Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You've been asked to review the loan request for a customer who wants to purchase a home You've noticed that they are requesting a

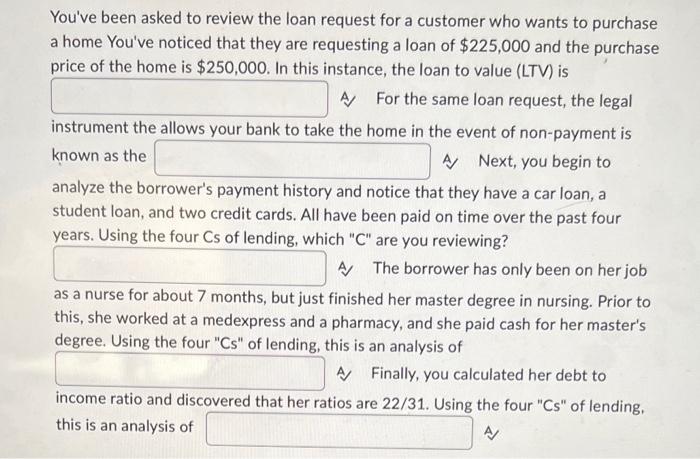

You've been asked to review the loan request for a customer who wants to purchase a home You've noticed that they are requesting a loan of $225,000 and the purchase price of the home is $250,000. In this instance, the loan to value (LTV) is A For the same loan request, the legal instrument the allows your bank to take the home in the event of non-payment is known as the A Next, you begin to analyze the borrower's payment history and notice that they have a car loan, a student loan, and two credit cards. All have been paid on time over the past four years. Using the four Cs of lending, which "C" are you reviewing? A The borrower has only been on her job as a nurse for about 7 months, but just finished her master degree in nursing. Prior to this, she worked at a medexpress and a pharmacy, and she paid cash for her master's degree. Using the four "Cs" of lending, this is an analysis of A Finally, you calculated her debt to income ratio and discovered that her ratios are 22/31. Using the four "Cs" of lending, this is an analysis of

Step by Step Solution

★★★★★

3.59 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the information provided 1 Loan to Value LTV The loan amount requested 225000 The pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started