Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You've inherited a building in a busy downtown area of a small city. It has retail on the bottom, currently leased by a national coffee

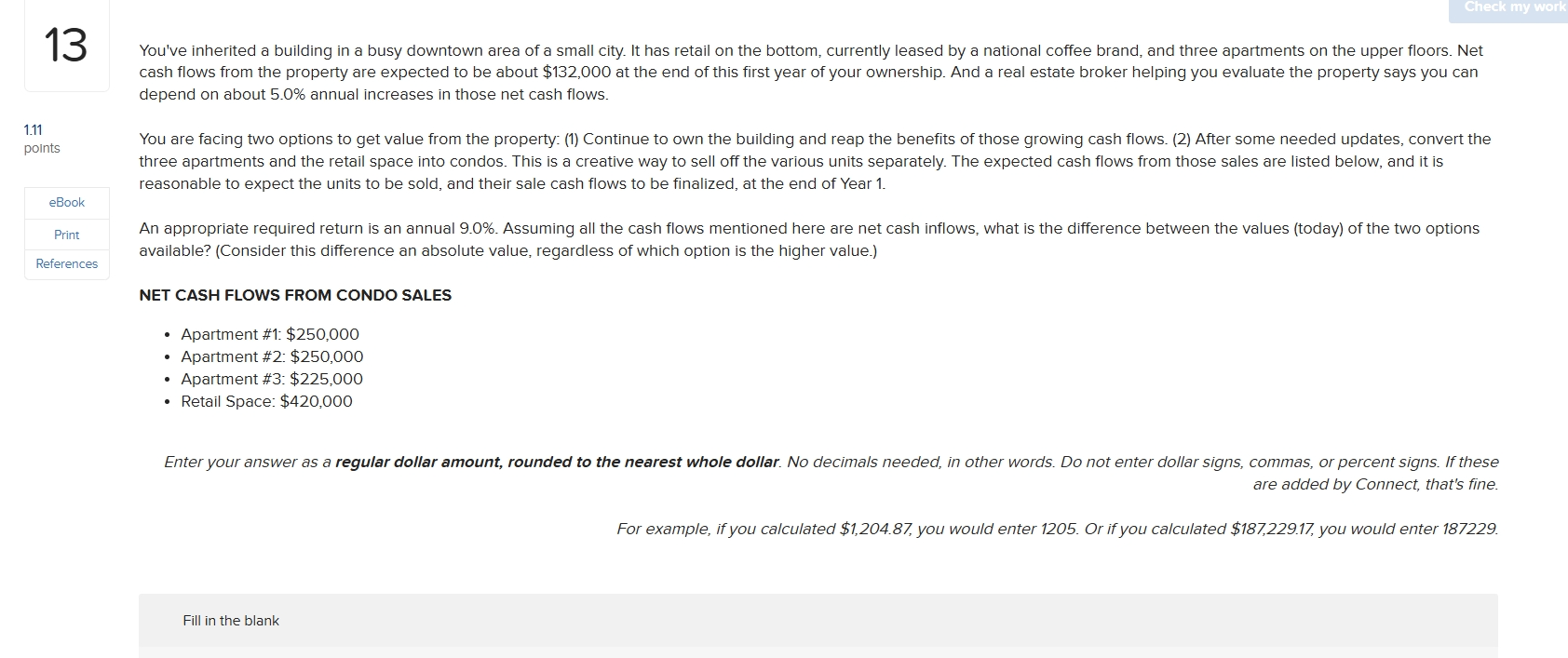

You've inherited a building in a busy downtown area of a small city. It has retail on the bottom, currently leased by a national coffee brand, and three apartments on the upper floors. Net cash flows from the property are expected to be about $ at the end of this first year of your ownership. And a real estate broker helping you evaluate the property says you can depend on about annual increases in those net cash flows.

You are facing two options to get value from the property: Continue to own the building and reap the benefits of those growing cash flows. After some needed updates, convert the three apartments and the retail space into condos. This is a creative way to sell off the various units separately. The expected cash flows from those sales are listed below, and it is reasonable to expect the units to be sold, and their sale cash flows to be finalized, at the end of Year

An appropriate required return is an annual Assuming all the cash flows mentioned here are net cash inflows, what is the difference between the values today of the two options available? Consider this difference an absolute value, regardless of which option is the higher value.

NET CASH FLOWS FROM CONDO SALES

Apartment #: $

Apartment #: $

Apartment #: $

Retail Space: $

Enter your answer as a regular dollar amount, rounded to the nearest whole dollar. No decimals needed, in other words. Do not enter dollar signs, commas, or percent signs. If these are added by Connect, that's fine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started