Answered step by step

Verified Expert Solution

Question

1 Approved Answer

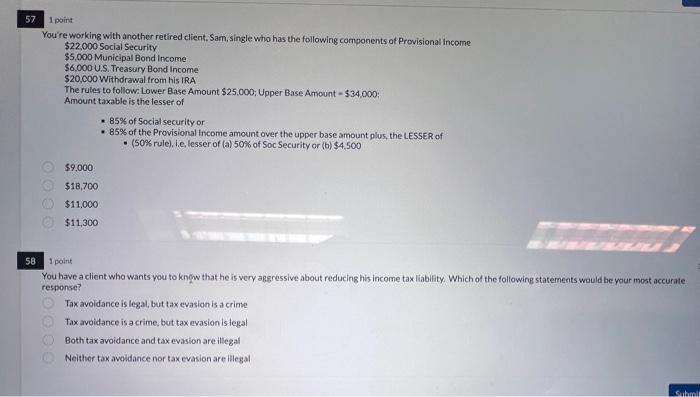

You're working with another retired client, Sam, single who has the following components of Provisional Income $22,000 Social Security $5,000 Municipal Bond Income $6,000 U.S.

You're working with another retired client, Sam, single who has the following components of Provisional Income $22,000 Social Security $5,000 Municipal Bond Income $6,000 U.S. Treasury Bond Income $20,000 Withdrawal from his IRA The rules to follow: Lower Base Amount $25,000; Upper Base Amount = $34,000: Amount taxable is the lesser of $9,000 $18,700 $11,000 $11,300 85% of Social security or 85% of the Provisional Income amount over the upper base amount plus, the LESSER of (50% rule), i.e, lesser of (a) 50% of Soc Security or (b) $4,500 L 1 point You have a client who wants you to know that he is very aggressive about reducing his income tax liability. Which of the following statements would be your most accurate response? Tax avoidance is legal, but tax evasion is a crime Tax avoidance is a crime, but tax evasion is legal Both tax avoidance and tax evasion are illegal Neither tax avoidance nor tax evasion are illegal Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started