Question

You've been saving for your child's college her whole live and have $200,000 saved for her. The college she chooses has a contracted-in-advance room,

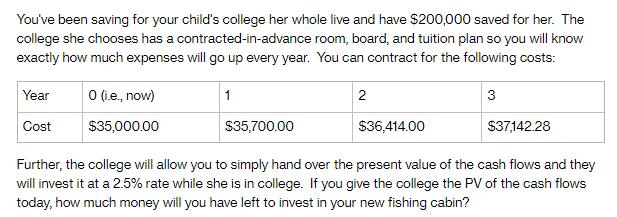

You've been saving for your child's college her whole live and have $200,000 saved for her. The college she chooses has a contracted-in-advance room, board, and tuition plan so you will know exactly how much expenses will go up every year. You can contract for the following costs: Year Cost 0 (i.e., now) $35,000.00 1 $35,700.00 2 $36,414.00 3 $37,142.28 Further, the college will allow you to simply hand over the present value of the cash flows and they will invest it at a 2.5% rate while she is in college. If you give the college the PV of the cash flows today, how much money will you have left to invest in your new fishing cabin?

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value PV of the cash flows we need to discount e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Analysis with Microsoft Excel

Authors: Timothy R. Mayes, Todd M. Shank

7th edition

1285432274, 978-1305535596, 1305535596, 978-1285432274

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App