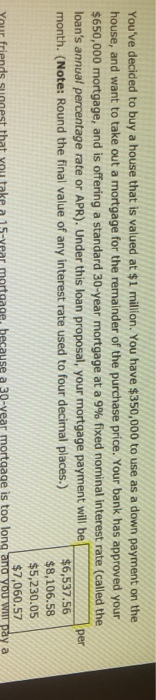

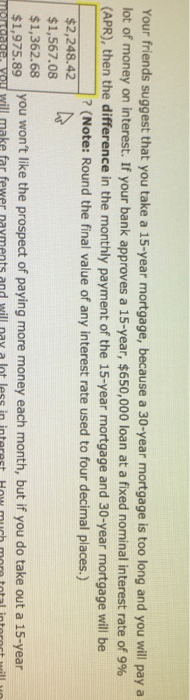

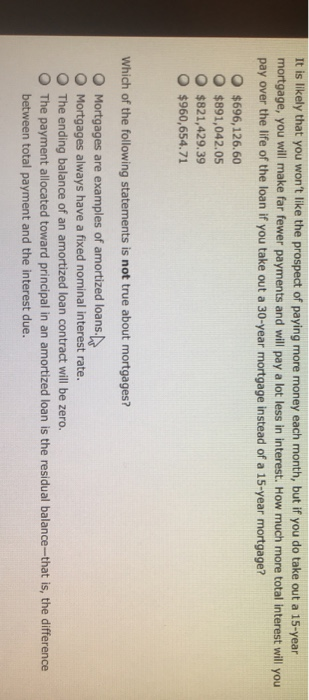

You've decided to buy a house that is valued at $1 milion. You have $350,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $650,000 mortgage, and is offering a standard 30-year mortgage at a 9% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be month. (Note: Round the final value of any interest rate used to four decimal places.) per $6,537.56 $8,106.58 $5,230.05 $7,060.57 Vour friends sugagest that you take a 15-vear mortgage. because a 30-vear mortgage is too long and you y a Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $650,000 loan at a fixed nominal interest rate of 9% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be ? (Note: Round the final value of any interest rate used to four decimal places.) $2,248.42 $1,567.08 $1,362.68 $1975.89 you won't like the prospect of paying more money each month, but if you do take out a 15-year E YOU will make far fewer nayments and will nav a lot less in interest How much more total intorost will likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? O $696,126.60 O $891,042.05 O $821,429.39 O $960,654.71 Which of the following statements is not true about mortgages? O Mortgages are examples of amortized loans. O Mortgages always have a fixed nominal interest rate. O The ending balance of an amortized loan contract will be zero. O The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and the interest due