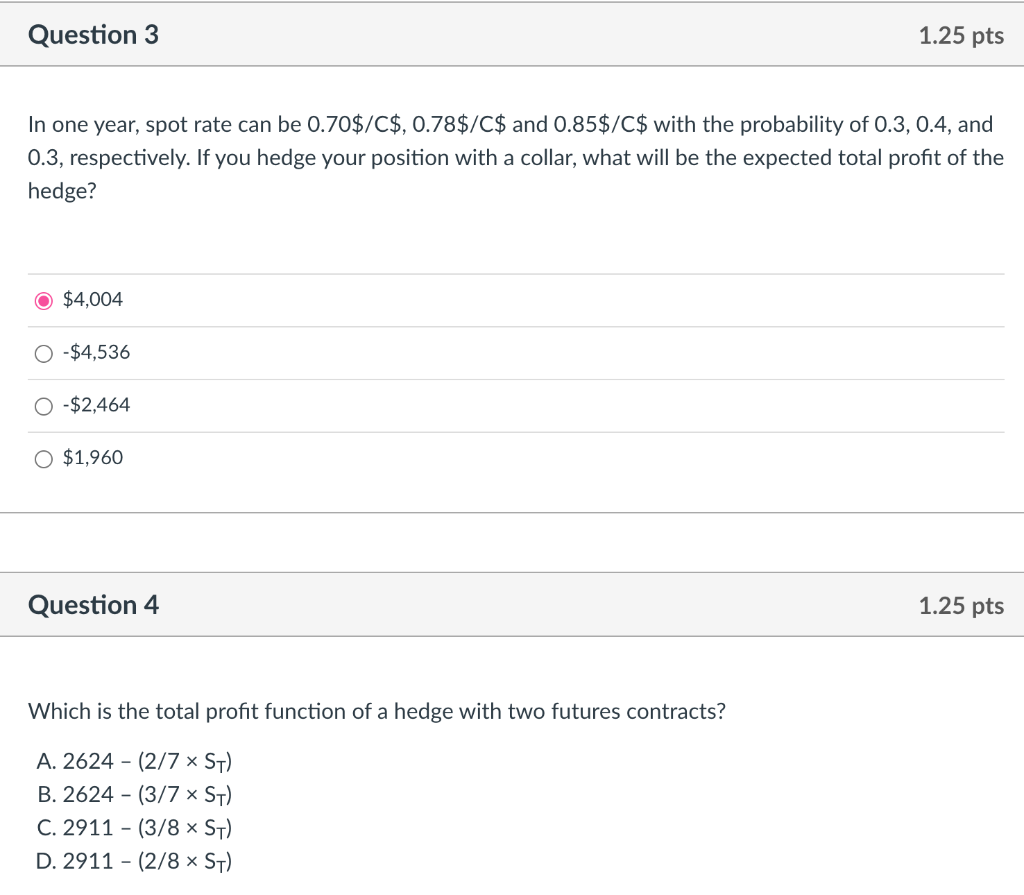

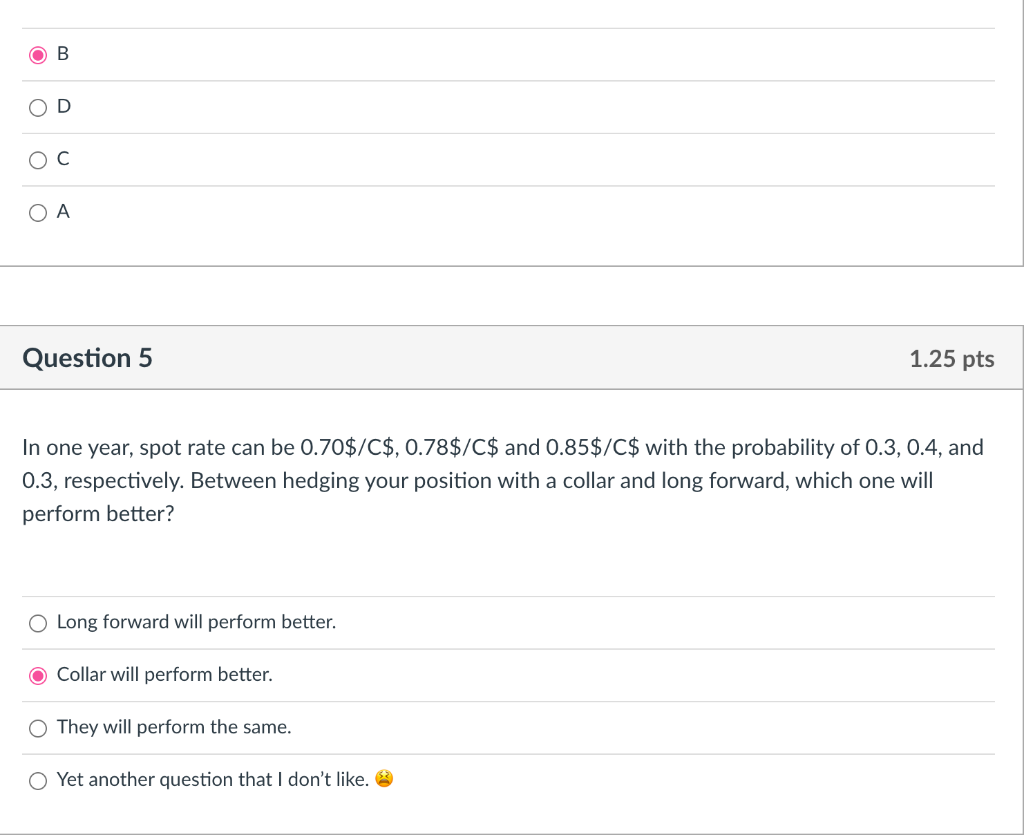

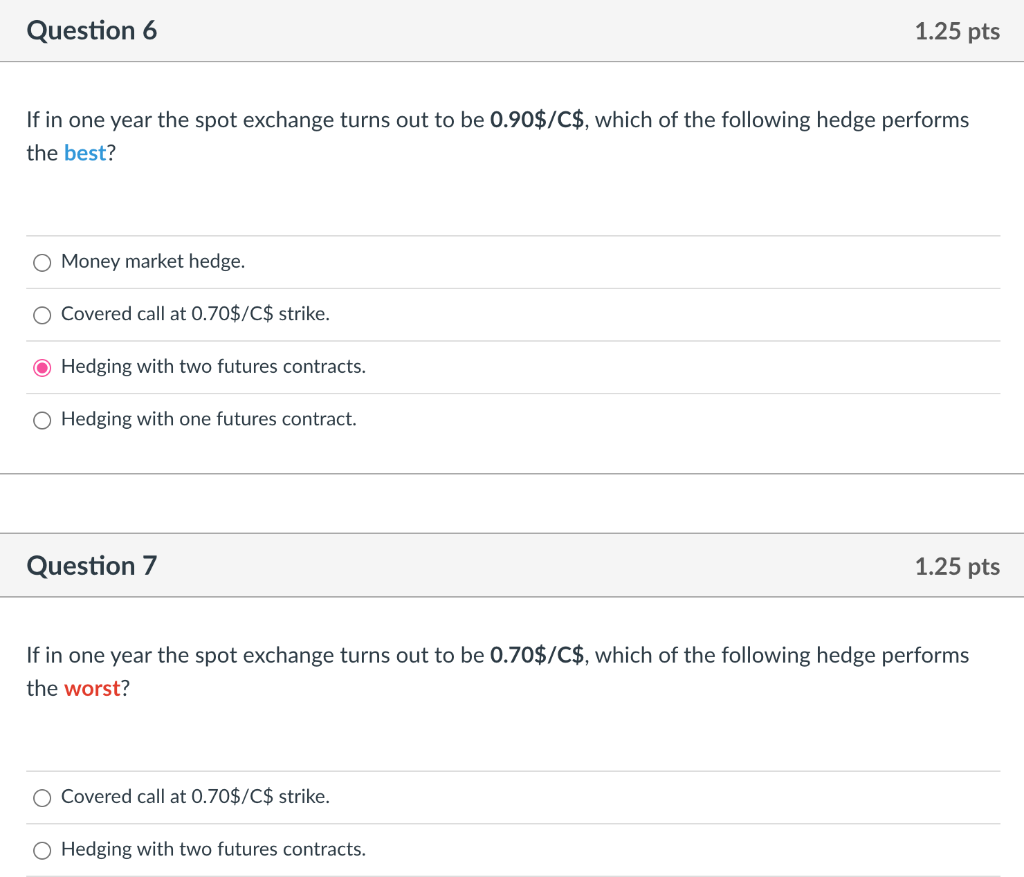

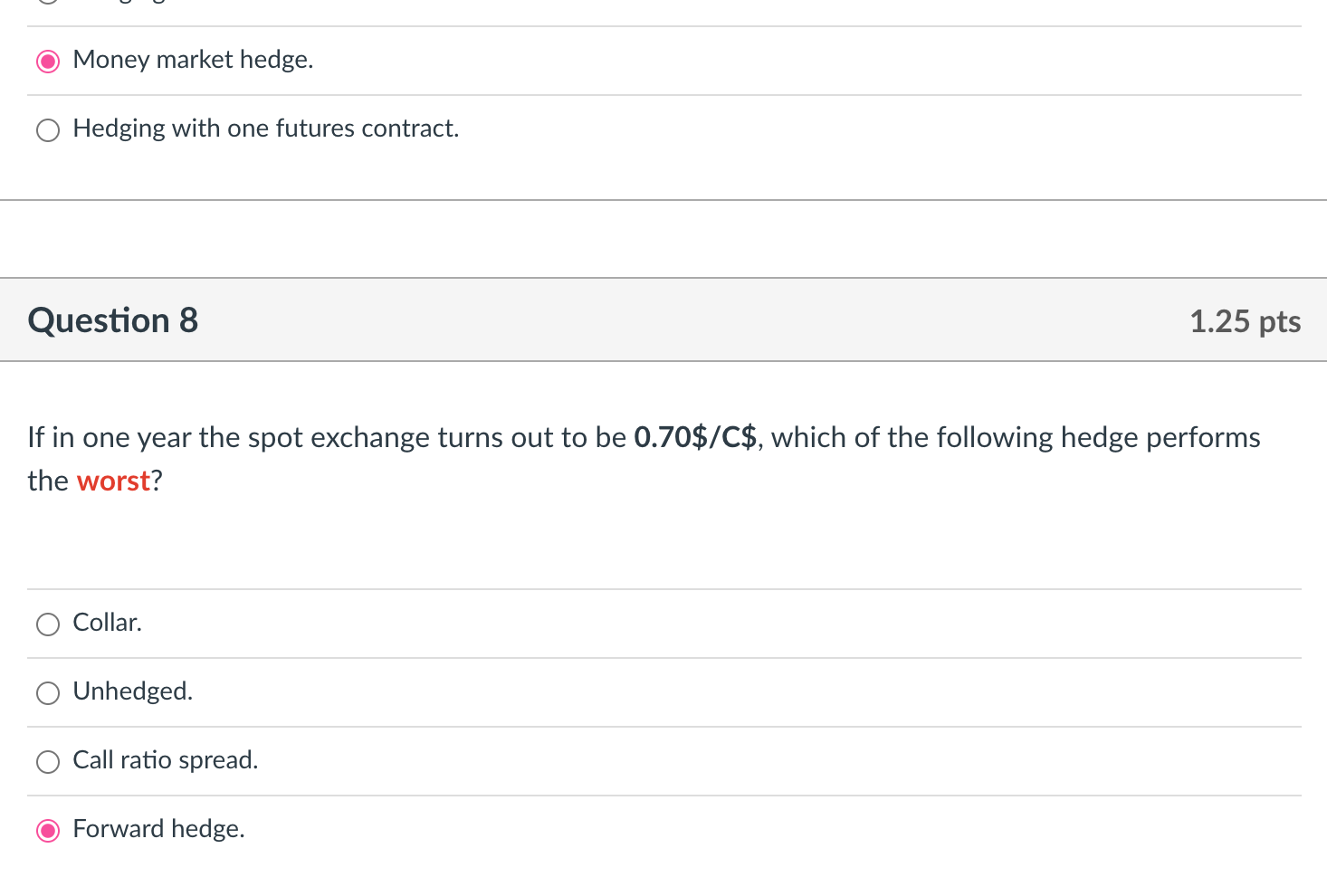

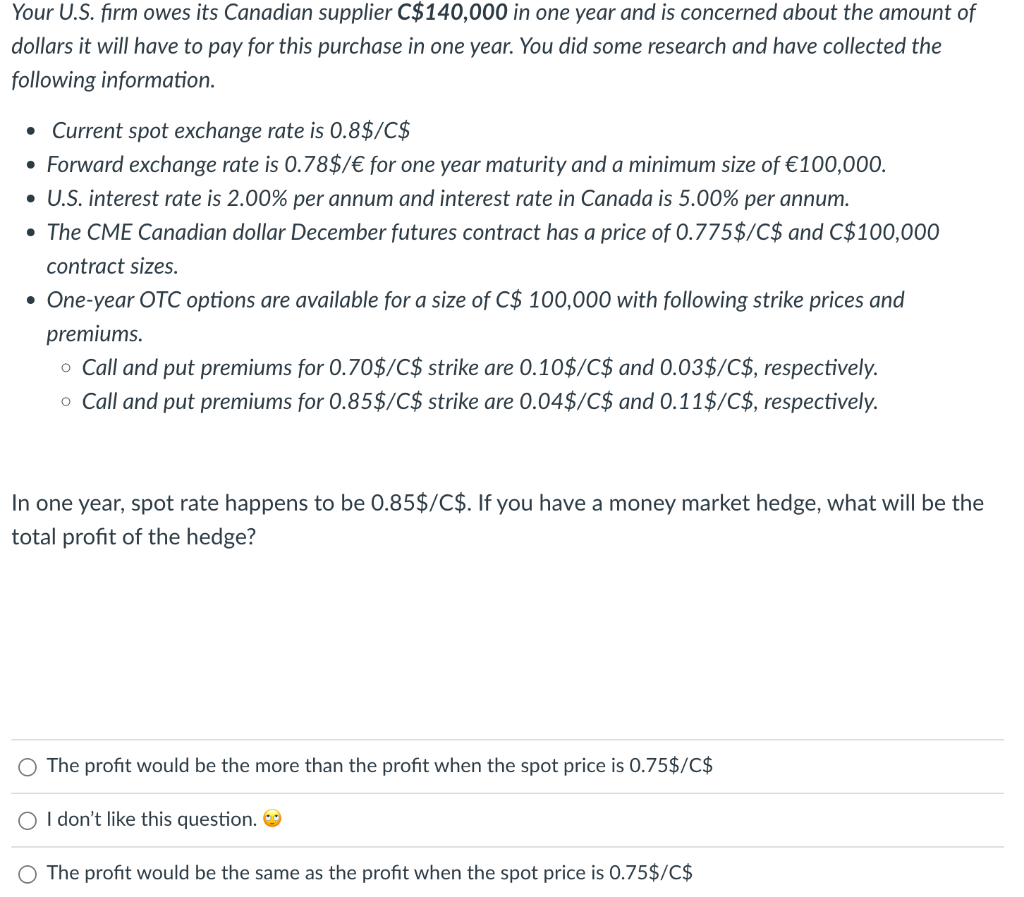

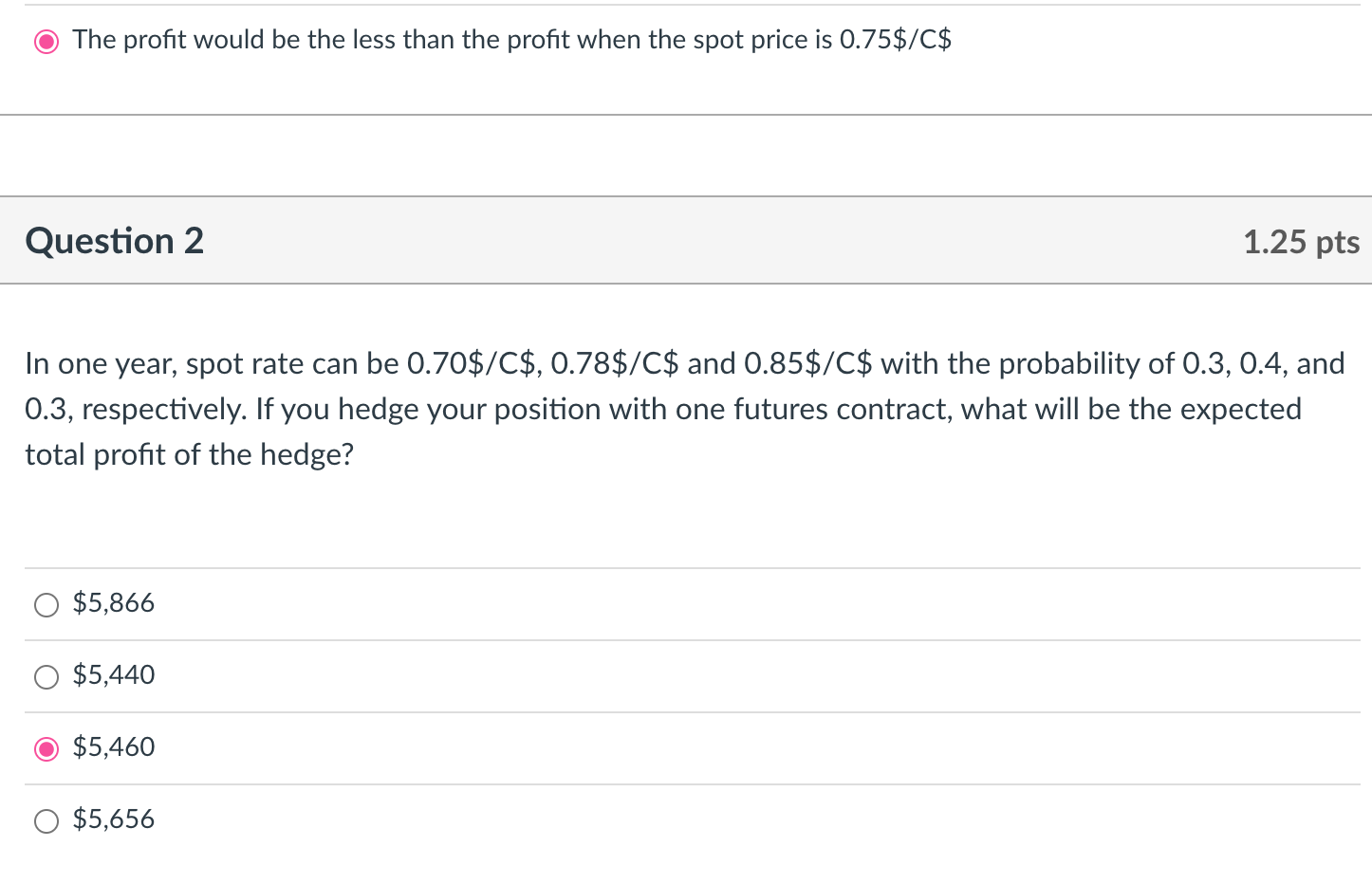

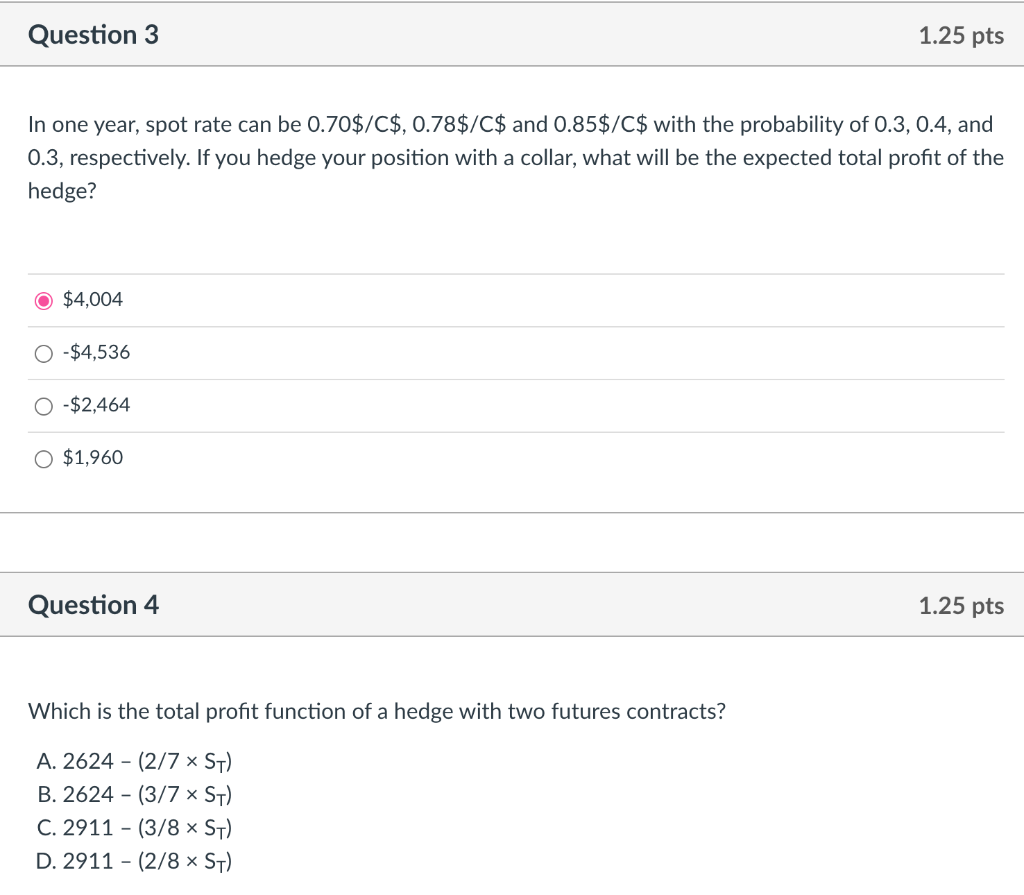

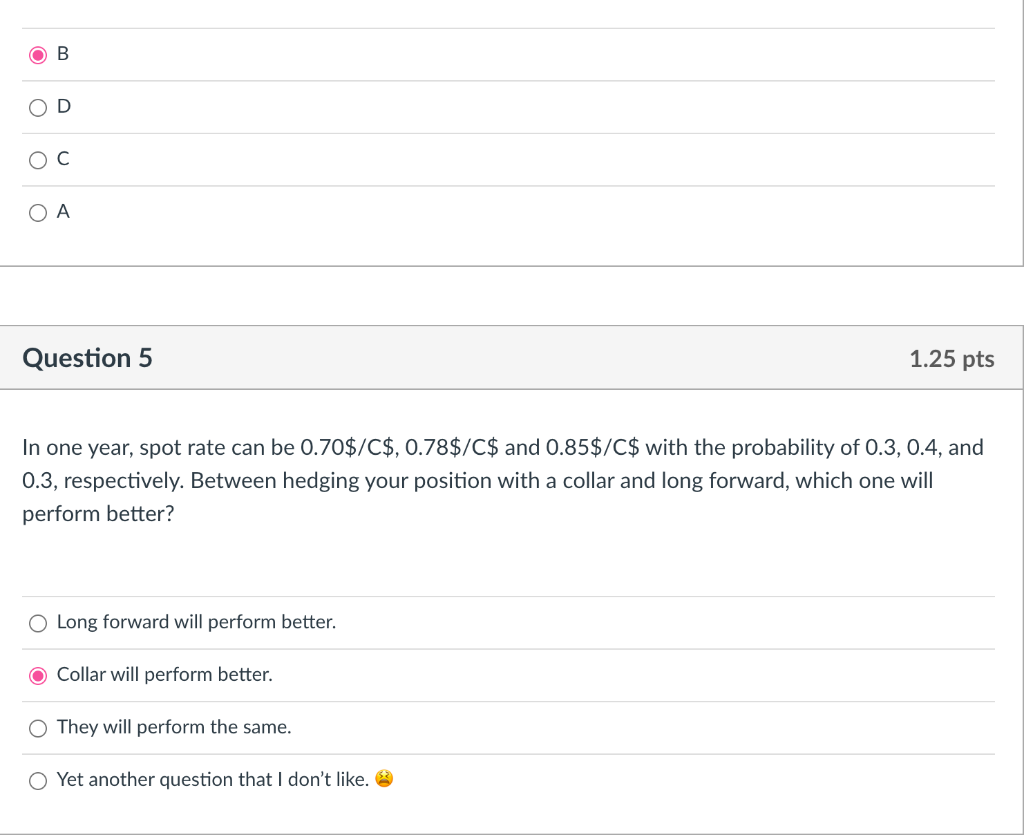

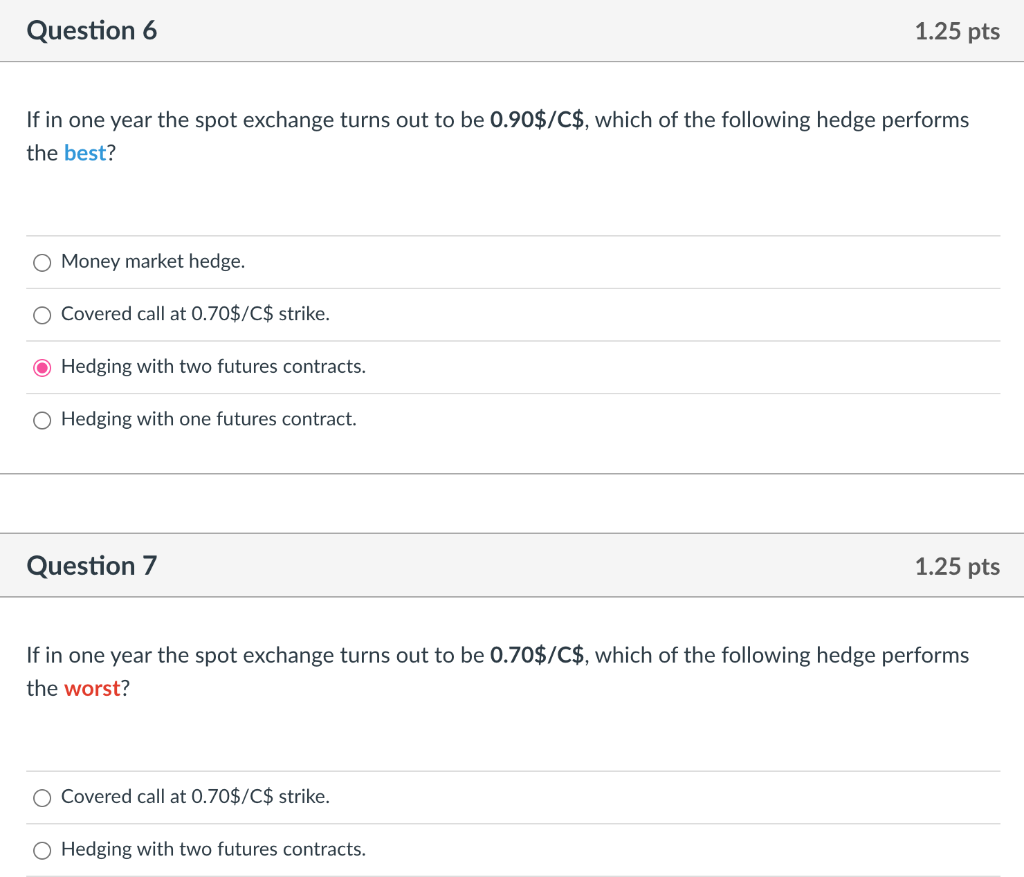

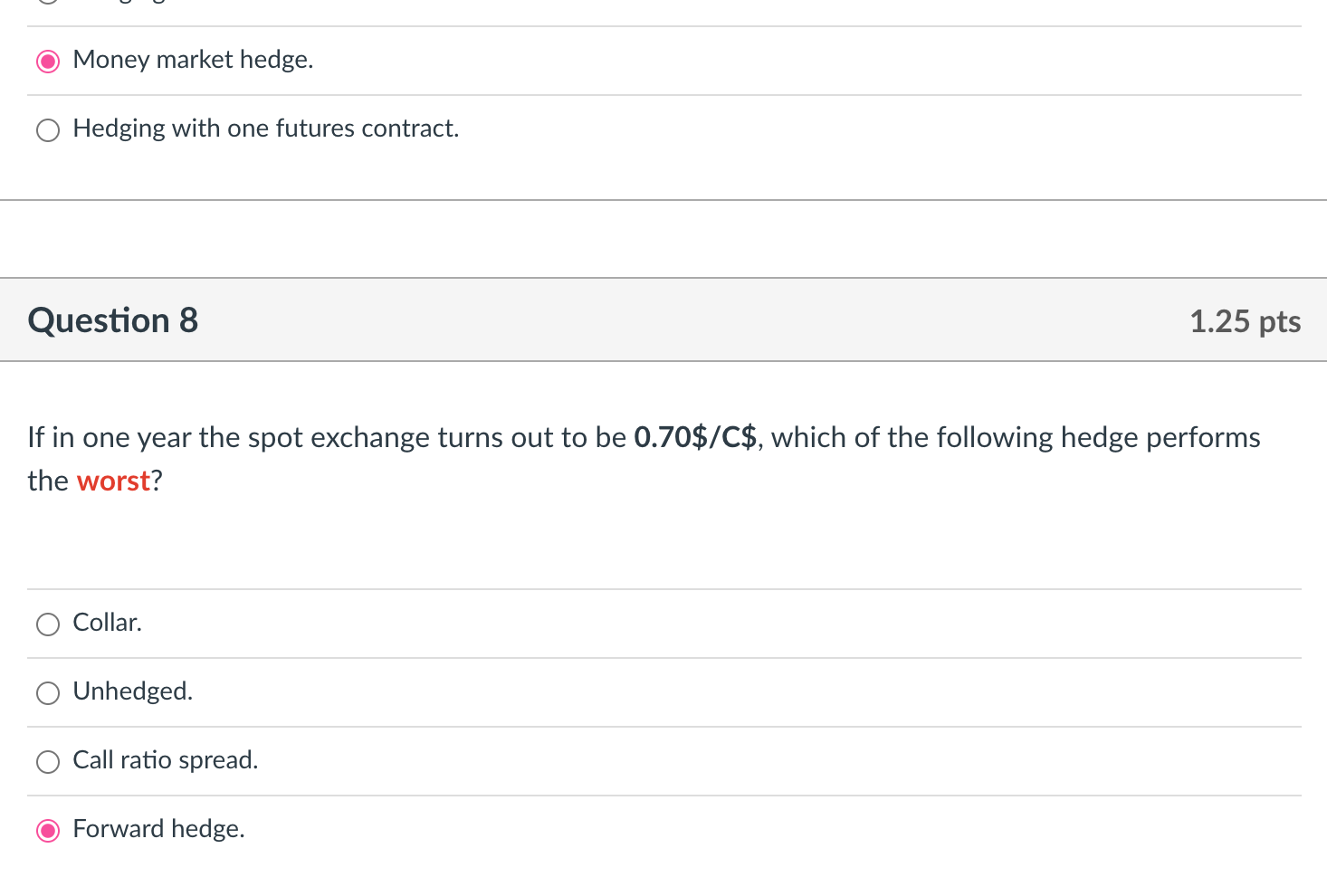

Your U.S. firm owes its Canadian supplier C$140,000 in one year and is concerned about the amount of dollars it will have to pay for this purchase in one year. You did some research and have collected the following information. . Current spot exchange rate is 0.8$/C$ Forward exchange rate is 0.78$/ for one year maturity and a minimum