Question

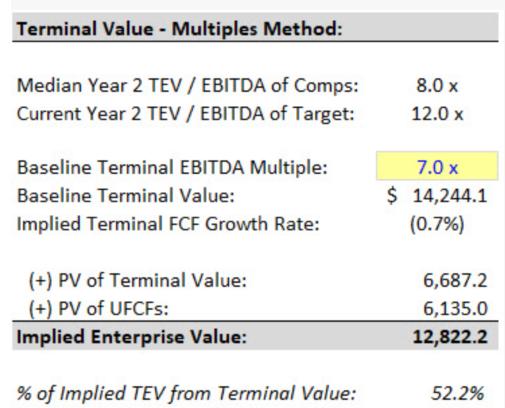

You're now completing a DCF for a similar steel manufacturing company based in the U.S., and you've calculated its Terminal Value based on the Multiples

You're now completing a DCF for a similar steel manufacturing company based in the U.S., and you've calculated its Terminal Value based on the Multiples Method, as shown below:

Terminal EBITDA Multiple: 7.0 x Baseline Terminal Value: $ 14,244.1 Implied Terminal FCF Growth Rate: (0.7%) (+) PV of Terminal Value: 6,687.2

(+) PV of UFCFs: 6,135.0 Implied Enterprise Value: 12,822.2 of Implied TEV from Terminal Value: 52.2%

This company operates in a highly cyclical industry, and its EBITDA multiples have fluctuated between 6x and 12x historically. Expected long-term GDP growth is in the 2-3% range.

Based on this description and the numbers above, would you recommend adjusting these baseline assumptions? If so, why? If not, why not?

A

No - the PV of the Terminal Value contributes a reasonable percentage to the Implied Enterprise Value, and the Implied Terminal FCF Growth Rate is below the expected long-term GDP growth rate, as it should be.

B

No - the PV of the Terminal Value contributes a reasonable percentage to the Implied Enterprise Value, and for highly cyclical companies like this one, it's best to assume that long-term FCF growth is negative, with a Terminal Multiple near the bottom of the historical trading range.

C

Yes - even if the company is in a cyclical industry, long-term FCF growth is unlikely to be *negative*, and the Terminal Multiple is too low relative to the EBITDA multiple of the comparable companies and the company's current multiple.

D

Yes - the PV of the Terminal Value should contribute well above 50% of the Implied Enterprise Value, and the baseline Terminal Multiple should generally be *above* the comparable companies' median multiple.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started