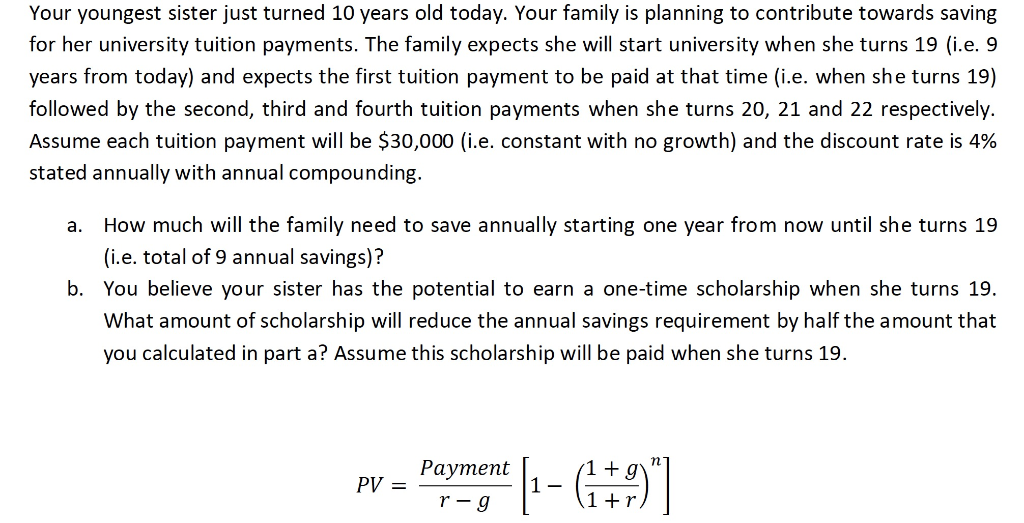

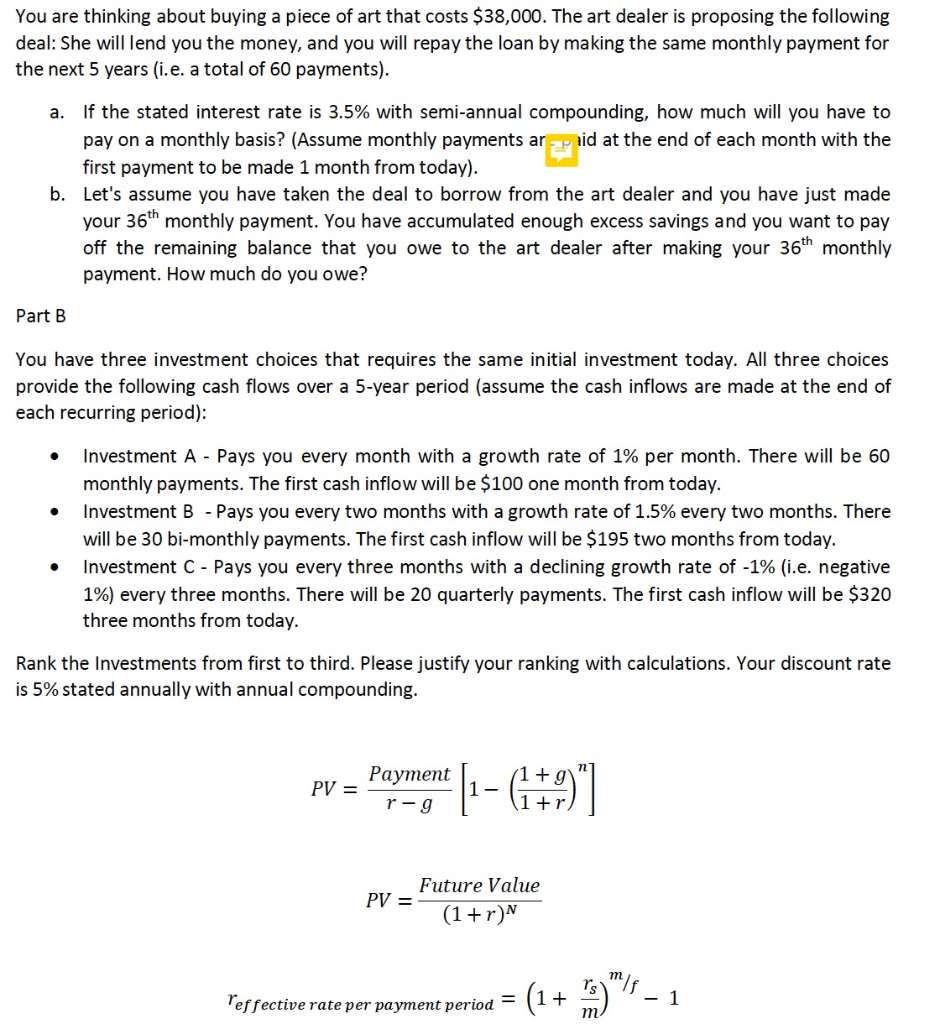

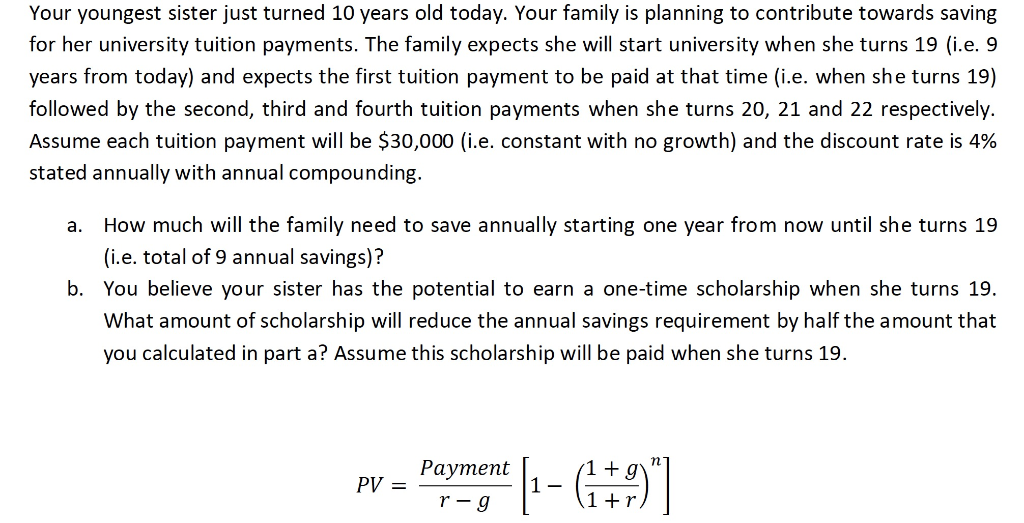

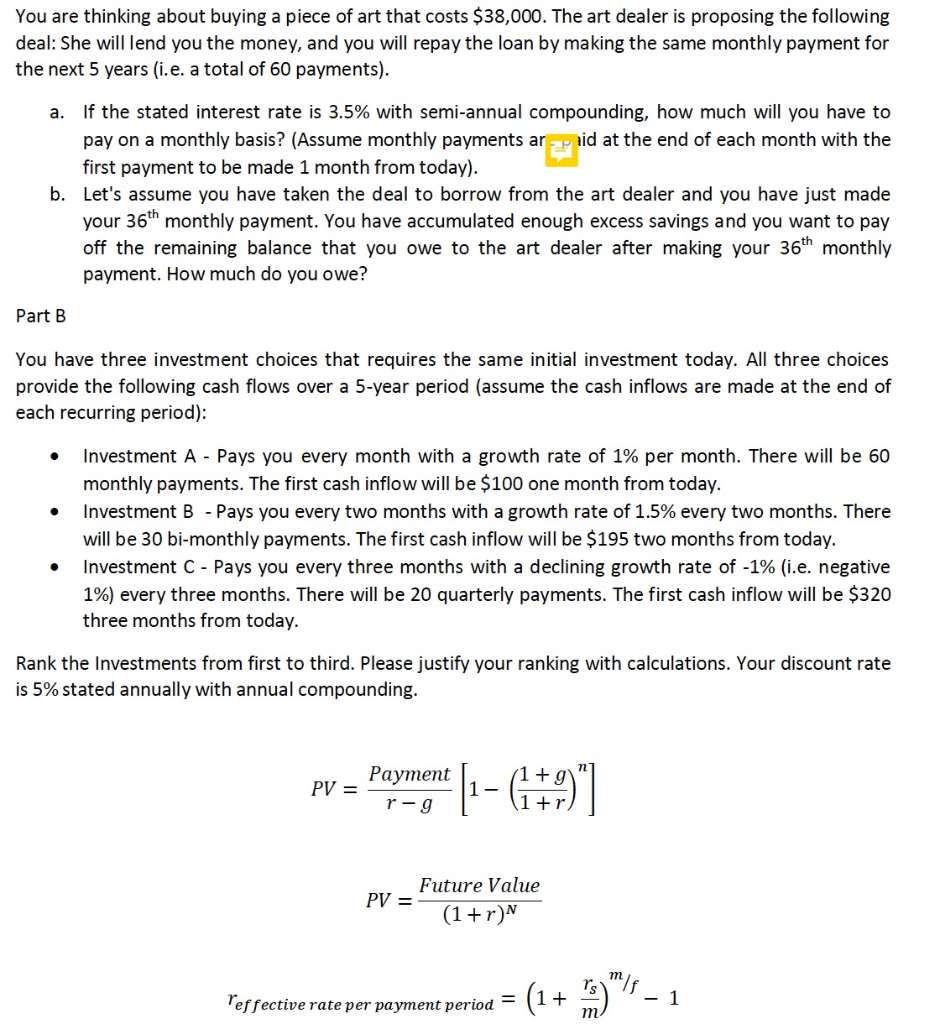

Your youngest sister just turned 10 years old today. Your family is planning to contribute towards saving for her university tuition payments. The family expects she will start university when she turns 19 (i.e. 9 years from today) and expects the first tuition payment to be paid at that time (i.e. when she turns 19) followed by the second, third and fourth tuition payments when she turns 20, 21 and 22 respectively. Assume each tuition payment will be $30,000 (i.e. constant with no growth) and the discount rate is 4% stated annually with annual compounding. a. How much will the family need to save annually starting one year from now until she turns 19 (i.e. total of 9 annual savings)? b. You believe your sister has the potential to earn a one-time scholarship when she turns 19. What amount of scholarship will reduce the annual savings requirement by half the amount that you calculated in part a? Assume this scholarship will be paid when she turns 19. PV = Payment P- + g 1+r You are thinking about buying a piece of art that costs $38,000. The art dealer is proposing the following deal: She will lend you the money, and you will repay the loan by making the same monthly payment for the next 5 years (i.e. a total of 60 payments). a. If the