size of 100,000. U.S. interest rate is 2.00% per annum and interest rate in Canada is 5.00% per annum. The CME Canadian dollar December futures contract has a price of 0.775$/C$ and C$100,000 contract sizes. One-year OTC options are available for a size of C$ 100,000 with following strike prices and premiums. o Call and put premiums for 0.70$/C$ strike are 0.10$/C$ and 0.03$/C$, respectively. o Call and put premiums for 0.85$/C$ strike are 0.04$/C$ and 0.11$/C$, respectively. . In one year, spot rate happens to be 0.85$/C$. If you have a money market hedge, what will be the total profit of the hedge? O The profit would be the more than the profit when the spot price is 0.75$/C$ O I don't like this question. O The profit would be the same as the profit when the spot price is 0.75$/C$ The profit would be the less than the profit when the spot price is 0.75$/C$ Question 2 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. If you hedge your position with one futures contract, what will be the expected total profit of the hedge? $5,866 $5,440 $5,460 $5,656 Question 3 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. If you hedge your position with a collar, what will be the expected total profit of the hedge? $4,004 0-$4,536 0 - $2,464 O $1,960 Question 4 1.25 pts Which is the total profit function of a hedge with two futures contracts? A. 2624 - (2/7 ~ ST) B. 2624 - (3/7 ~ ST) C. 2911 - (3/8 ~ ST) D. 2911 - (2/8 ~ ST) B OD OA Question 5 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. Between