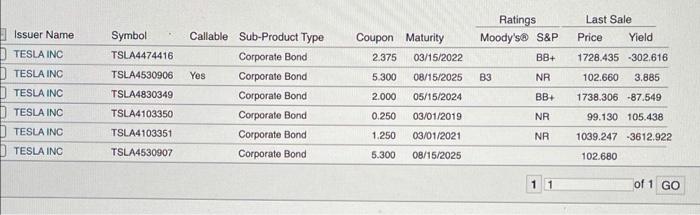

Ara- 6. Estimate the cost of debt for TSLA: You now need to estimate the cost of debt for TSLA. Go to search "Tesla" as the Issuer Name to find all the outstanding bonds. Answer the following questions: (1) There are some bonds shown as a negative yield. Explore why? (2) Calculate (estimate) the YTM of the bond "TSLA4530907." Be sure to show your work. You may assume the bonds are semiannual coupon bonds. Also know that the bond prices are expressed as "percentage of par" c.g. $101 means 101% of par value. (3) Compare the bond "TSLA4530907" with "TSLA4530906". What's the difference between these two bonds? Why their YTM is different even though they both mature on the same day? (4) Ultimately, what is the estimated cost of debt you should use for Tesla? Symbol TSLA4474416 Last Sale Price Yield Ratings Moody's S&P BB+ Coupon Maturity 2.375 03/15/2022 1726.435 -302.616 5.300 B3 NR 102.660 3.885 Issuer Name TESLA INC TESLA INC TESLA INC TESLA INC TESLA INC TESLA INC TSLA4530906 TSLA4830349 Callable Sub-Product Type Corporate Bond Yes Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond 2.000 08/15/2025 05/15/2024 03/01/2019 BB+ 1738.306 -87.549 0.250 NR TSLA4103350 TSLA4103351 99.130 105.438 1039.247 -3612.922 1.250 03/01/2021 NR TSLA4530907 5.300 08/15/2025 102.680 1 1 of 1 GO Ara- 6. Estimate the cost of debt for TSLA: You now need to estimate the cost of debt for TSLA. Go to search "Tesla" as the Issuer Name to find all the outstanding bonds. Answer the following questions: (1) There are some bonds shown as a negative yield. Explore why? (2) Calculate (estimate) the YTM of the bond "TSLA4530907." Be sure to show your work. You may assume the bonds are semiannual coupon bonds. Also know that the bond prices are expressed as "percentage of par" c.g. $101 means 101% of par value. (3) Compare the bond "TSLA4530907" with "TSLA4530906". What's the difference between these two bonds? Why their YTM is different even though they both mature on the same day? (4) Ultimately, what is the estimated cost of debt you should use for Tesla? Symbol TSLA4474416 Last Sale Price Yield Ratings Moody's S&P BB+ Coupon Maturity 2.375 03/15/2022 1726.435 -302.616 5.300 B3 NR 102.660 3.885 Issuer Name TESLA INC TESLA INC TESLA INC TESLA INC TESLA INC TESLA INC TSLA4530906 TSLA4830349 Callable Sub-Product Type Corporate Bond Yes Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond 2.000 08/15/2025 05/15/2024 03/01/2019 BB+ 1738.306 -87.549 0.250 NR TSLA4103350 TSLA4103351 99.130 105.438 1039.247 -3612.922 1.250 03/01/2021 NR TSLA4530907 5.300 08/15/2025 102.680 1 1 of 1 GO