stated interest rate is 3.5% with semi-annual compounding, how much will you have to pay on a monthly basis? (Assume monthly payments ar paid at the end of each month with the first payment to be made 1 month from today). b. Let's assume you have taken the deal to borrow from the art dealer and you have just made your 36th monthly payment. You have accumulated enough excess savings and you want to pay off the remaining balance that you owe to the art dealer after making your 36th monthly payment. How much do you owe? Part B You have three investment choices that requires the same initial investment today. All three choices provide the following cash flows over a 5-year period (assume the cash inflows are made at the end of each recurring period): Investment A - Pays you every month with a growth rate of 1% per month. There will be 60 monthly payments. The first cash inflow will be $100 one month from today. Investment B - Pays you every two months with a growth rate of 1.5% every two months. There will be 30 bi-monthly payments. The first cash inflow will be $195 two months from today. Investment C - Pays you every three months with a declining growth rate of -1% (i.e. negative 1%) every three months. There will be 20 quarterly payments. The first cash inflow will be $320 three months from today. Rank the Investments from first to third. Please justify your ranking with calculations. Your discount rate is 5% stated annually with annual compounding. PV = Payment r-9 [1-679" PV = Future Value (1+r)^ mes Perfective rate per payment period = (1 + ) - 1 The UTM Investment Co. needs some help understanding the intricacies of bond pricing. It has observed the following prices today for zero coupon bonds: Maturity Price per $100 Face Value 1 year 99 2 years 97.50 3 years 96 a. How much should UTM Investment Co. be willing to pay for a three-year bond (face value of $1,000) that pays a 4-percent coupon, assuming annual coupon payments start one year from now? b. Suppose UTM Investment Co. purchases this coupon bond and then un-bundles it into its four component cash flows: three coupon payments and the par value amount. At what price(s) can the company resell each of the first three cash flows (the coupon payments) today? c. The remaining cash flow (the face value amount) is a "synthetic three-year, zero-coupon bond. How much must this strip bond" be sold for if UTM Investment Co. is to break even on the investment? d. What is the yield to maturity on the synthetic three-year, zero-coupon bond? e. What are the 1-year, 2-year and 3-year spot rates? f. What is the forward rate in the 2nd year? What is the forward rate in the 3rd year? What do these forward rates tell us about future interest rates and/or liquidity premiums? PV = Payment r-9 ne |-- 6+2)" Future Value PV = (1+r)N (1 + in)" (1+fm) = (1 + in+1)n+1