hedging your position with a collar and long forward, which one will perform better? O Long forward will perform better. Collar will perform better. O They will perform the same. Yet another question that I don't like. * Question 6 1.25 pts If in one year the spot exchange turns out to be 0.90$/C$, which of the following hedge performs the best? O Money market hedge. O Covered call at 0.70$/C$ strike. O Hedging with two futures contracts. O Hedging with one futures contract. Question 7 1.25 pts If in one year the spot exchange turns out to be 0.70$/C$, which of the following hedge performs the worst? O Covered call at 0.70$/C$ strike. O Hedging with two futures contracts. Money market hedge. Hedging with one futures contract. Question 8 1.25 pts If in one year the spot exchange turns out to be 0.70$/C$, which of the following hedge performs the worst? Collar. Unhedged. Call ratio spread. Forward hedge. Your U.S. firm owes its Canadian supplier C$140,000 in one year and is concerned about the amount of dollars it will have to pay for this purchase in one year. You did some research and have collected the following information. . Current spot exchange rate is 0.8$/C$ Forward exchange rate is 0.78$/ for one year maturity and a minimum size of 100,000. U.S. interest rate is 2.00% per annum and interest rate in Canada is 5.00% per annum. The CME Canadian dollar December futures contract has a price of 0.775$/C$ and C$100,000 contract sizes. One-year OTC options are available for