Answered step by step

Verified Expert Solution

Question

1 Approved Answer

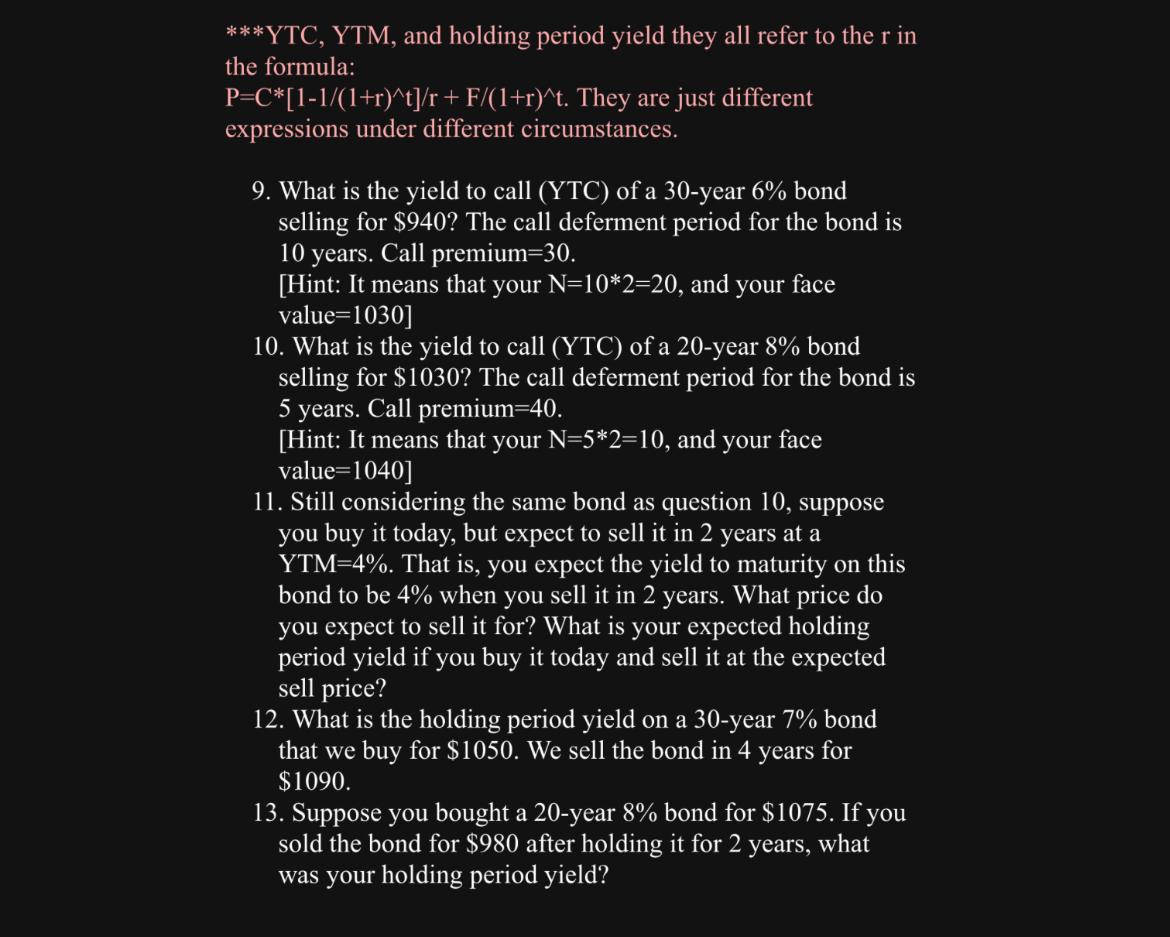

* * * YTC , YTM , and holding period yield they all refer to the r in the formula: P = C * *

YTC YTM and holding period yield they all refer to the in the formula:

They are just different expressions under different circumstances.

What is the yield to call YTC of a year bond selling for $ The call deferment period for the bond is years. Call premium

Hint: It means that your and your face value

What is the yield to call YTC of a year bond selling for $ The call deferment period for the bond is years. Call premium

Hint: It means that your and your face value

Still considering the same bond as question suppose you buy it today, but expect to sell it in years at a YTM That is you expect the yield to maturity on this bond to be when you sell it in years. What price do you expect to sell it for? What is your expected holding period yield if you buy it today and sell it at the expected sell price?

What is the holding period yield on a year bond that we buy for $ We sell the bond in years for $

Suppose you bought a year bond for $ If you sold the bond for $ after holding it for years, what was your holding period yield?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started