a size of C$ 100,000 with following strike prices and premiums. o Call and put premiums for 0.70$/C$ strike are 0.10$/C$ and 0.03$/C$, respectively. o Call and put premiums for 0.85$/C$ strike are 0.04$/C$ and 0.11$/C$, respectively. . In one year, spot rate happens to be 0.85$/C$. If you have a money market hedge, what will be the total profit of the hedge? O The profit would be the more than the profit when the spot price is 0.75$/C$ O I don't like this question. O The profit would be the same as the profit when the spot price is 0.75$/C$ The profit would be the less than the profit when the spot price is 0.75$/C$ Question 2 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. If you hedge your position with one futures contract, what will be the expected total profit of the hedge? $5,866 $5,440 $5,460 $5,656 Question 3 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. If you hedge your position with a collar, what will be the expected total profit of the hedge? $4,004 0-$4,536 0 - $2,464 O $1,960 Question 4 1.25 pts Which is the total profit function of a hedge with two futures contracts? A. 2624 - (2/7 ~ ST) B. 2624 - (3/7 ~ ST) C. 2911 - (3/8 ~ ST) D. 2911 - (2/8 ~ ST) B OD OA Question 5 1.25 pts In one year, spot rate can be 0.70$/C$, 0.78$/C$ and 0.85$/C$ with the probability of 0.3, 0.4, and 0.3, respectively. Between hedging your position with a collar and long forward, which one will perform better? O Long forward will perform better. Collar will perform better. O They will perform the same. Yet another question that I don't like. * Question 6 1.25 pts If in one year the spot exchange turns out to be 0.90$/C$, which of the following hedge performs the best? O Money market hedge. O Covered call at 0.70$/C$ strike. O Hedging with two futures contracts. O Hedging with one futures contract. Question 7 1.25 pts If in one year the spot exchange turns out to be 0.70$/C$, which of the following hedge performs the worst? O Covered call at 0.70$/C$ strike. O Hedging with two futures contracts. Money market hedge. Hedging with one futures contract. Question 8 1.25 pts If in one year the spot exchange turns out to be 0.70$/C$, which of the following hedge performs the worst? Collar. Unhedged. Call ratio spread. Forward hedge